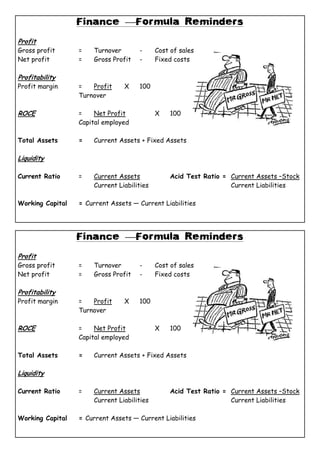

The document provides formulas for calculating key financial metrics like gross profit, net profit, profit margin, return on capital employed, current ratio, and acid test ratio. It also defines common financial terms like turnover, cost of sales, current assets, fixed assets, total assets, current liabilities, capital employed, working capital, and operating profit.