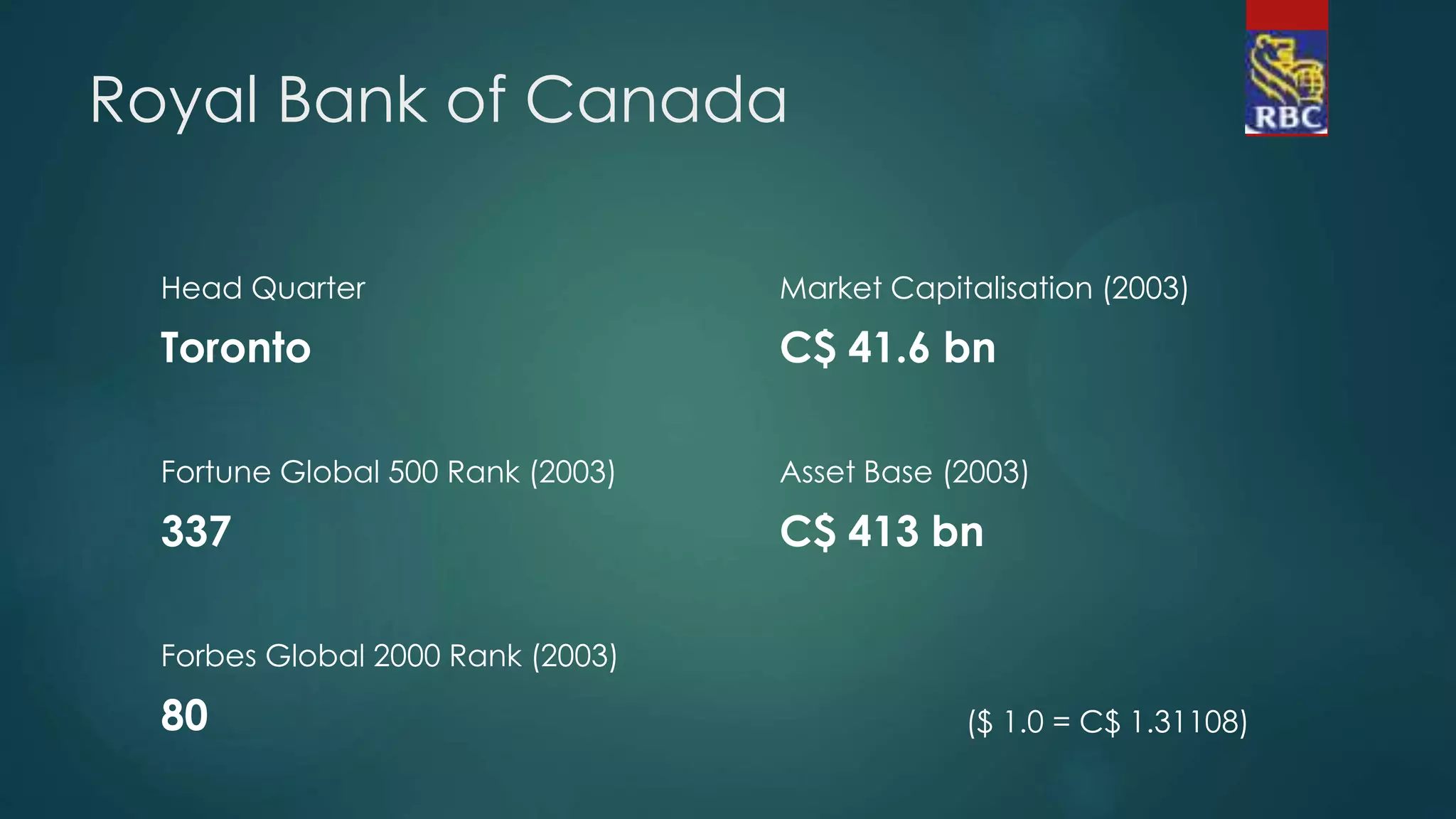

This document discusses corporate governance and provides an example case study of the Royal Bank of Canada. It defines corporate governance as the mechanisms and processes by which corporations are controlled and directed. It describes the role of boards of directors in overseeing management and shareholders' interests. It also discusses financial reporting responsibilities and the role of audit committees in providing oversight. The case study then provides details on the Royal Bank of Canada's governance structure, including its independent board composition and oversight committees.