Embed presentation

Download to read offline

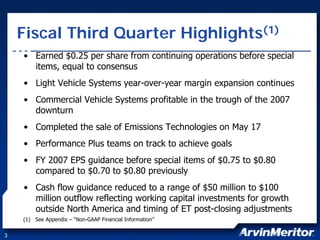

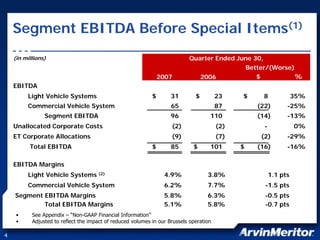

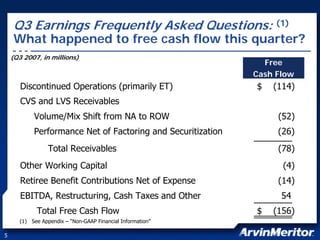

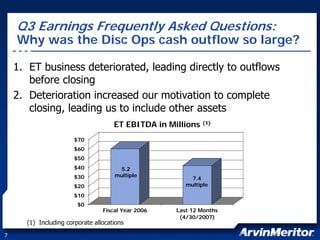

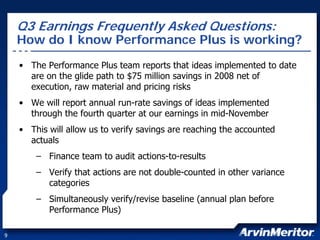

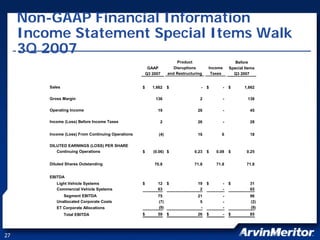

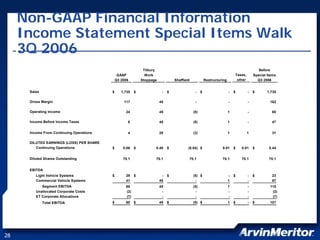

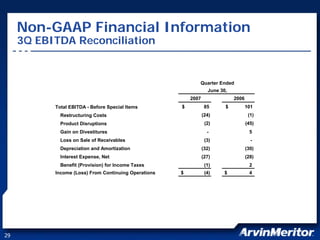

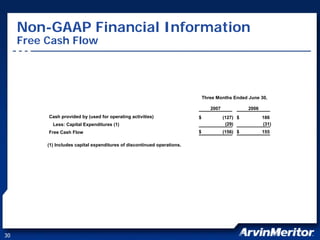

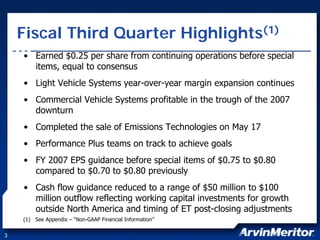

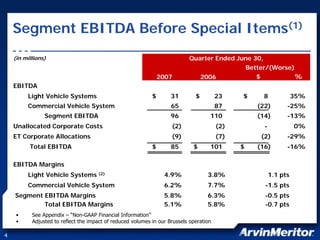

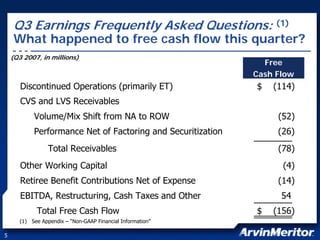

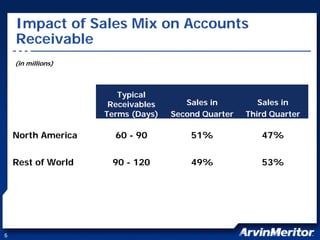

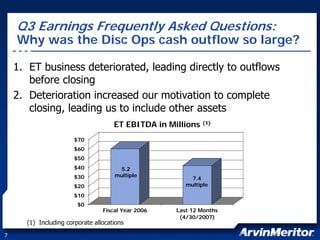

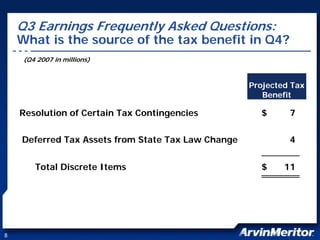

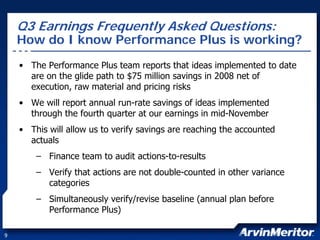

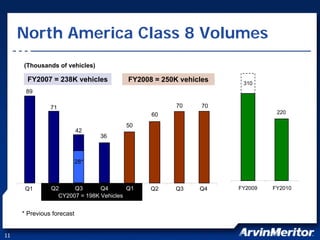

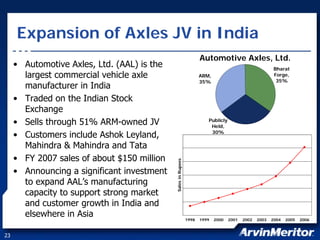

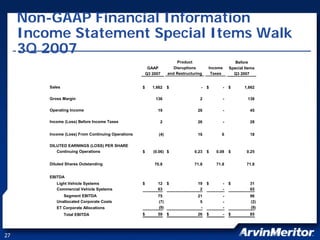

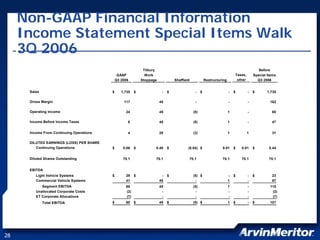

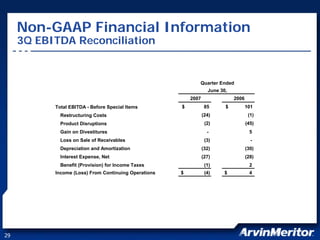

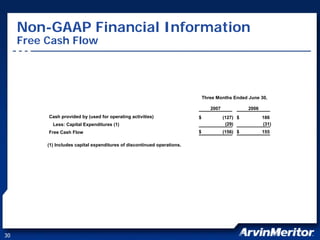

This document summarizes a presentation given by Jay Craig, Senior Vice President and Controller of ArvinMeritor, at the JPMorgan Harbour Auto Conference on August 6, 2007. The presentation discusses ArvinMeritor's financial results for the third quarter of fiscal year 2007, including earnings of $0.25 per share before special items. It also provides guidance for full year 2007 EPS of $0.75 to $0.80 before special items. The presentation addresses questions about free cash flow and the sale of the Emissions Technologies business unit.