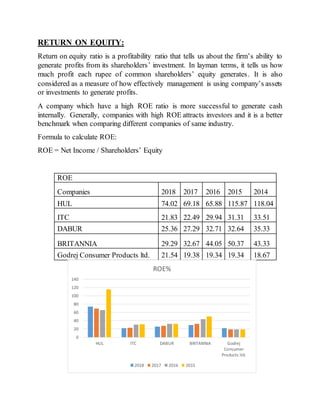

The document is a project report analyzing the fundamentals of companies in the Fast Moving Consumer Goods (FMCG) sector in India. It analyzes the top 5 FMCG companies based on market capitalization over 5 years of financial data using ratio analysis. The ratio analysis shows Hindustan Unilever has the highest P/E ratio, indicating investors are willing to pay more for its shares, while ITC has a lower P/E ratio, suggesting it may be undervalued. The report aims to help investors identify fundamentally strong FMCG stocks to invest in or create an optimal investment portfolio.