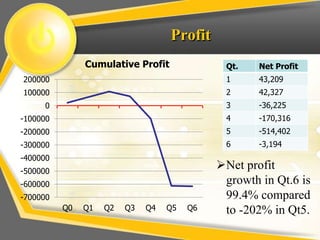

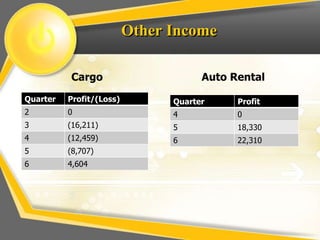

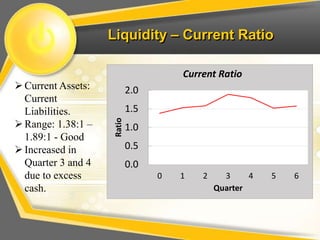

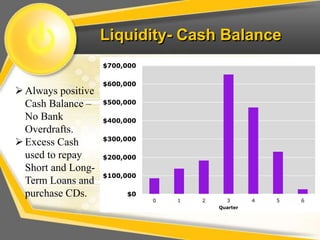

The document outlines the strategy and performance of Solair, focusing on customer-centric growth, cost reduction, and diversification of services. It highlights recent financial data such as net profit improvements and liquidity stability, as well as short and long-term plans aimed at sustaining growth and shareholder satisfaction. The conclusion reflects a positive outlook on the company's strategies and willingness to adapt to industry changes.