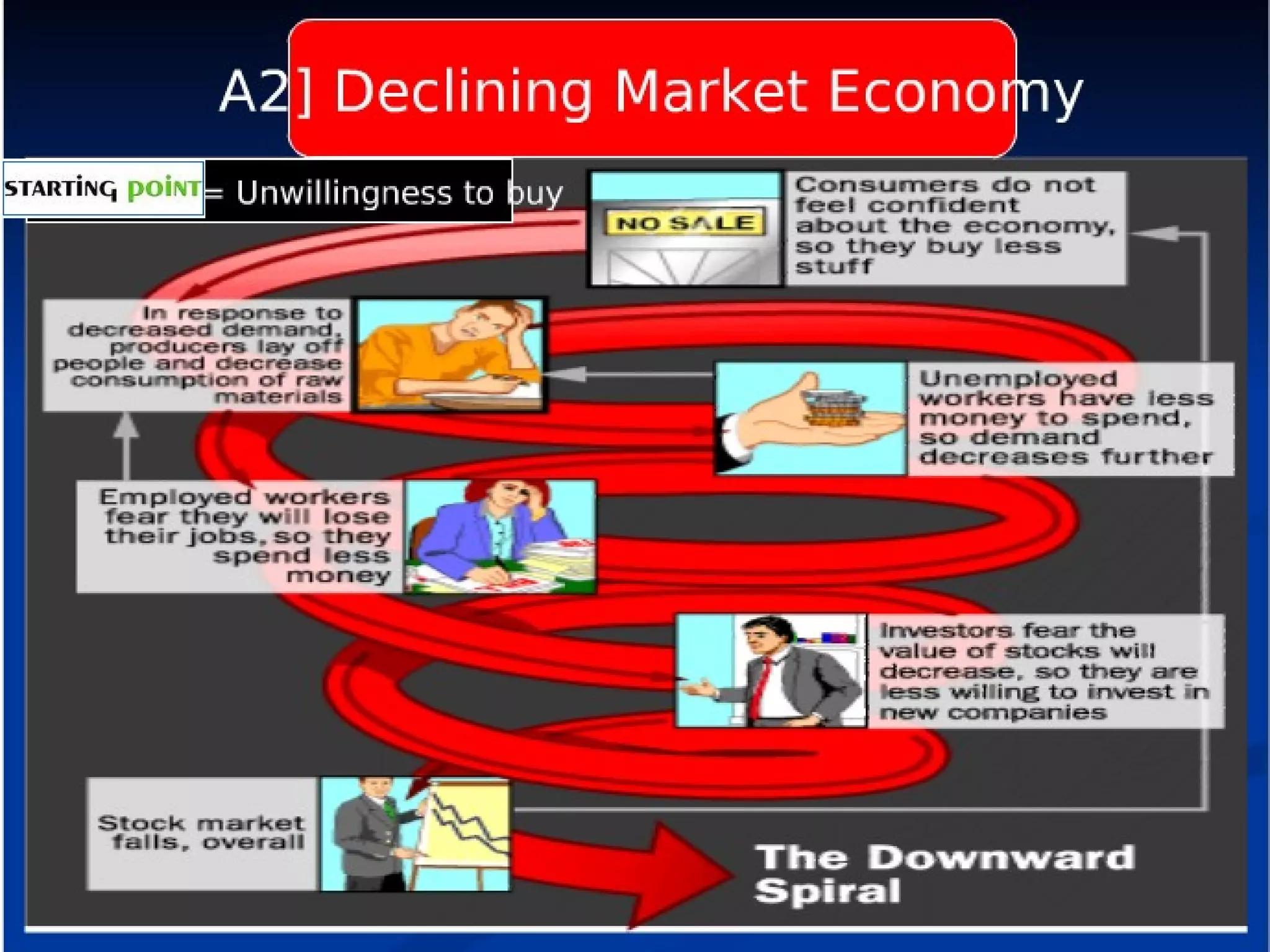

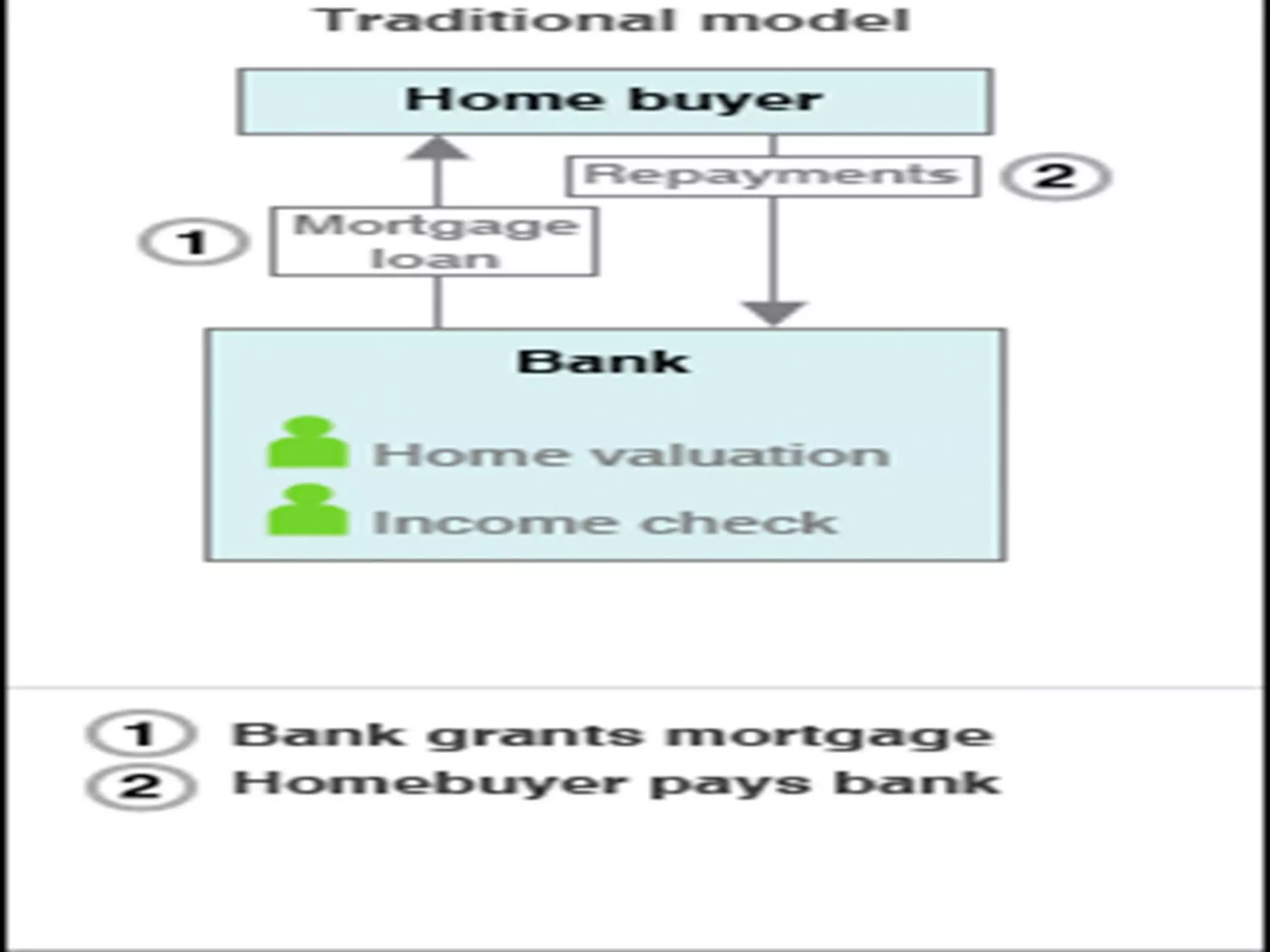

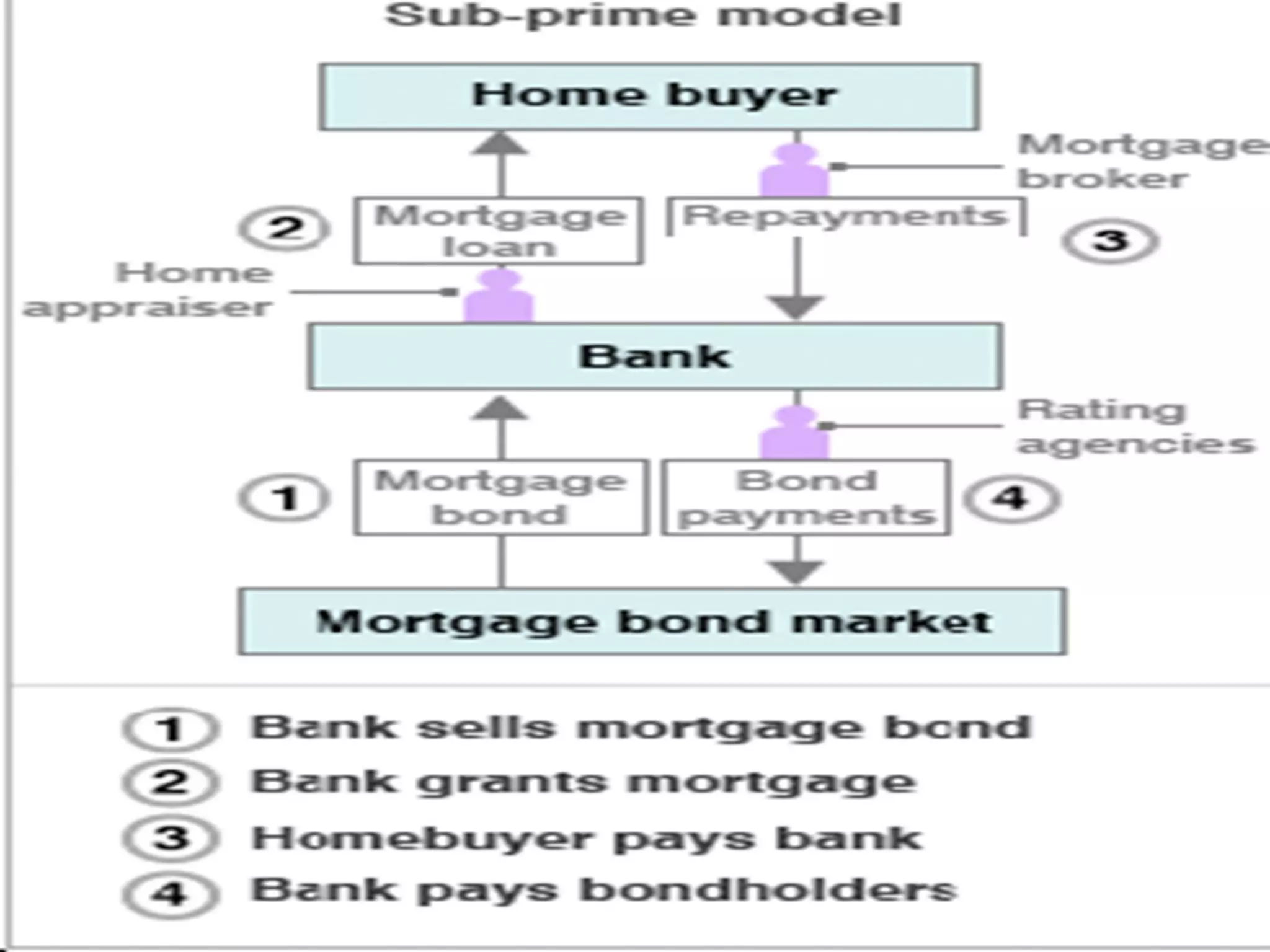

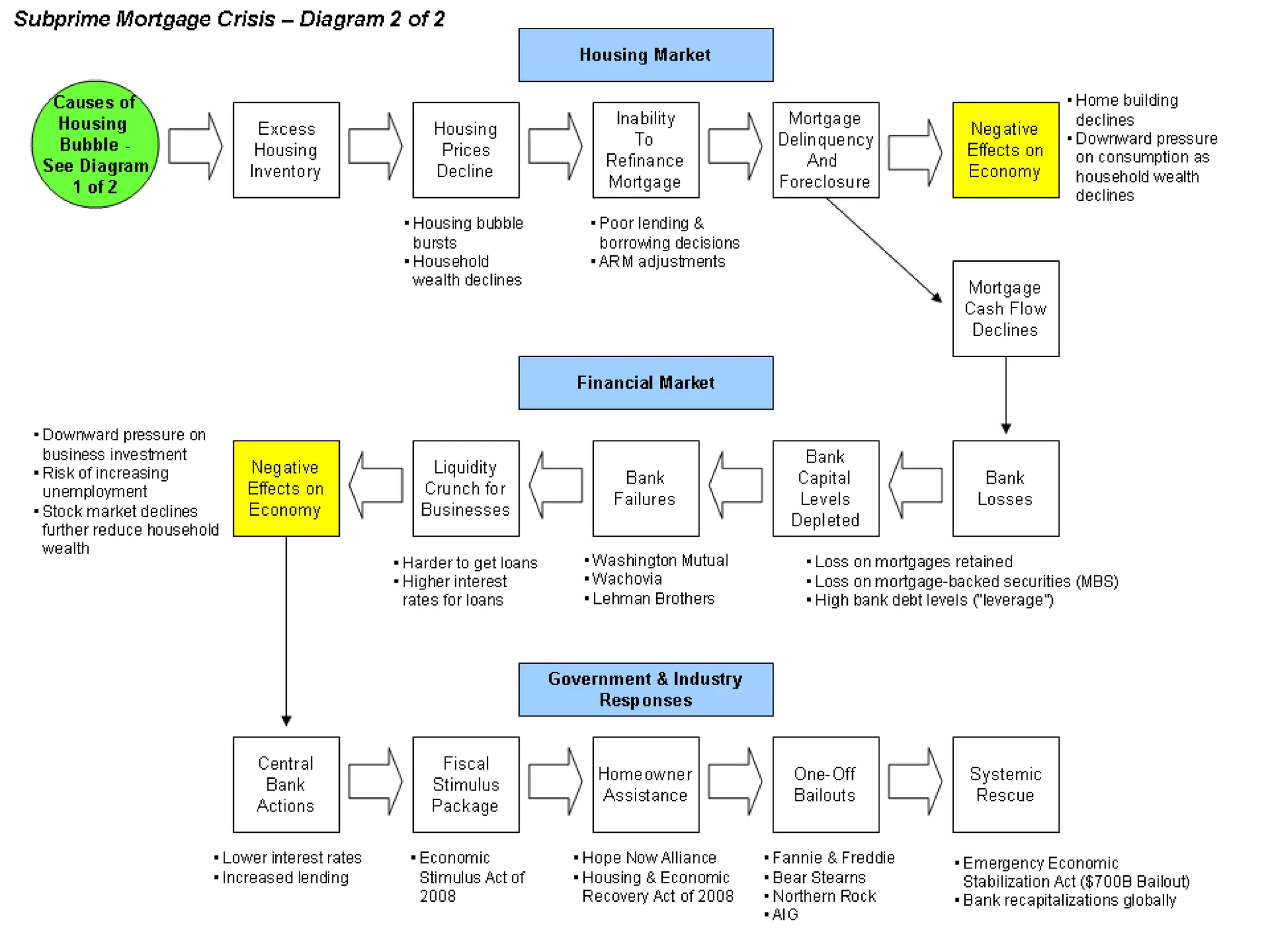

The document discusses the 2008 global financial crisis and subprime mortgage crisis. Key events included Lehman Brothers declaring bankruptcy, Merrill Lynch being acquired by Bank of America, Bear Stearns being acquired by JP Morgan Chase, and AIG receiving government assistance. European banks also experienced problems, with BNP Paribas suspending funds and the ECB pumping money into European markets. The crisis originated from high-risk subprime home loans in the US that later defaulted in large numbers.