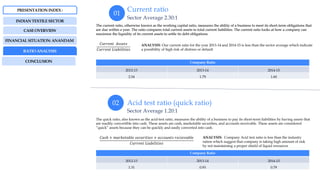

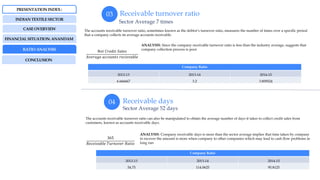

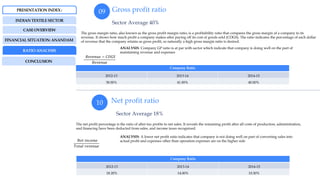

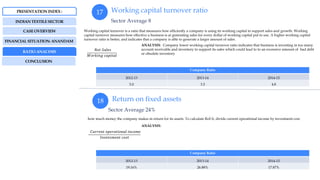

The document provides an overview of the Indian textile sector and a case study on Anandam Manufacturing Company. It discusses key details about the Indian textile market size, growth drivers, challenges. It then presents the case of Anandam, a garment manufacturer established in 2012. By 2015, the company was facing financial problems due to working capital requirements and sought additional bank funding of Rs. 50 million. Ratio analyses are presented comparing Anandam's ratios to industry averages for current ratio, debt-to-equity, inventory turnover, and others, showing some areas where the company lags industry standards.