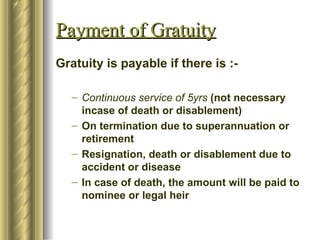

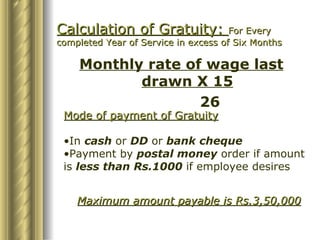

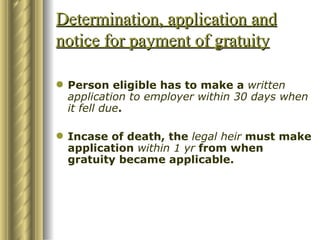

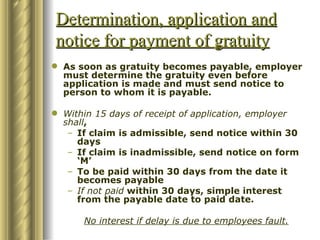

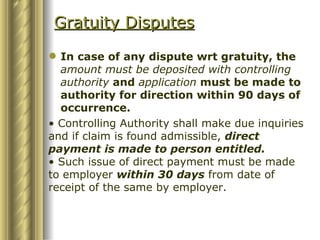

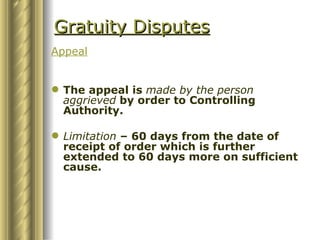

The Payment of Gratuity Act, 1972 provides for mandatory gratuity payments to employees in India who have worked for over 5 years continuously in a company or establishment. Gratuity is calculated as 15 days wages for every completed year of service and paid as a lump sum on termination or retirement. The employer must determine gratuity payable, send notices to eligible employees, and make payment within 30 days of application or when it becomes due. Disputes over gratuity are handled by controlling authorities and appeals can be made within specified time limits.