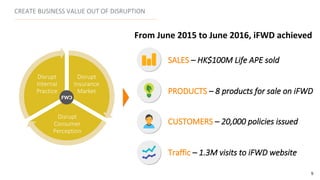

FWD Life Insurance Company launched an internal disruptor team called iFWD to change the way people feel about insurance using new technology and an agile development approach. iFWD quickly became the top direct and digital insurance distribution channel in Hong Kong by prototyping products rapidly based on online customer validation. iFWD disrupted consumer perception by ranking first in brand surveys and disrupted FWD's internal practices by digitalizing processes. They use precision marketing, innovative products like Savie savings insurance, partnerships, and work with regulators to push insurtech forward.

![INNOVATIVE SAVING INSURANCE – SAVIE

An innovative & digital saving solution to change market perception and target the digital generation customers

11

Key Selling Points

Savie guarantees annual crediting

rate of the first 3 years.

You can withdraw the account value

with NO charges at any time - giving you

flexibility of access to meet your needs!

Received a death benefit of 105% of

your account value, and a further

accidental death benefit equivalent to

100% of the account value.

Save with ease

Free from charges

Extra protection

Key Selling Points

Simple product design, with no fees and

charges at all

Flexibility to stay with us after 3 years to

earn rates declared by FWD

Happy to explain through 24x7 hotlines,

LiveChat & Customer Centre

Innovative Online-to-offline process to

create new experience

Financial Need Analysis to ensure you

are buying what you need

Free withdrawal; we are there when you

are in need

We used a “Hunger Selling” tactic to market our

Saving Insurance, Savie, to young, digitally savvy

first-time insurance buyers

We marketed Savie online and invited interested

customers to enter for a chance to sign up for Savie

[Reduced the barrier to convert]

We sent the lucky winners an email detailing the

next step

[Created anticipation]

Only the lucky, selected winners were able to visit

the site and apply for a Savie account

[Created a “privilege” to buy]

We successfully increased the conversion rate and

created a rush of customers looking to buy our

product

[Similar to the experience of IPO or signing up for

iPhone]](https://image.slidesharecdn.com/attachment2-pptdeckforfwd-160910012130/85/FWD-Innovation-Award-Presentation-11-320.jpg)