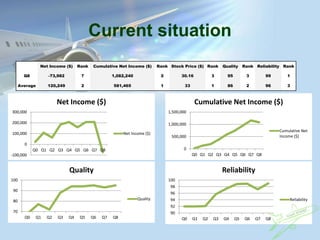

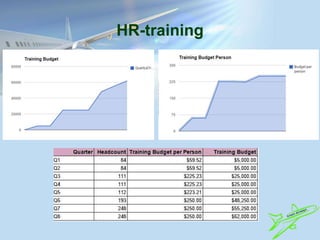

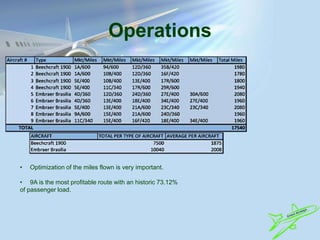

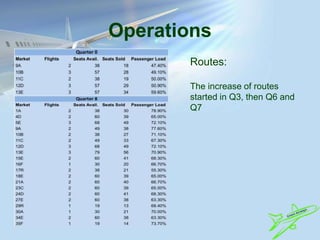

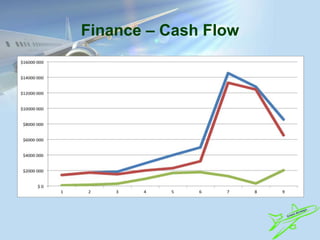

Green Airways is a low-cost airline with a mission to offer customers quality at a reasonable price. The document outlines the company's current financial situation, management team, goals and strategies across different time horizons. It discusses increasing fares and routes, adjusting marketing expenses, reducing turnover, optimizing operations and maintenance costs, paying off loans, increasing stock price and market share, and continuing to invest in training. The overall goal is to remain a low-cost yet reliable airline through strategic financial and operational planning.