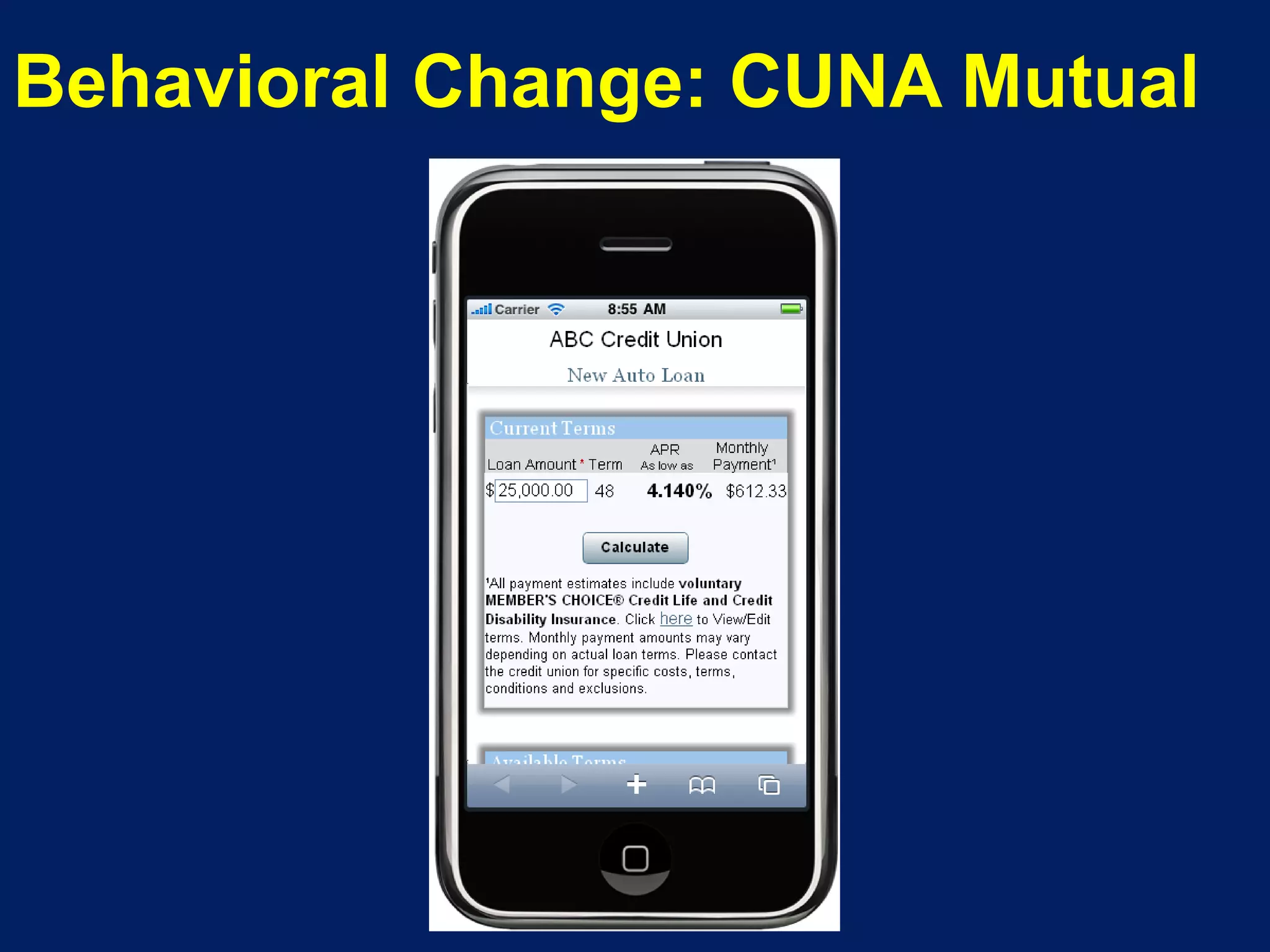

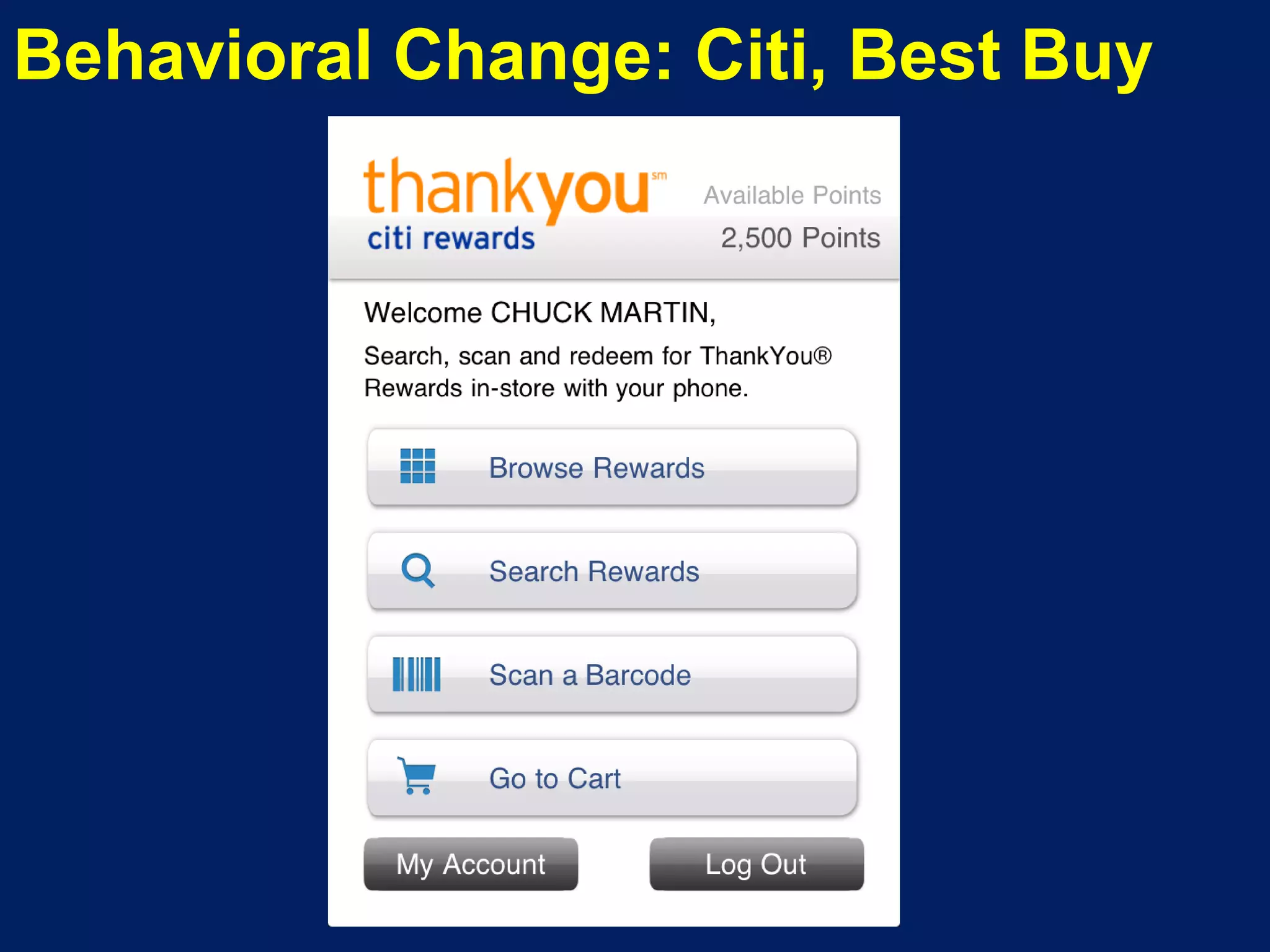

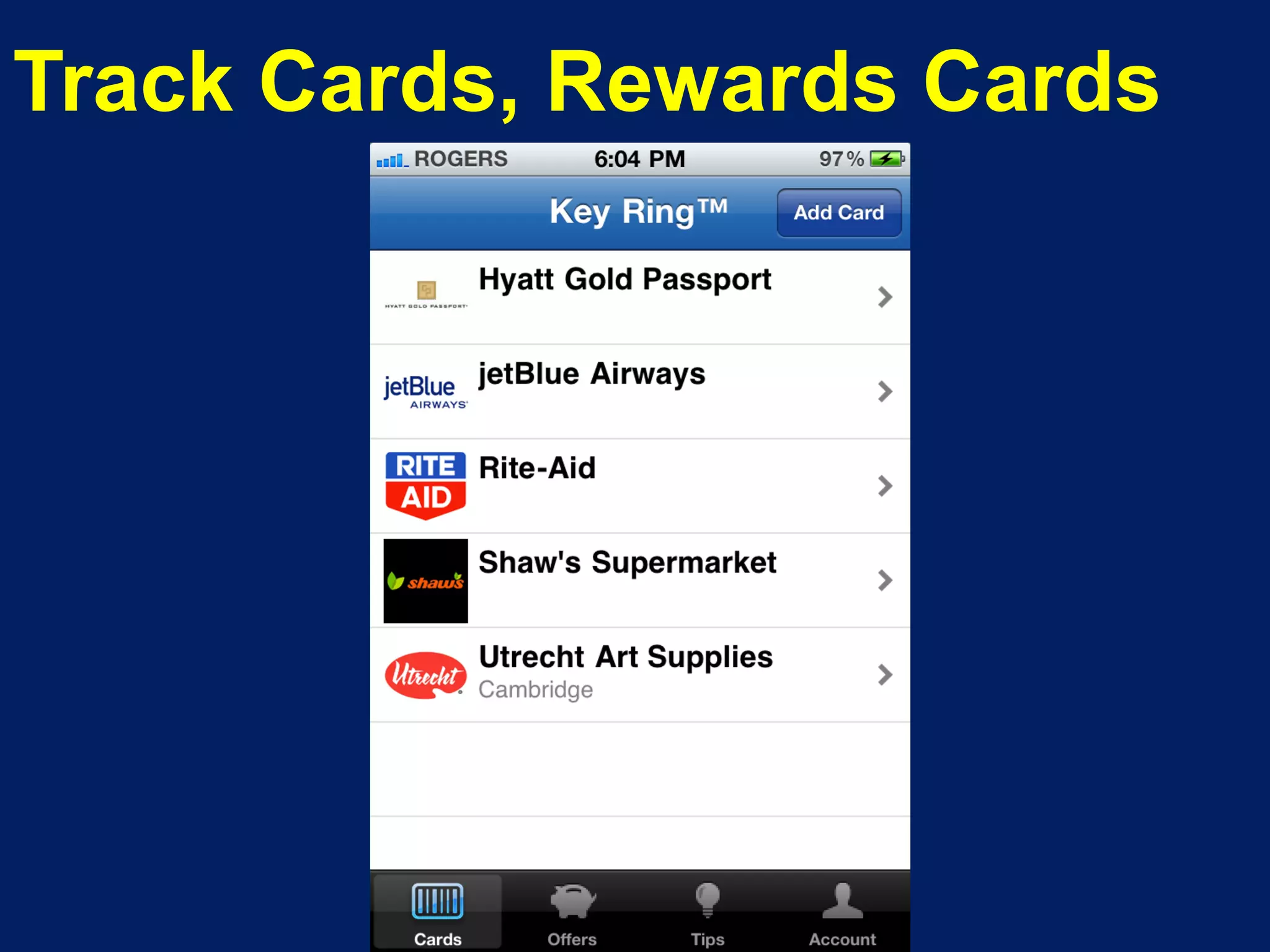

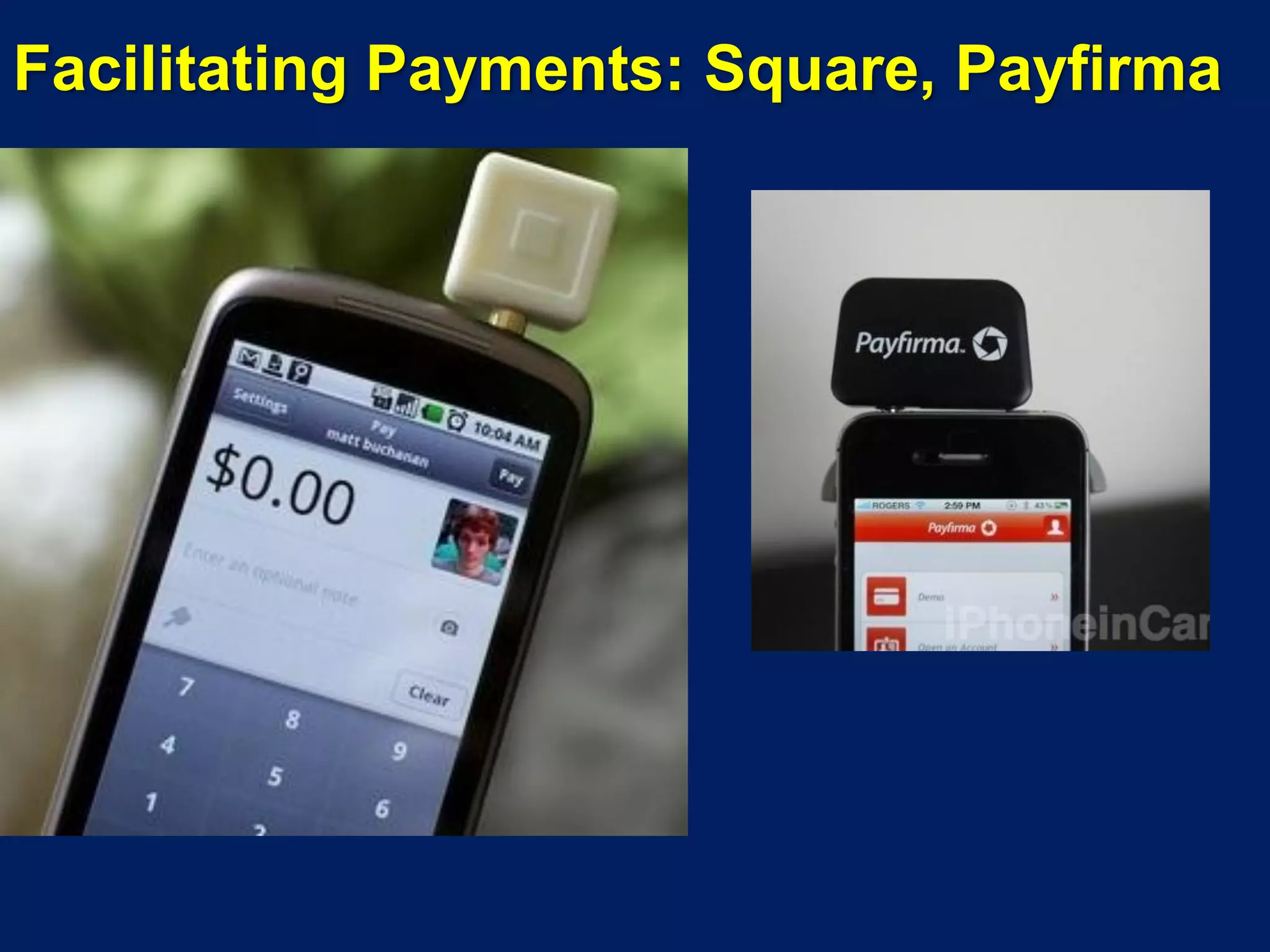

The document discusses the evolution of mobile technology, highlighting the shift towards consumer-centric models with the rise of smartphones and mobile communications. It examines various mobile opportunities such as SMS, MMS, and mobile video, emphasizing their importance in consumer engagement and marketing strategies. Additionally, it identifies behavioral changes related to mobile usage and offers insights into leveraging mobile channels for improved customer experiences.