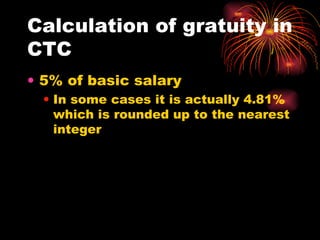

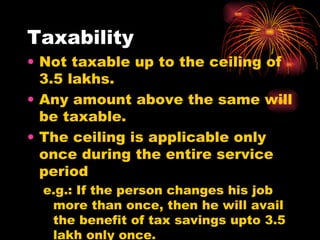

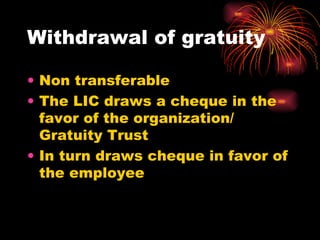

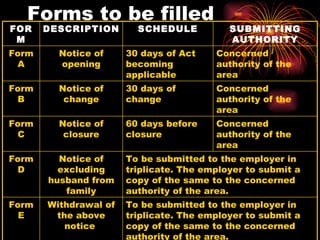

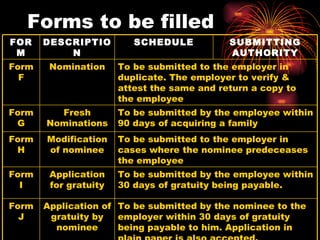

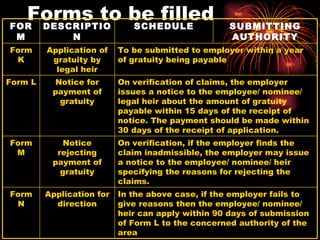

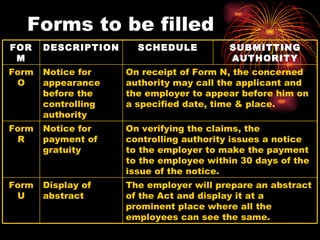

This document summarizes the rules around gratuity payments for employees in organizations with more than 10 employees. It discusses who is eligible for gratuity payments after 5 years of continuous service, how the amount is calculated based on salary and years of service, tax treatment, forms to submit for payments, withdrawals, and nominations. Gratuity can be paid upon superannuation, resignation after 5 years, permanent disability, or death.

![Calculation The formula for calculating gratuity is as follows – [(Salary*15)/26]*service period Where, Salary = Basic + DA](https://image.slidesharecdn.com/gratuity-12575796430751-phpapp01/85/Gratuity-7-320.jpg)