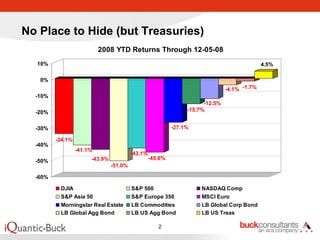

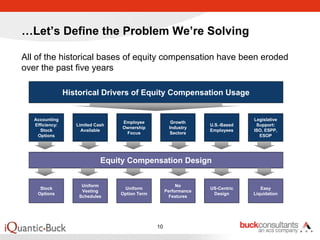

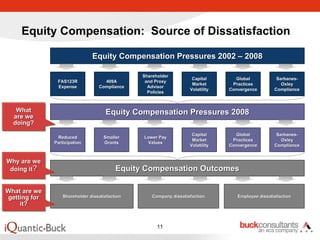

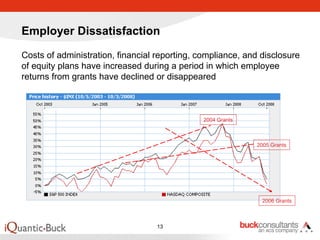

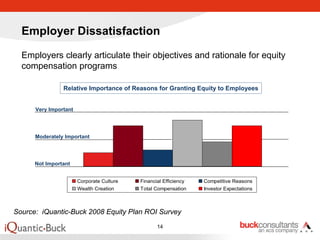

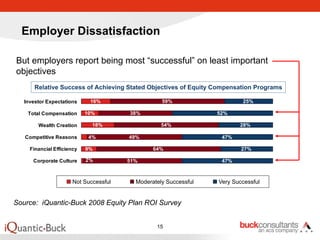

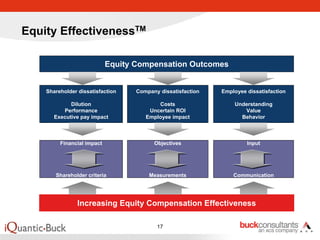

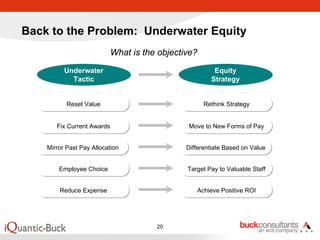

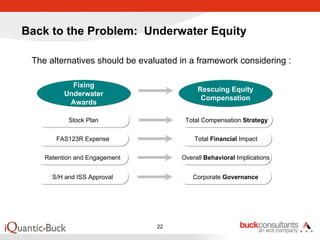

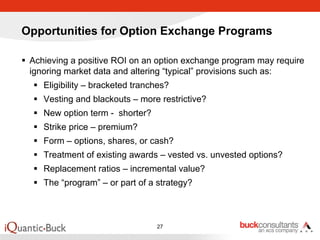

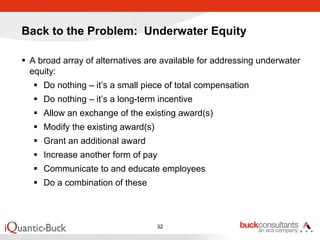

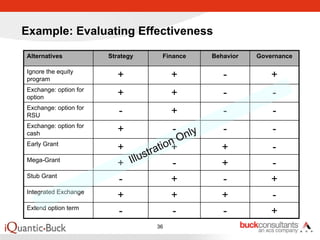

The document discusses the problems facing equity compensation plans in volatile market conditions. It notes that options, RSUs, and performance plans have all gone "underwater" as stock prices have declined significantly. This has led to shareholder value losses, revenue reductions, and widespread layoffs. Questions are raised about restoring equity value through actions like option exchanges that may raise governance concerns. The status of various equity award types is assessed, and the need to redefine the purpose and effectiveness of equity compensation is discussed.