Embed presentation

Download to read offline

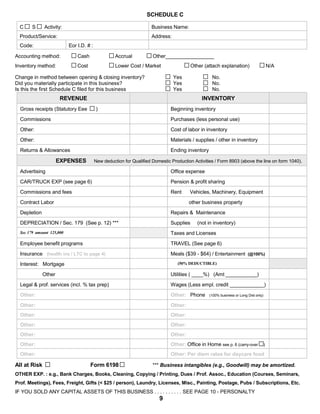

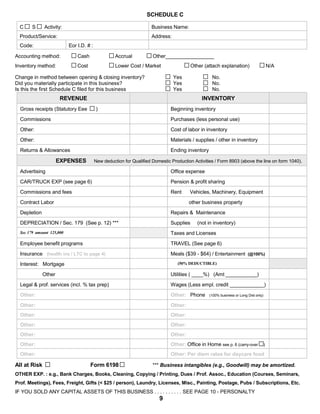

This document contains a personal tax data form for a client for the 2007 tax year. It requests information such as names, addresses, social security numbers, income sources, deductions, and credits. The form is used by a tax preparer to gather necessary information from a client to complete their tax return. It covers many common income types and deductions including W-2 wages, 1099 forms, alimony, rental income, self-employment income, itemized deductions, and various tax credits.