This document provides information about income from business or profession that is taxable under Section 28 of the Indian Income Tax Act. It discusses the types of income that are taxable as business income, such as profits from any profession, compensation received related to business, export incentives from the government, and interest or remuneration received by partners from a firm. It also outlines specific deductions allowed for expenses like rent, repairs, depreciation, and unabsorbed business losses that can be carried forward to future tax assessments.

![Charging Section[Sec.28]

Profits and gains of any profession/profession

Any compensation received related business

Income received from members of similar

profession

Any benefit or perquisites from business

/profession

Export incentives from government

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-2-2048.jpg)

![Business income not taxable u/s 28

1. Rental income in case of dealer in property

taxable under the head income from house

property[u/s22].

2. Dividend on shares in case of a dealer in

shares- taxed under income from other sources

[u/s 56].

3. winning from lotteries (lottery business) taxed

u/s 56-income from other sources.

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-6-2048.jpg)

![Loss not deductible from business

Loss due to destruction of Capital asset.

Loss on sale of investments held as investment.

Loss of advance to set up a business but business could

not be started.

Depreciation in value of foreign currency for capital

purpose

Anticipated future losses.

Loss of discontinued business

Loss from illegal business[T.A.Qureshiv.CIT(2006)SC]

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-8-2048.jpg)

![Computation of assessable

profits/loss for tax

Net profit as per P/L Account

Add: Amount debited to P/L A/c in respect of

the following

Loss of earlier years

Capital losses

Personal expenses (such as drawings)

Income tax, surtax, wealth tax, gift tax, estate

duty[Direct taxes], tax penalty, penal interest,

fine.

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-9-2048.jpg)

![Continues

Less:

Salary income( income from salary(u/s 15)

Rental incomeIncome from House property(u/s22)

Capital gain(u/s 45)

Dividend[ Income from other sources(56)]

Direct taxes refund such as Income tax, Wealth tax, estate

duty, surtax refunds

Bad debts, excise duty recovered not allowed as

expenditure preceding previous years

Deduct:

Expenses not debited to P/L A/c but allowed u/s 30 to 40A

Depreciation u/s 32

Income chargeable under income from

business/profession.

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-12-2048.jpg)

![Tea, coffee and rubber development

account[Sec.33AB]

Deposit with NABARD or Deposit account of

tea, coffee or rubber Board

With in 6 months from the end of the previous

year or before the last date of filing of returns

whichever earlier

Exemption:

Amount deposited or 40% of profit whichever is less

Can amount be withdrawn?

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-39-2048.jpg)

![Site restoration fund[sec.33ABA]

Production of Petroleum /Natural gas in India

Deposit with SBI/account opened as per

petrolem and Natural Gas Commission In a

scheme specified

Before the end of the previous year

Amount withdrawn should be used for low

priority sector/100% depreciated and utiled

within 8 years at the end of previous year.

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-41-2048.jpg)

![###Scientific research[Sec.35]

In house research

All Revenue expenditure and Capital expenditure related

to one’s business during the current previous year or even

3***preceding previous years allowed

[Except Land]

Even asset is not put into use –it is allowed.

No depreciation is allowed on such capital asset

If such asset is sold what could be the consequences?

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-42-2048.jpg)

![Expenditure on Patent rights and

copy rights[35A]

Capital Expenditure incurred before 1st

April 1998

14instalments

After 1st April 1998-Depreciation can be

claimed-25%

Revenue expenditure-Fully allowed

expenditure in the year such expenditure incurred.

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-45-2048.jpg)

![Amortisation of telecom license

fees[35ABB]

Conditions

Capital Expenditure

Acquiring any right to operate telecommunication

services

Incurred before or after commencement of Business

Mainly incurred to obtain license.

If conditions fulfilled claim can be done u/s 35ABB

otherwise u/s 37(1) as business expenditure.

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-47-2048.jpg)

![Amortisation of expenditure incurred

for amalgamation[35DD]

Indian company

Deductions in five

successive installments

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-53-2048.jpg)

![Amortisation of expenditure under voluntary

retirement scheme[35DDA]

Any assessee

Deduction 1/5every year

Voluntary retirement scheme need not be

accordance with guidelines prescribed under

section 10(10C)

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-54-2048.jpg)

![Amartisation of expenditure on development of

certain minerals[35E]

Indian companies and

Resident assessee

I/10 every year allowed

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-55-2048.jpg)

![Insurance premium to protect the

asset or employees[36(1)(i)]

Allowed

Bonus to

employees[36(1)(ii)]

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-56-2048.jpg)

![Discount on Zeeero coupon

Discount Bonds[36(1)(iiia)]

Issued after June 1, 2005

Minimum 10 years and Maximum 20 years

Deduction on pro rata basis.

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-59-2048.jpg)

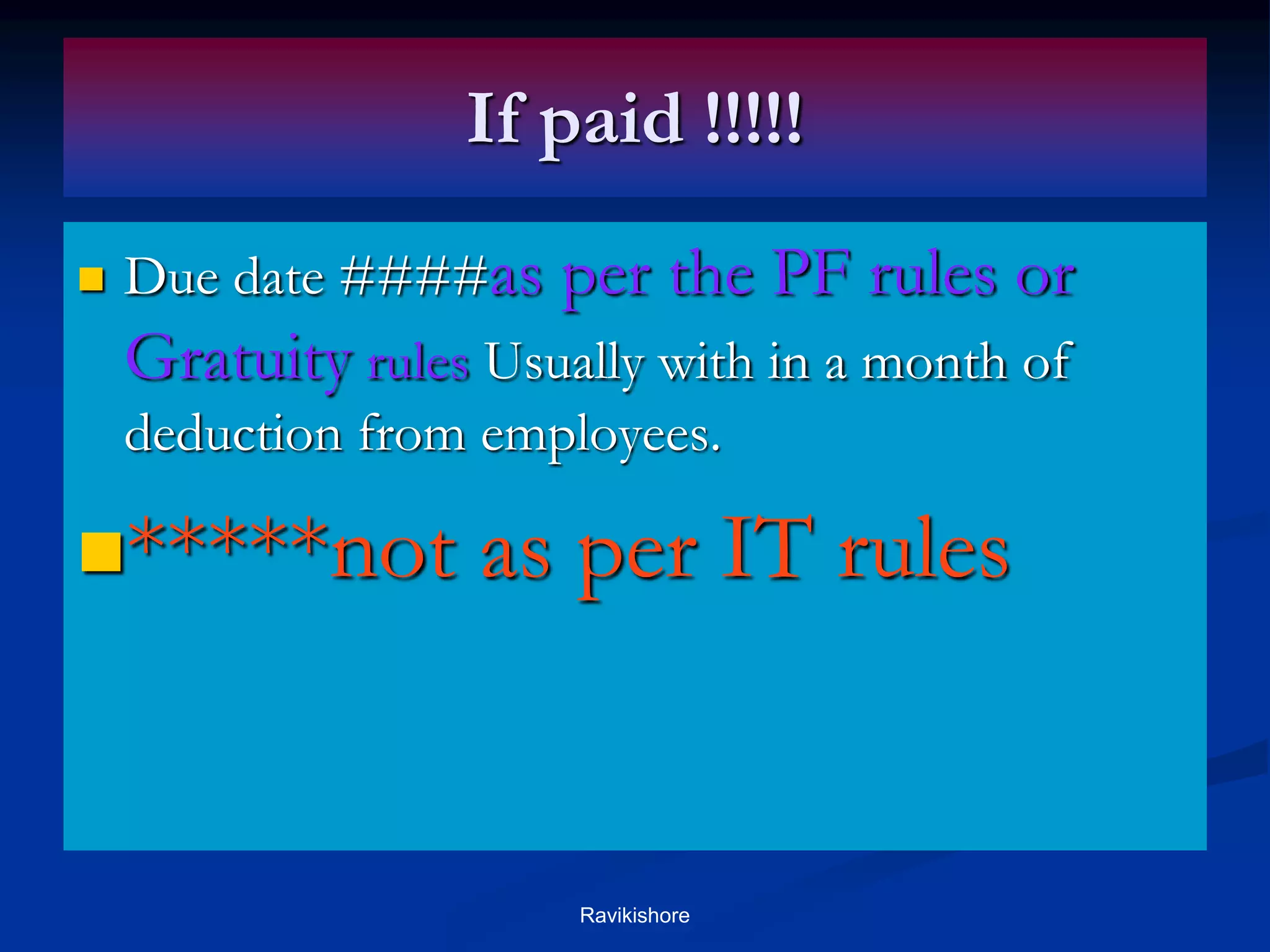

![****Employees’ contribution towards staff welfare

scheme such as PF[36(1)(va)]

Amount received by employer-

Included with the

assessee’s Income

If Paid to the

employees’s account???

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-62-2048.jpg)

![Written off of allowance for animals

[36(1)(vi)]

If died /useless

Used as capital asset

Allowed loss = Original cost- Carcasses

or ( sale of animals)

No depreciation is allowed

any time on animals

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-64-2048.jpg)

![Bad debts [36(1)(vii)] !!!

If actual- allowed

Provision –Never allowed

If recovered[41(4)]-----If earlier

allowed it is taxable

If earlier denied - not taxable

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-65-2048.jpg)

![Provision for Bad and doubtful debts to rural branches of

scheduled and non scheduled commercial

banks[36(1)(vii)]

bank and Institution bank

Non scheduled

Scheduled Financial Foreign

7.5% of income 5% 5%

10% of advances --- ---

made by rural

branchs

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-66-2048.jpg)

![Transfer to SPECIAL RESERVE

[36(1)(viii)]

Long term (5 years or more) financial corporation/public

company/government company

Finance for industry/agriculture/infrastructure facilities in

India.

Deduction: Whichever is less

1. amount transferred to such account or

2. 40% of profit from business activities before such

deductions

3. 200% of paid up capital and reserve on the last day of

PY(- )amount in special reserve account in the beginning of

the PY

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-67-2048.jpg)

![Family planning expenditure [36(1)(ix)]

For Company assessee

Revenue expenditure- Fully allowed

Capital Expenditure - 1/5th every year

Non-corporate assessee can claim u/s

32(Depreciation on capital expenditure) and

37(1)(Revenue expenditure)

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-68-2048.jpg)

![Advertisement Expenditure[37(2B)]

Advertisement In publication of political

party------Not allowed

All advertisements --Allowed

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-69-2048.jpg)

![Contribution towards Exchange risk

Administration fund [36(1)(x)]

By Public financial

institution

Deductible upto the

assessment year 2007-08

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-71-2048.jpg)

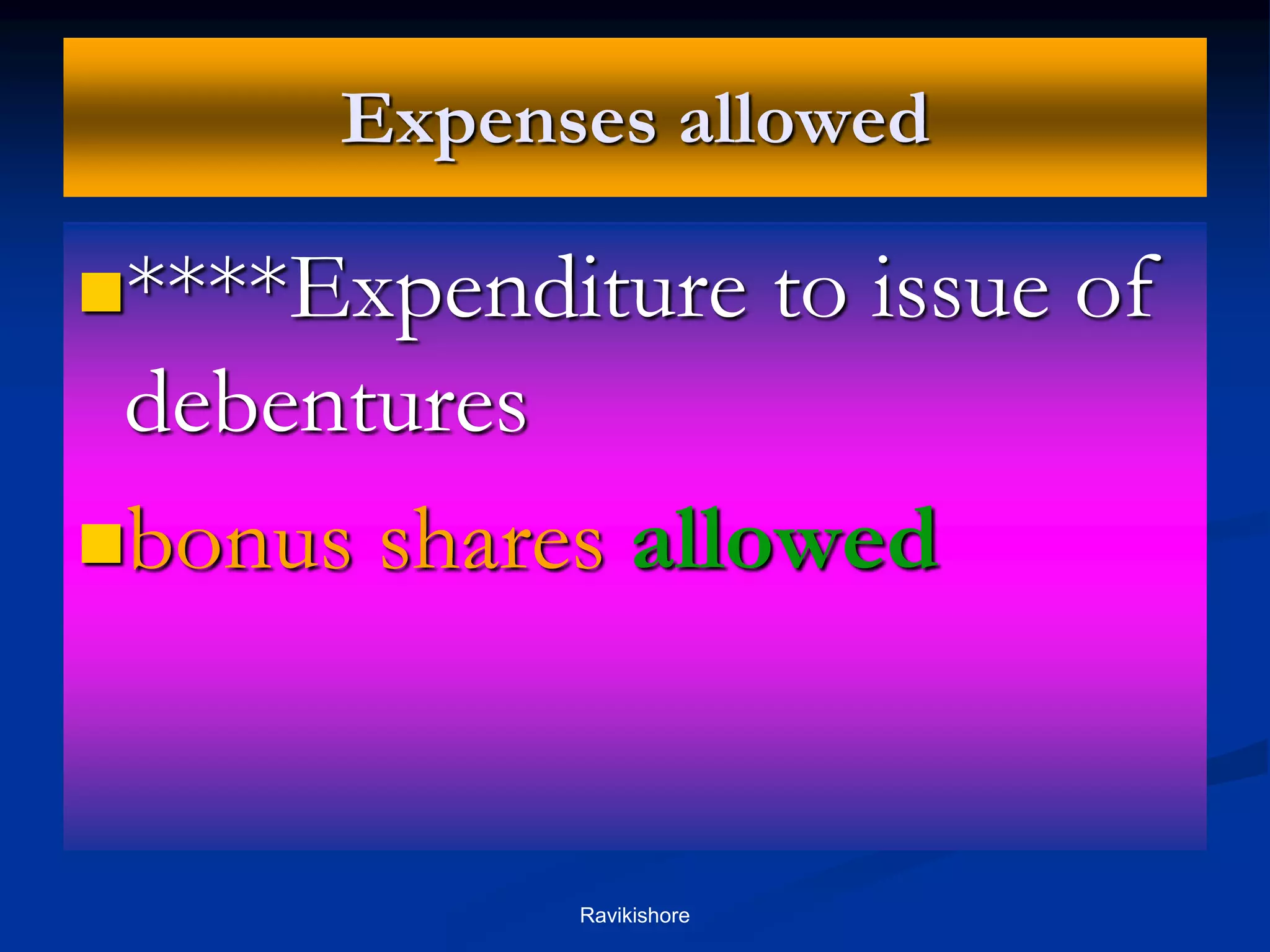

![General deductions[37(1)]

It should not be a capital expenditure or

Not personal

Not prohibited by law such as fine, penalty

Not be an illegal expenditure

Can we see some of the expenditures allowed as

per various case laws?

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-73-2048.jpg)

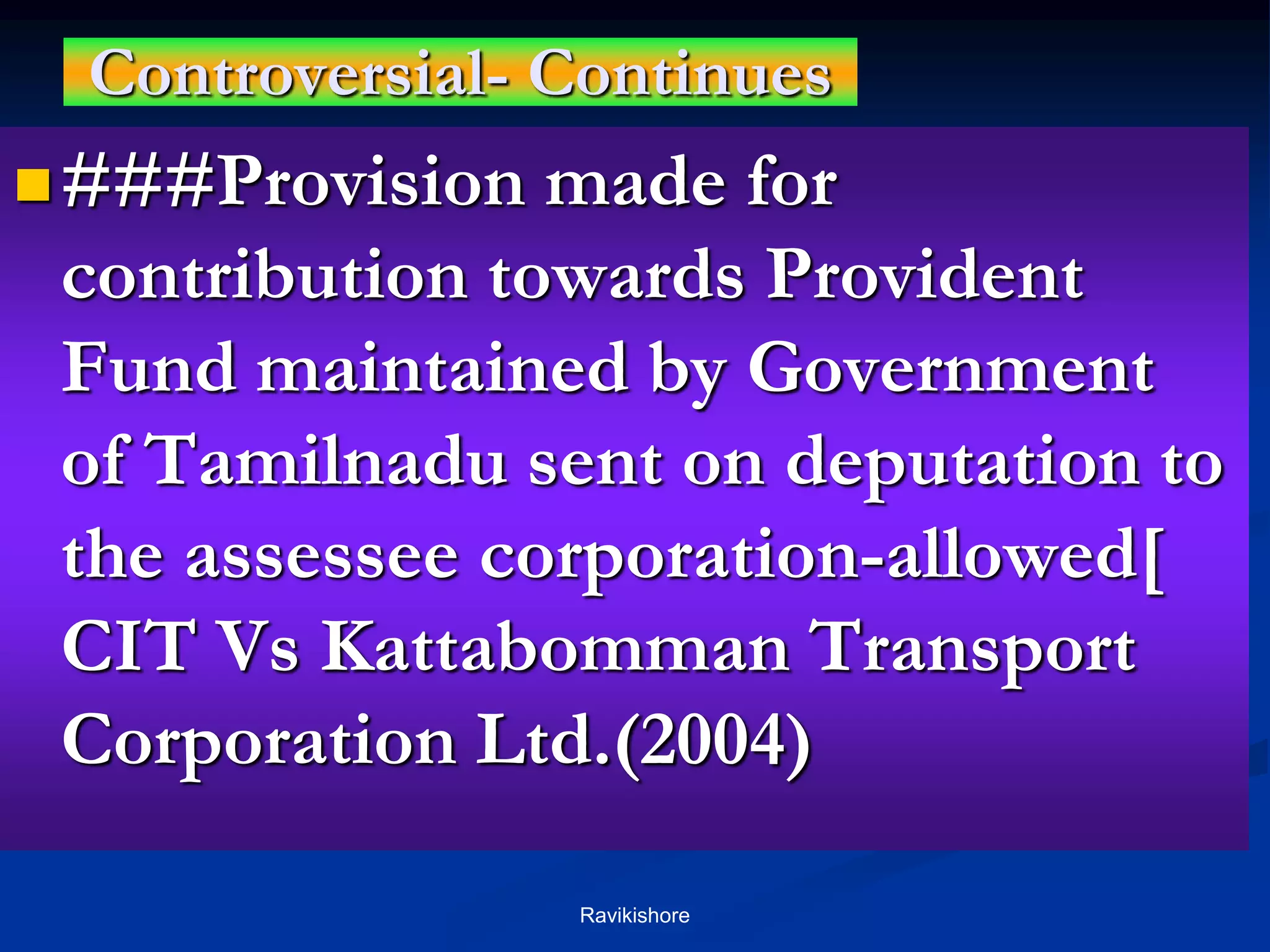

![Expenses allowed-case laws

###Estimated probable liability for free maintenance

CIT vs Modi Olovetti ltd.(2004)

***Expenditure to car even it is huge[CIT vs

Mangalchand premchand& co.[2004]

**Repairs to maintain building taken on lease

[Sumitomo Corpn. India (p) ltd.

Expenditure on civil work on leased asset [Hero Honda

motors vs CIT

***Interest on delayed payment of Provident fund[CIT

vs Ishwari Khetan Sugar Mills (P0 ltd.(2004)

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-76-2048.jpg)

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-79-2048.jpg)

![Controversial Continues

Medical expenses of wife employee

of cine actor-Allowed [Ajay Singh

Deol Vs CIT]

Payment on account of

membership fees for health club

and also paid membership fees for

an another club-Allowed [Sterlite

Industries (India) Vs CIT(2006)

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-80-2048.jpg)

![Payment to relatives[ Sec. 40A(2)]

Excess or

unreasonable -

disallowed

Relative: husband, wife, brother or sister or lineal

ascendant or descendant of that individual.

Substantial interest:- at least 20% of equity or 20%

profits of a concern at any time during the year

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-92-2048.jpg)

![Undisclosed income

Cash credit[sec.68]

Undisclosed investment[sec.69]

Unexplained money [sec. 69A]

Amount of investments not fully disclosed

[sec.69B]

Unexplained expenditure [sec.69C]

Amount borrowed or repaid on hundi[sec.69D]

They are deemed income of the current previous

year. Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-96-2048.jpg)

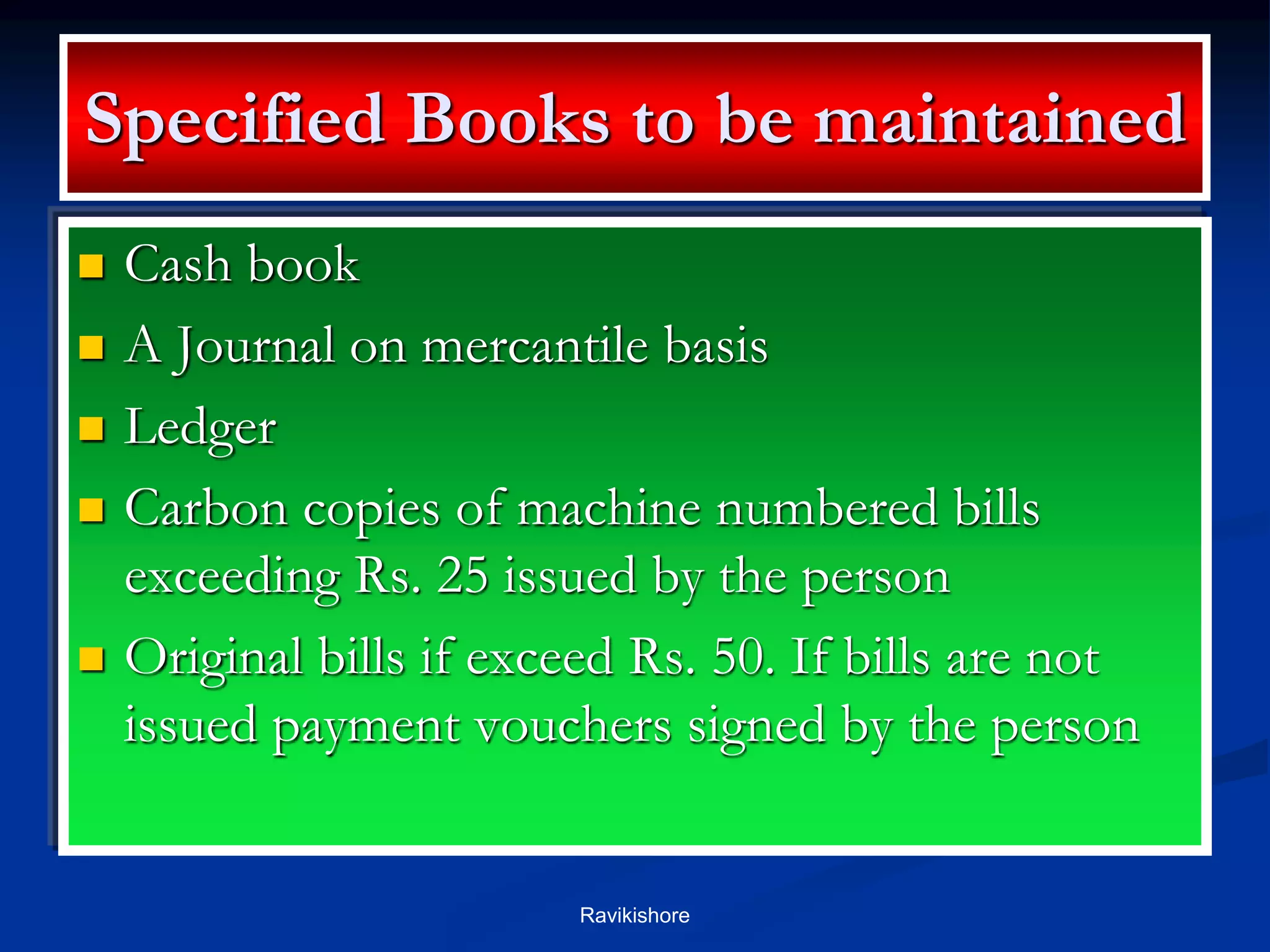

![Maintenance of books

compulsory[Sec.44AA]

Legal medical, engineering, architectural, accountancy,

Film artist technical consultancy, or interior decoration

and other notified profession [Specified professional]

If gross receipts exceed 1,50,000 in any of the three

years preceding the previous year.

Non-specified professional- Income exceed Rs.

1,20,000 and total gross receipts exceed 10,00,000

What are those books maintained?

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-97-2048.jpg)

![Audit of Accounts[sec.44AB] if

crossed limit

Business-Gross receipts

/sales exceed 40 lakhs

Profession- gross receipts

exceed 10 lakhs

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-100-2048.jpg)

![Audit compulsory with out any limit

of income/receipt

Person engaged in:

1. civil construction[44AD]- 8% of gross receipts

2.Business of plying, leasing or hiring trucks[44AE]-

Heavy vehicles Rs. 3500 pm (owned months), other

vehicles- 3150 pm (not owned more than 10 vehicles

any time during the previous year.-No expenditure is

deductible .

Retail traders[44AF]- 5% of turnover is considered as

income

Ravikishore](https://image.slidesharecdn.com/2127businessincome-221117141934-68215d52/75/21_27_business_income-ppt-101-2048.jpg)