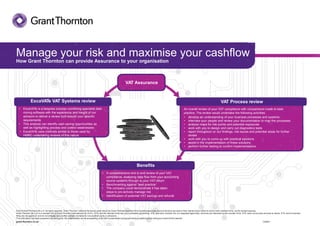

VAT: Manage your risk and maximise your cashflow

•

1 like•271 views

ExcaVATe is a bespoke process combining specialist data mining software with the experience and insight of our advisors to deliver a review built around your specific requirements. This analysis can identify cash saving opportunities as well as highlighting process and control weaknesses ExcaVATe uses methods similar to those used by HMRC undertaking reviews of this nature

Report

Share

Report

Share

Download to read offline

Recommended

Jornadas Odoo 2016 - Cómo realizar un módulo de Odoo compatible con todo - Pe...

Jornadas Odoo 2016 - Cómo realizar un módulo de Odoo compatible con todo - Pe...Pedro Manuel Baeza Romero

El CTO de Tecnativa realizará durante 30 minutos una charla de corte técnico sobre metodologías para mejorar la compatibilidad de un módulo dentro del ecosistema de Odoo para evitar conflictos con el resto. Se darán nociones de herencia, tests, metodologías, buenas prácticas y otros consejos para llevar a cabo la tarea.Jornadas Odoo 2016 - La comunidad mundial de Odoo (OCA) y su ecosistema - Ped...

Jornadas Odoo 2016 - La comunidad mundial de Odoo (OCA) y su ecosistema - Ped...Pedro Manuel Baeza Romero

Charla de 30 min para integradores (técnica) sobre lo que es la OCA, su función, sus beneficios, organización, etc.

Recommended

Jornadas Odoo 2016 - Cómo realizar un módulo de Odoo compatible con todo - Pe...

Jornadas Odoo 2016 - Cómo realizar un módulo de Odoo compatible con todo - Pe...Pedro Manuel Baeza Romero

El CTO de Tecnativa realizará durante 30 minutos una charla de corte técnico sobre metodologías para mejorar la compatibilidad de un módulo dentro del ecosistema de Odoo para evitar conflictos con el resto. Se darán nociones de herencia, tests, metodologías, buenas prácticas y otros consejos para llevar a cabo la tarea.Jornadas Odoo 2016 - La comunidad mundial de Odoo (OCA) y su ecosistema - Ped...

Jornadas Odoo 2016 - La comunidad mundial de Odoo (OCA) y su ecosistema - Ped...Pedro Manuel Baeza Romero

Charla de 30 min para integradores (técnica) sobre lo que es la OCA, su función, sus beneficios, organización, etc.

Jornadas Odoo 2016 - Odoo 9 seis meses después - Pedro M. Baeza

El CTO de Tecnativa dará un repaso durante 30 minutos a las características más destacadas de la versión 9 después de haber sido publicada, ya que la charla de las anteriores jornadas sólo había una versión beta. También se hablará del ecosistema Odoo para la versión 9 (OCA, localización, etc). Esta charla tiene un corte más funcional.

Jornadas Odoo 2015 - Charla con Odoo S. A.

Charla directa con Olivier Dony en representación de Odoo S. A., que nos ha puesto al tanto de las novedades, modelo de negocio, etc del sistema.

Jornadas Odoo 2016 - ¿Qué esperar de una nueva implantación de un ERP (Odoo)?...

Jornadas Odoo 2016 - ¿Qué esperar de una nueva implantación de un ERP (Odoo)?...Pedro Manuel Baeza Romero

¿Qué esperar de un ERP? ¿Qué esperar de Odoo? De la Excel a Odoo…. La idea es explicar los posibles escenarios que se pueden dar y lo que puede suceder basado en experiencias, tanto a nivel económico como funcional.Jornadas Odoo 2015 - Buenas prácticas en el desarrollo de Odoo

A menudo cuando se desarrolla, se acaba con código que a lo largo del tiempo resulta imposible de mantener. Eso se puede deber en parte a no haber seguido unas pautas y buenas prácticas cuando se desarrolló.

En este charla, intentaré explicar algunas buenas prácticas, muchas de ellas implantadas como reglas en código como el de la OCA (Odoo Community Association), y algunas pautas obtenidas por la experiencia.

Jornadas Odoo 2015 - Cómo migrar un módulo OpenERP a la nueva API de Odoo

La nueva API de desarrollo supone un ahorro de tiempo, mayor eficacia y menos posibles errores, por lo que aunque Odoo sigue siendo compatible con la antigua API, es conveniente migrar tu código a la nueva versión.

En esta charla se darán las pautas para migrar código realizado en la antigua API de OpenERP a la nueva API que se ha introducido en la versión 8 de Odoo.

Jornadas Odoo 2015 - Novedades Odoo v9

Queda poco para que la próxima versión de Odoo esté disponible (plazo exacto no definido), y en las jornadas Odoo experience se pudieron ver las novedades que traerá a nivel funcional. Centrada sobre todo en una reforma general de la contabilidad, la nueva versión también incorporará como es habitual un refinamiento del resto de opciones y un puñado de nuevas características que se añaden a las ya existentes.

Además, la nueva versión traerá aparejado un nuevo modelo de negocio que también se explicará y se opinará sobre el mismo.

Jornadas Odoo 2015 - Implantación de Odoo en una empresa de automatización in...

Jornadas Odoo 2015 - Implantación de Odoo en una empresa de automatización in...Pedro Manuel Baeza Romero

En esta charla se explicó un caso real de una implantación de Odoo hecha para una empresa norteamericana de automatización industrial. Se vio las particularidades de este sector, así como los beneficios y retos de exportar servicios de consultoría Odoo al extranjero (y particularmente a países donde hay una gran diferencia horaria).International indirect tax - the view from Grant Thornton

This placemat sets out two indirect tax issues facing businesses with a global footprint or international supply chain and some of Grant Thornton's solutions:

• How can we manage indirect tax in our global supply chain?

• How can we manage our VAT, GST and sales tax compliance obligations globally?

This also sets out details of what Grant Thornton sees as the current hot topics in indirect tax:

• Automation and tax technology

• Taxing the digital economy

• Focus on processes and controls

Short term business visitors managing risk and driving value for your business

With an increased focus on "good corporate governance" and the introduction of the OECD's BEPS action plan, tracking your STBVs is now essential for managing risk but can also help you identify opportunities.

BT Associate Profile

BT Associates, is a Management consulting firm providing specialized services in the area of Indirect Taxation. We cover entire gamut of Indirect taxation services viz Customs, Central Excise, Service tax, VAT and foreign Trade Policy.

Dawgen Global Services

Dawgen Global is an integrated multidisciplinary professional service firm in the Caribbean Region. We are integrated as one Regional firm and provide service in the Bahamas, Bermuda, the Cayman Islands, the Eastern Caribbean (Barbados, Antigua, St Lucia, Grenada, and St Kitts & Nevis), Jamaica, the Netherlands Antilles (Bonaire, Curacao, and St Maarten) and Aruba, Trinidad and Tobago and theTurks and Caicos Islands. Visit: https://dawgen.global/

The Future of Auditing and Fraud Detection

Re-imagining the art and science of auditing and fraud detection is coming to the forefront of risk management functions. What was seen as a “nice to have” a few years ago has become a “must have” as digital transformation and data surrounds all aspects of the organization.

Specific learning objectives include:

o See how analytics can maximize the annual audit plan and better ensure focus is placed on top organizational risks.

o Establish a framework to using analytics and automation across the entire audit lifecycle.

o Use the general ledger and revenue audit areas as a case study to provide a digital road map for analytics for detecting fraud (and errors) within the organization.

Invitation to grow with us

We help dynamic organisations unlock their potential for growth by providing meaningful and actionable advice through a broad range of services

More Related Content

Viewers also liked

Jornadas Odoo 2016 - Odoo 9 seis meses después - Pedro M. Baeza

El CTO de Tecnativa dará un repaso durante 30 minutos a las características más destacadas de la versión 9 después de haber sido publicada, ya que la charla de las anteriores jornadas sólo había una versión beta. También se hablará del ecosistema Odoo para la versión 9 (OCA, localización, etc). Esta charla tiene un corte más funcional.

Jornadas Odoo 2015 - Charla con Odoo S. A.

Charla directa con Olivier Dony en representación de Odoo S. A., que nos ha puesto al tanto de las novedades, modelo de negocio, etc del sistema.

Jornadas Odoo 2016 - ¿Qué esperar de una nueva implantación de un ERP (Odoo)?...

Jornadas Odoo 2016 - ¿Qué esperar de una nueva implantación de un ERP (Odoo)?...Pedro Manuel Baeza Romero

¿Qué esperar de un ERP? ¿Qué esperar de Odoo? De la Excel a Odoo…. La idea es explicar los posibles escenarios que se pueden dar y lo que puede suceder basado en experiencias, tanto a nivel económico como funcional.Jornadas Odoo 2015 - Buenas prácticas en el desarrollo de Odoo

A menudo cuando se desarrolla, se acaba con código que a lo largo del tiempo resulta imposible de mantener. Eso se puede deber en parte a no haber seguido unas pautas y buenas prácticas cuando se desarrolló.

En este charla, intentaré explicar algunas buenas prácticas, muchas de ellas implantadas como reglas en código como el de la OCA (Odoo Community Association), y algunas pautas obtenidas por la experiencia.

Jornadas Odoo 2015 - Cómo migrar un módulo OpenERP a la nueva API de Odoo

La nueva API de desarrollo supone un ahorro de tiempo, mayor eficacia y menos posibles errores, por lo que aunque Odoo sigue siendo compatible con la antigua API, es conveniente migrar tu código a la nueva versión.

En esta charla se darán las pautas para migrar código realizado en la antigua API de OpenERP a la nueva API que se ha introducido en la versión 8 de Odoo.

Jornadas Odoo 2015 - Novedades Odoo v9

Queda poco para que la próxima versión de Odoo esté disponible (plazo exacto no definido), y en las jornadas Odoo experience se pudieron ver las novedades que traerá a nivel funcional. Centrada sobre todo en una reforma general de la contabilidad, la nueva versión también incorporará como es habitual un refinamiento del resto de opciones y un puñado de nuevas características que se añaden a las ya existentes.

Además, la nueva versión traerá aparejado un nuevo modelo de negocio que también se explicará y se opinará sobre el mismo.

Jornadas Odoo 2015 - Implantación de Odoo en una empresa de automatización in...

Jornadas Odoo 2015 - Implantación de Odoo en una empresa de automatización in...Pedro Manuel Baeza Romero

En esta charla se explicó un caso real de una implantación de Odoo hecha para una empresa norteamericana de automatización industrial. Se vio las particularidades de este sector, así como los beneficios y retos de exportar servicios de consultoría Odoo al extranjero (y particularmente a países donde hay una gran diferencia horaria).Viewers also liked (13)

Jornadas Odoo 2016 - Odoo 9 seis meses después - Pedro M. Baeza

Jornadas Odoo 2016 - Odoo 9 seis meses después - Pedro M. Baeza

Jornadas Odoo 2016 - ¿Qué esperar de una nueva implantación de un ERP (Odoo)?...

Jornadas Odoo 2016 - ¿Qué esperar de una nueva implantación de un ERP (Odoo)?...

Jornadas Odoo 2015 - Buenas prácticas en el desarrollo de Odoo

Jornadas Odoo 2015 - Buenas prácticas en el desarrollo de Odoo

Jornadas Odoo 2015 - Cómo migrar un módulo OpenERP a la nueva API de Odoo

Jornadas Odoo 2015 - Cómo migrar un módulo OpenERP a la nueva API de Odoo

Jornadas Odoo 2015 - Implantación de Odoo en una empresa de automatización in...

Jornadas Odoo 2015 - Implantación de Odoo en una empresa de automatización in...

Similar to VAT: Manage your risk and maximise your cashflow

International indirect tax - the view from Grant Thornton

This placemat sets out two indirect tax issues facing businesses with a global footprint or international supply chain and some of Grant Thornton's solutions:

• How can we manage indirect tax in our global supply chain?

• How can we manage our VAT, GST and sales tax compliance obligations globally?

This also sets out details of what Grant Thornton sees as the current hot topics in indirect tax:

• Automation and tax technology

• Taxing the digital economy

• Focus on processes and controls

Short term business visitors managing risk and driving value for your business

With an increased focus on "good corporate governance" and the introduction of the OECD's BEPS action plan, tracking your STBVs is now essential for managing risk but can also help you identify opportunities.

BT Associate Profile

BT Associates, is a Management consulting firm providing specialized services in the area of Indirect Taxation. We cover entire gamut of Indirect taxation services viz Customs, Central Excise, Service tax, VAT and foreign Trade Policy.

Dawgen Global Services

Dawgen Global is an integrated multidisciplinary professional service firm in the Caribbean Region. We are integrated as one Regional firm and provide service in the Bahamas, Bermuda, the Cayman Islands, the Eastern Caribbean (Barbados, Antigua, St Lucia, Grenada, and St Kitts & Nevis), Jamaica, the Netherlands Antilles (Bonaire, Curacao, and St Maarten) and Aruba, Trinidad and Tobago and theTurks and Caicos Islands. Visit: https://dawgen.global/

The Future of Auditing and Fraud Detection

Re-imagining the art and science of auditing and fraud detection is coming to the forefront of risk management functions. What was seen as a “nice to have” a few years ago has become a “must have” as digital transformation and data surrounds all aspects of the organization.

Specific learning objectives include:

o See how analytics can maximize the annual audit plan and better ensure focus is placed on top organizational risks.

o Establish a framework to using analytics and automation across the entire audit lifecycle.

o Use the general ledger and revenue audit areas as a case study to provide a digital road map for analytics for detecting fraud (and errors) within the organization.

Invitation to grow with us

We help dynamic organisations unlock their potential for growth by providing meaningful and actionable advice through a broad range of services

VAT Club: New ERP - VAT considerations

Please find a copy of the slides from Grant Thornton UK LLP's recent VAT Club seminar, held at our Finsbury Square offices in London. In this breakout session, Alex Baulf and Franklin Mac, discussed key VAT considerations of selecting and implementing a new ERP system.

Operational Transfer Pricing (OTP) – Delivering future solutions

While TP policies are set by tax teams, implementation responsibility lies with finance

function, which may result in data definition gaps

• With different finance personnel working on different entities, the TP policies / cost

allocation logics may not be consistently applied to all the entities within the Group

• Manual computations are prone to errors; increasing the TP risk significantly

• Legal entity P&L

Third-Party Risk Management: Implementing a Strategy

Two Part Series: Part I of II

Third-Party Risk Management: Implementing a Strategy

Sleep Better at Night: Learn techniques to manage risks associated with third-party relationships.

5 misconceptions about the R&D tax credit

With Congress debating tax extenders, including the R&D tax credit, it's a good time to check your understanding of the credit and how you could use it more effectively. More at http://gt-us.co/1uDxLn6

Why prepare now? 5 things that smart businesses are doing TODAY to prepare fo...

Tax reform is top of mind for many of today’s businesses as they struggle to understand what it might mean to them, and what they should be doing to prepare. While it may be easy to be paralyzed by the uncertainty of the legislative process, a “wait-and-see” approach is a mistake. The prospect of tax reform creates tremendous new tax planning opportunities, and many of these are effective only if done before tax reform is enacted. No company should be making long-term business decisions without understanding how tax reform could affect the economic impact. Learn the five steps your business can take now to prepare for tax reform.

An industrial approach to risk and control self-assessments

Derive more value from your risk and control self-assessment process, and integrate your organization’s overall operational risk management process to comply with Dodd Frank and other legislation. We specialize in working with clients to help identify, remediate and resolve assessment gaps so they efficiently meet or exceed regulatory requirements.

Malaysia: GST Health Check

It is vital for businesses to identify the GST risks that may impact daily operations.

Grant Thornton Malaysia can provide GST Health Check Services that will accord you with guidance and assistance to identify the GST risks and subsequently your business can prepare remedial measures to mitigate the GST risks.

Similar to VAT: Manage your risk and maximise your cashflow (20)

International indirect tax - the view from Grant Thornton

International indirect tax - the view from Grant Thornton

Short term business visitors managing risk and driving value for your business

Short term business visitors managing risk and driving value for your business

Operational Transfer Pricing (OTP) – Delivering future solutions

Operational Transfer Pricing (OTP) – Delivering future solutions

Third-Party Risk Management: Implementing a Strategy

Third-Party Risk Management: Implementing a Strategy

Why prepare now? 5 things that smart businesses are doing TODAY to prepare fo...

Why prepare now? 5 things that smart businesses are doing TODAY to prepare fo...

An industrial approach to risk and control self-assessments

An industrial approach to risk and control self-assessments

More from Alex Baulf

Bahrain: Phased roll out of VAT in Bahrain

The National Bureau of Taxation, operating under the Ministry of Finance, conducted their first VAT briefing session on 3rd December 2018 which was attended by several accounting firms. MOF presented the way forward on VAT implementation and addressed several concerns raised during the meeting. In light of this discussion, Grant Thornton Bahrain's VAT team has set out the key takeaways in the attached Alert.

UK: VAT alert - Government publicises VAT changes if there is “no-deal” on B...

Not that it is expecting a ‘no-deal’ scenario – the UK Government has specifically emphasised that it fully expects the opposite - but, just in case, it has announced a number of measures relating to UK VAT should agreement between the EU and the UK not materialise.

The Government considers that it is progressing well in its negotiations with the EU on the terms of Britain’s exit. However, rightly, it recognises that it is always possible that agreement will not be reached. As a consequence, it has made announcements in relation to VAT in the event of a so-called Brexit ‘no-deal’.

UK businesses – especially those that trade with businesses in other Member States of the EU have had concerns on a number of fronts, not least how the UK VAT system will work after Brexit and what changes will be needed in relation to import and export procedures.

The announcements made by the Government should help businesses to prepare for a ‘no-deal’ Brexit with a little more certainty. In line with the Government, businesses should not assume that an agreement will be reached. Businesses should be prepared for a ‘no-deal’ scenario even though that may not come to fruition.

Case alert - Adecco UK Ltd & Ors

The Court of Appeal has released its judgment in Adecco UK Ltd & Ors (Adecco). In dismissing Adecco’s appeal the Court confirmed the decisions of the First Tier Tribunal (FTT) and Upper Tribunal (UT) that Adecco’s supplies of temporary staff under its ‘non-employment’ contract arrangements were liable to VAT on the full value of the supply by Adecco to the client. Adecco contended that it was liable to VAT only to the extent of its administrative and ancillary charges to the client. In its view, any charges relating directly to the costs of paying temps were not liable to VAT.

Adecco’s supplies of the services of ‘employed’ temps and ‘selfemployed’ temps were not in question. The dispute centred around ‘non-employed’ temps. In the case of ‘non-employed’ temps, the Court determined that the extent of control exerted by Adecco, the fact that Adecco met the temp’s PAYE/NIC and similar obligations was significant. Further, the Court found that there were no material differences in contracts with clients whether Adecco were placing employed or non-employed temps, such that the client would be unaware of any distinction. Adecco supplied the services of temps to clients. Adecco’s appeal dismissed.

Case alert - The Rank Group plc

The First Tier Tribunal (FTT) has released its decision in the case of The Rank Group plc (Rank). Rank operated 3 types of automated gambling machine: Fixed Odds Betting Terminals (FOBT), section 16/21 and section 31/34 machines. The issue for the FTT to consider was whether the machines were ‘similar’. If so, treating them differently for VAT purposes would offend the principle of neutrality. The CJEU had previously held that the machines in question fell within the same category (broadly referred to as slot machines). However, it was for the UK court to decide whether the machines in question were ‘similar’. If so, treating the income from such machines differently for VAT purposes would be considered to offend the principle of fiscal neutrality. The FTT determined that the correct test was to examine the betting experience from the perspective of the user. Would the user’s needs be equally met whichever machine was selected? In examining the evidence, the FTT concluded that the user experience was substantially similar and that users would select machines for a variety of reasons, often playing machines interchangeably. On the basis that such factors as machine location, atmosphere, opening hours and availability were specifically stated by the CJEU to be disregarded in this context, the FTT concluded that the machines were similar. Accordingly, the principle of fiscal neutrality was offended. Rank’s appeal allowed.

Case alert - Zipvit Ltd

The Court of Appeal has issued a unanimous judgment in the appeal by Zipvit Ltd (Zipvit) against the judgment of the Upper Tribunal. Zipvit, like many other businesses, contracted with Royal Mail to supply delivery services. At the relevant time, these services were treated by Royal Mail, Zipvit and HMRC as being exempt from VAT under the UK’s implementation of the ‘postal services’ exemption.

However, following the Court of Justice judgment in the ‘TNT’ case in 2009 (which ruled that VAT exemption only applied to universal postal services), it became clear to all parties (including HMRC) that the mailmedia service provided by Royal Mail should have been liable to VAT at the standard rate.

On that basis, Zipvit submitted a claim for a refund of the input VAT purportedly included in the price it had paid to Royal Mail. HMRC rejected that claim and Zipvit appealed to the First-tier Tax Tribunal (FTT). The FTT dismissed the appeal as did the Upper Tribunal.

Now, the Court of Appeal has dismissed Zipvit’s appeal. The judgment issued on 30 June 2018 dismisses the appeal on the basis that Zipvit had no valid VAT invoice to support its claim. A fact regarded as a fatal flaw.

Case alert - Marle Participations SARL

This case - a referral to the Court of Justice by the French court - delivers the judgment of the European Court with regard to the recovery of input VAT on expenditure incurred by Marle Participations SARL (‘Marle’). The company sought to recover input VAT on expenditure incurred on expenses relating to a corporate restructure. The tax authorities denied input VAT recovery on the grounds that the expenditure related to activities that were capital in nature and so fell outside the scope of VAT (thereby precluding VAT recovery). Marle argued that the letting of property by the holding company to a subsidiary amounted to ‘involvement in the management’ of the subsidiary. This involvement constituted an ‘economic activity’ so enabling VAT to be recovered on the restructuring costs.

The Court has ruled that the letting of property to its subsidiary amounted to ‘involvement in the management’ of that subsidiary. As such it constituted an ‘economic activity’ carrying the right, in principle, to input VAT recovery. Such input VAT recovery was to be regarded as general expenditure of Marle (and therefore subject to the normal rules governing VAT recovery). Providing the letting services were supplied by Marle on a continuing basis, for consideration, the services were taxable and Marl could demonstrate a direct link between those services to its subsidiary and the consideration it received, input VAT could be deducted in full.

International Indirect Tax - Global VAT/GST update (June 2018)

High level slides from Grant Thornton's VAT Club seminar in London held in June 2018.

Topics covered include:

ECJ decision - C-580/16 Hans Bühler - Triangulation

Netherlands - VAT rate change

Russia - VAT rate change

Bahamas - VAT rate change

Angola - New VAT system

Liberia - New VAT system

Costa Rica - New VAT system

Costa Rica - e-invoicing requirements

Hungary - Electronic Invoicing

Italy - Mandatory e-invoicing

Australia - GST on hotel accommodation

Poland - VAT split payments

Spain - First penalties in relation to SII

Greece - SAF-T & E-Invoicing?

Argentina - VAT on digital services

Columbia VAT on digital services

Canada - Quebec: New QST obligations for non-resident suppliers of digital services

USA: Wayfair – the Decision

India - “Happy Birthday GST" - what's next

New Zealand - Low value consignment relief

Malaysia - GST to 0% and transition to SST

United Arab Emirates - Exchange Rates for VAT purposes

Kuwait - VAT postponed until 2021?

GCC - Bahrain, Oman, Qatar VAT implementation latest

Spain - First penalties relating to SII

The Spanish Tax Authorities have announced that they start to impose penalties for the non-compliance with the Immediate Supply of Information on VAT (ISI). The ISI entered into force last 1 July 2017, but the appropriate regulation of certain specific penalties did not come into effect until 1 January 2018.

USA: Georgia Enacts Legislation Imposing Bright-Line Nexus Collection or Repo...

On May 3, 2018, Georgia Governor Nathan Deal signed H.B. 61 enacting significant changes to sales and use tax laws, including imposing a bright-line nexus rule on certain sellers of tangible personal property. Effective January 1, 2019, any seller that conducts 200 or more separate retail sales of tangible personal property for Georgia delivery or obtains more than $250,000 in gross revenue from such sales is considered a dealer that must either register to collect and remit sales tax or notify customers of use tax obligations and report to the state that such requirements have been fulfilled.

U.S. Supreme Court Holds Hearing in South Dakota v. Wayfair

On April 17, 2018, the U.S. Supreme Court considered oral arguments in South Dakota v. Wayfair, a case that may have groundbreaking implications with respect to sales and use tax nexus standards. Last year, the South Dakota Supreme Court unanimously affirmed a circuit court’s decision that a law requiring certain remote sellers that do not have a physical presence in South Dakota to collect sales tax on sales made in the state is unconstitutional. In affirming the circuit court, the South Dakota Supreme Court agreed that the law violates the physical presence requirement for sales and use taxes under Quill v. North Dakota and its application of the Commerce Clause. The U.S. Supreme Court decided to consider the case and recently heard oral arguments. Mark Arrigo, Matthew Melinson, Jamie Yesnowitz and Jeremy Jester from Grant Thornton LLP attended the hearing and provide their observations in this Alert.

China tax bulletin - Issue 2 April 2018

As a supplement to Grant Thornton China's China Tax Alert, China Tax Bulletin aims to provide you with a prompt and high level overview on the latest tax rules released by various authorities, especially those by China SAT and local tax authorities. Implications for your business are also presented for the tax rules.

The latest issue of China Tax Bulletin covers the following topics:

* New Rules Issued on Deferral of Withholding Tax on Dividends Paid to Foreign Investors and Reinvested in China

* SAT Releases 2017 Enterprise Income Tax Return Forms Clarifications on the filing of tax exemption for cross-border taxable activities and other VAT-related issues

* Government Issues More Guidance Clarifying Issues Arising from VAT Reform

State Administration of Taxation Further Clear the Determination of “Beneficial Owner”

We hope you can like our sharing and find it beneficial to your daily business. At the same time, please feel free to contact us for any further clarification on any of the covered tax issues.

International Indirect Tax - Global VAT/GST update (March 2018)

These are the slides from the International Indirect Tax - Global VAT/GST update presented at Grant Thornton's VAT Club held in London on 9th March 2018.

The topics discussed include:

EU

• Bulgarian Presidency

• VAT Action Plan – proposal for a Definitive VAT System based on destination principle

• Customs: Binding Valuation Information (BVI)

• Considerations for using TP for Customs value

• Hungary: Electronic Invoicing

• Spain: SII 1.1 new version

• Italy: Simplifications to “Communications of data of invoices issued and received”

• Italy: Mandatory e-invoicing?

EMEA

• South Africa: VAT rate increase

• GCC – where are we?

• UAE: What's been released ? What's missing? Designated Zones

NOAM

• USA: Landmark sales tax nexus case to be heard in Supreme Court

APAC

• India: GST update

• China: Further VAT reform

• Malaysia: GST Compliance Assurance Program (MyGCAP)

• Singapore: Future GST rate increase / reverse charge

• Australia: Final guidance published for online retailers - GST on low value imported goods

This publication has been prepared only as a high level guide. No responsibility can be accepted by us for loss occasioned to any person acting or refraining from acting as a result of any material in this publication.

China: Tax Bulletin-Latest update on VAT Regulations

Subsequent to Grant Thornton China's last update in July 2017, this VAT Alert summarizes some of the further significant changes on VAT regulations for your reference.

- Revision of the “Provisional Regulations of the People's Republic of China on Value-added Tax” (Referred to as “VAT regulation revision 2017“)

- Clarification on Input VAT Issues

- VAT regulations on specified financial products

- Changes on VAT invoices

- Simplified tax administration on registration of general VAT payers

India: Recommendations from GST Council in 25th meeting

The GST council in its 25th council meeting held on 18 January 2018 in New Delhi, recommended various changes to the GST law. The changes, inter alia, include revision of rates applicable to certain goods/services, introduction of exemptions, and rationalisation of various existing exemptions etc.

Serbia: Tax Alert - Amendments of Serbian Tax Laws (Dec 2017)

On 14 December 2017, the Serbian Parliament adopted amendments to the VAT Law, which were published in the Official Gazette of the Republic of Serbia No.113/2017.

The adopted amendments will go into force on January 1 2018, with exception of certain provisions for which it is particularly emphasized.

On 14 December 2017, the Serbian Parliament adopted amendments to the Corporate Income Tax Law, which were published in the Official Gazette of the Republic of Serbia No.113/2017.

The adopted amendments will go into force on January 1 2018, with exception of provisions regulating withholding taxation. The majority of provisions shall be applied starting from the filing of tax return for 2018.

Please see a high level overview of these changes in the Tax Alert from Grant Thornton Serbia.

USA: NY - New York Appellate Division Holds Certain Data Information Services...

The New York Supreme Court, Appellate Division has held that the competitive price reports purchased by a supermarket retailer were considered to be information services that qualified for a statutory exclusion from sales tax. The Court concluded that the information services were excluded from sales tax because the information was personal or individual in nature and was not substantially incorporated into reports of others.

UK: Briefing Paper - Are you ready for Making Tax Digital?

The UK government is going ahead with its Making Tax Digital (“MTD”) programme, starting with VAT-registered taxpayers. From 1 April 2019, businesses with a turnover above the VAT registration threshold will be required to keep specified minimum records in the VAT account and to submit the current nine- box VAT return to HMRC via Application Program Interface (“API”) software (linking either the accounting system or excel spreadsheets to the HMRC system).

China: Tax bulletin 2017 Issue 4 - VAT

As a supplement to Grant Thornton China's China Tax Alert, China Tax Bulletin aims to provide you with a prompt and high level overview on the latest tax rules released by various authorities, especially those by China SAT and local tax authorities. Implications for your business are also presented for the tax rules.

The latest issue of China Tax Bulletin covers the following topics:

Preferential tax deduction regarding R&D expenses extended to small and medium sized technology enterprises;

New value-added tax rules applicable to assets management products;

Clarifications on the filing of tax exemption for cross-border taxable activities and other VAT-related issues;

Key updates relating to the issuance of VAT invoices;

Widened scope of income tax incentives for small low profit enterprises;

New issued catalogue of industries for guiding foreign investment;

New administration guidance on China withholding tax; and

Detailed guidance on scope of concentration of super pre-tax deduction for R&D costs.

Cyprus: VAT Alert - VAT on building land, leasing of commercial immovable pro...

Following much anticipation and speculation the Cyprus Parliament has enacted far reaching amendments to the Cyprus VAT Law on 3/11/2017 which impact transactions related to immovable property. The amending legislation (N157(1) of 2017) was published in the Official Gazette of the Republic of Cyprus on 13/11/2017.

• A significant part of the aforementioned changes involve the imposition of VAT on the supply of land. These amendments to the Cyprus VAT Law were a condition of Cyprus’ accession to the EU in 1/5/2004 for which a derogation was secured until 31/12/2007. Their enactment brings Cyprus in line with the obligations undertaken within this scope.

Saudi Arabia - VAT Frequently Asked Questions

Summary of the KSA VAT FAQs published by GAZT on its website in November 2017.

More from Alex Baulf (20)

UK: VAT alert - Government publicises VAT changes if there is “no-deal” on B...

UK: VAT alert - Government publicises VAT changes if there is “no-deal” on B...

International Indirect Tax - Global VAT/GST update (June 2018)

International Indirect Tax - Global VAT/GST update (June 2018)

USA: Georgia Enacts Legislation Imposing Bright-Line Nexus Collection or Repo...

USA: Georgia Enacts Legislation Imposing Bright-Line Nexus Collection or Repo...

U.S. Supreme Court Holds Hearing in South Dakota v. Wayfair

U.S. Supreme Court Holds Hearing in South Dakota v. Wayfair

International Indirect Tax - Global VAT/GST update (March 2018)

International Indirect Tax - Global VAT/GST update (March 2018)

China: Tax Bulletin-Latest update on VAT Regulations

China: Tax Bulletin-Latest update on VAT Regulations

India: Recommendations from GST Council in 25th meeting

India: Recommendations from GST Council in 25th meeting

Serbia: Tax Alert - Amendments of Serbian Tax Laws (Dec 2017)

Serbia: Tax Alert - Amendments of Serbian Tax Laws (Dec 2017)

USA: NY - New York Appellate Division Holds Certain Data Information Services...

USA: NY - New York Appellate Division Holds Certain Data Information Services...

UK: Briefing Paper - Are you ready for Making Tax Digital?

UK: Briefing Paper - Are you ready for Making Tax Digital?

Cyprus: VAT Alert - VAT on building land, leasing of commercial immovable pro...

Cyprus: VAT Alert - VAT on building land, leasing of commercial immovable pro...

VAT: Manage your risk and maximise your cashflow

- 1. VAT AssuranceVAT Assurance Manage your risk and maximise your cashflow How Grant Thornton can provide Assurance to your organisation VAT Process review An overall review of your VAT compliance with comparisons made to best practice. The review would undertake the following activities: Benefits • A comprehensive end to end review of your VAT compliance, analysing data flow from your accounting source systems through to your VAT return • Benchmarking against ‘best practice’ • The company could demonstrate it has taken steps to pro-actively manage risk • Identification of potential VAT savings and refunds ExcaVATe VAT Systems review • ExcaVATe is a bespoke process combining specialist data mining software with the experience and insight of our advisors to deliver a review built around your specific requirements • This analysis can identify cash saving opportunities as well as highlighting process and control weaknesses • ExcaVATe uses methods similar to those used by HMRC undertaking reviews of this nature • develop an understanding of your business processes and systems • interview your people and review your documentation to map the processes • analyse maps for risk points and potential exposures • work with you to design and carry out diagnostics tests • report throughout on our findings, risk issues and potential areas for further review • work with you to come up with practical solutions • assist in the implementation of these solutions • perform further testing to confirm implementations. © 2014GrantThorntonUK LLP.All rights reserved. 'Grant Thornton’ refers to the brand under which the Grant Thornton member firms provide assurance, tax and advisory services to their clients and/or refers to one or more member firms, as the context requires. Grant Thornton UK LLP is a member firm of Grant Thornton International Ltd (GTIL). GTIL and the member firms are not a worldwide partnership. GTIL and each member firm is a separate legal entity. Services are delivered by the member firms. GTIL does not provide services to clients. GTIL and its member firms are not agents of, and do not obligate, one another and are not liable for one another’s acts or omissions. This information has been prepared only as a guide. No responsibility can be acceptedby us for loss occasionedto any personactingor refrainingfrom actingas a result of this material. grant-thornton.co.uk V22847