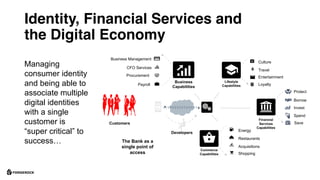

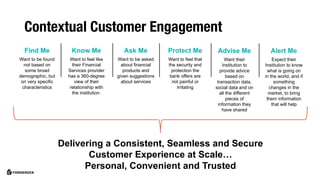

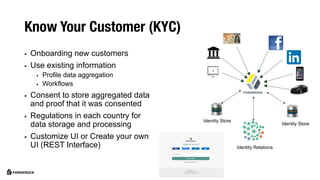

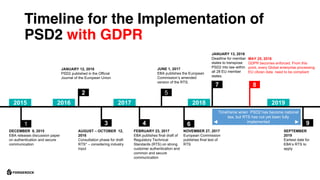

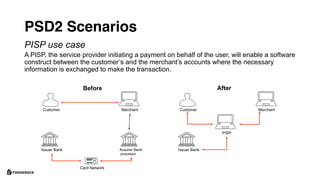

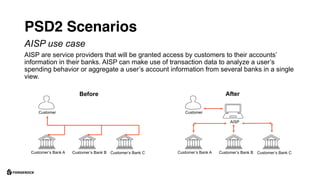

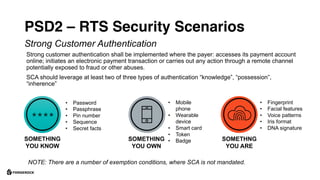

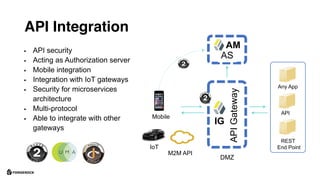

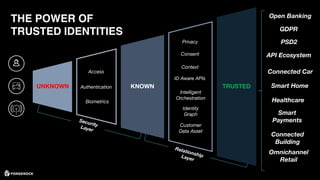

The document discusses the essential aspects of digital identity in financial services, emphasizing the importance of customer-centric approaches that enhance user experience and comply with regulatory requirements such as PSD2 and GDPR. It outlines the need for effective identity management, secure authentication, and the integration of customer data to deliver personalized services across digital channels. Additionally, it highlights the challenges and recommendations for organizations to adapt to evolving regulations and improve operational efficiency in the digital economy.