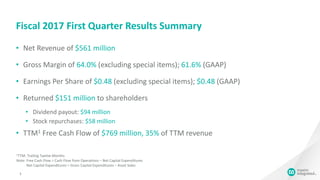

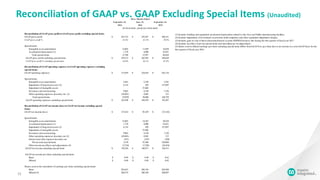

- In the first quarter of fiscal year 2017, the company reported net revenue of $561 million, gross margin of 64.0% excluding special items, and earnings per share of $0.48 excluding special items.

- The company returned $151 million to shareholders in the quarter through $94 million in dividends and $58 million in stock repurchases.

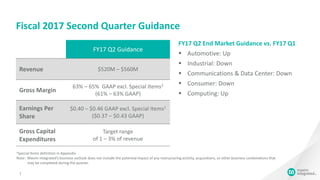

- For the second quarter of fiscal year 2017, the company expects revenue between $520-560 million and earnings per share between $0.40-0.46 excluding special items.