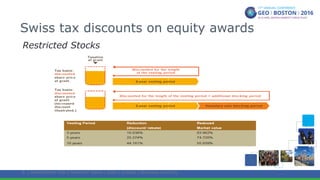

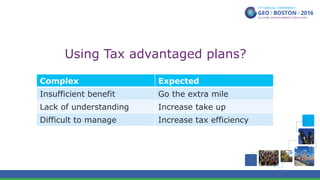

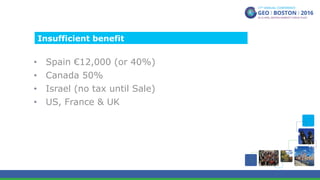

The document outlines details for speakers at the GEO's 17th annual international conference, including presentation guidelines, hotel reservation deadlines, and contact information for speakers. It emphasizes the importance of understanding various international tax-advantaged plans and discusses their complexities, benefits, and employee expectations. A call to action encourages attendees to consider exploring tax-approved plans to enhance employee engagement and tax efficiency.