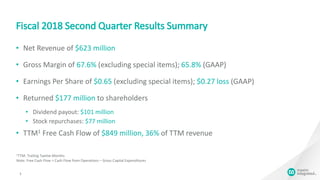

- The company reported net revenue of $623 million for the fiscal second quarter of 2018, an increase of 13% from the same quarter last year. Gross margin was 67.6% excluding special items and 65.8% under GAAP. Earnings per share was $0.65 excluding special items and a loss of $0.27 under GAAP.

- For the fiscal third quarter of 2018, the company expects revenue between $620-660 million with gross margin of 66-68% excluding special items. Earnings per share is expected to be $0.66-0.72 excluding special items.

- Key metrics such as free cash flow, capital expenditures, dividends, and share repurchases

![$0.18

$0.22

$0.26

$0.30

$0.34

$0.38

$0.42

FY12 Q3 FY14 Q3 FY16 Q3 FY18 Q3

Quarterly Cash Dividend Per Share

11

$0

$50

$100

$150

$200

$250

FY12 Q2 FY14 Q2 FY16 Q2 FY18Q2

Dividends & Share Repurchases

Dividend

Return of Cash to Shareholders

Buyback

+9%

+8%

+8%

Share repurchase increasing in FY18 Q3 to enable

100% of FCF returned to shareholders

+9%

+7%

+10%

Quarterly dividend increased to $0.42

per share in FY18 Q3

[$M] +17%](https://image.slidesharecdn.com/q218earningspresentationfinal-180125194918/85/Q218-earnings-presentation-final-11-320.jpg)