Embed presentation

Download to read offline

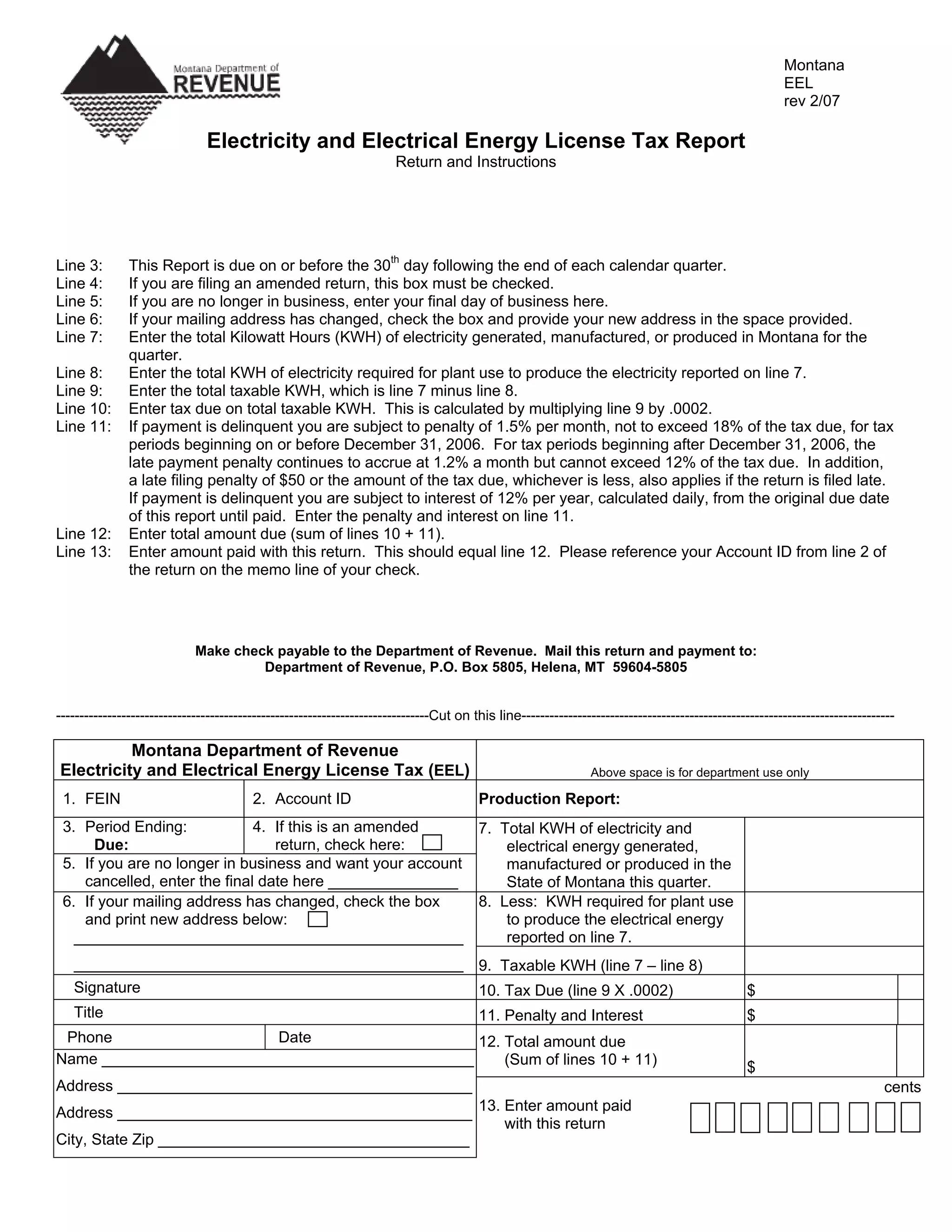

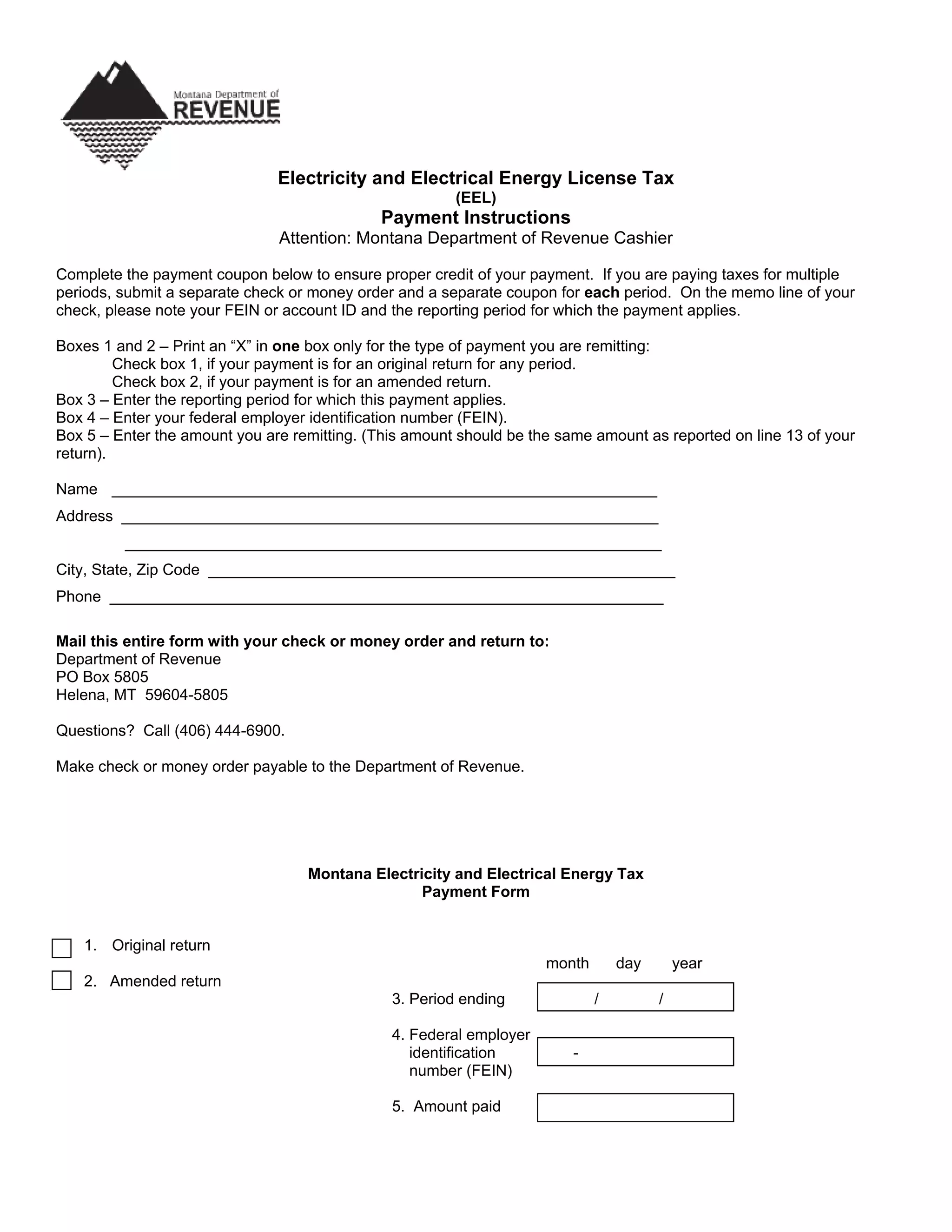

This document provides instructions for filing the Montana Electricity and Electrical Energy License Tax report. It explains that the report is due quarterly by the 30th day after the end of each calendar quarter. It outlines the key lines on the report including reporting total kilowatt hours generated and taxable kilowatt hours. It also provides details on calculating penalties and interest for late or amended filings. The payment instructions explain how to submit the proper payment with the account ID and reporting period clearly noted.