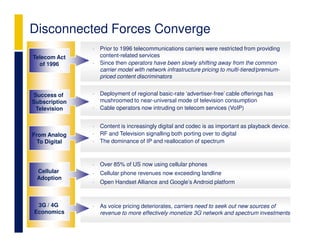

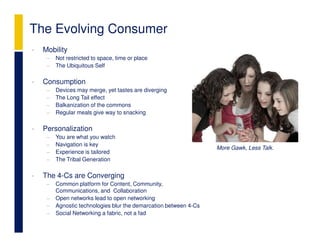

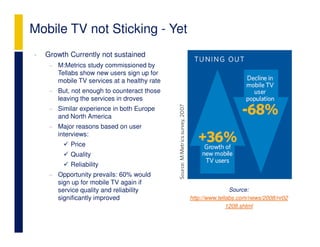

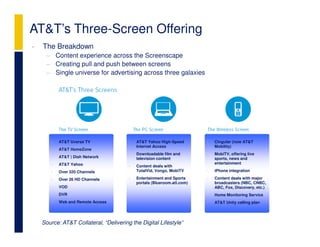

The document discusses the evolution of broadcasting and telecommunications, emphasizing a 'three-screen' strategy that integrates television, internet, and mobile devices to enhance consumer digital experience. It highlights the need for carriers to adapt their business models amid competition and changing consumer behavior, particularly in mobile video services and the importance of content personalization. AT&T is used as a case study to illustrate the execution of this strategy, focusing on their investment in technology and partnerships to deliver a cohesive digital lifestyle.