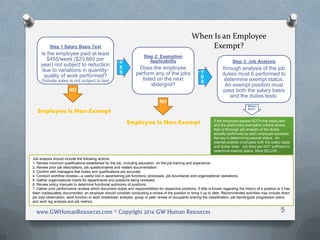

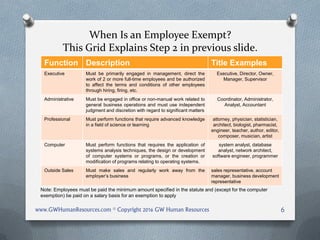

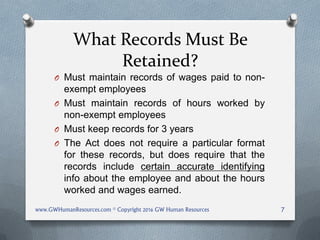

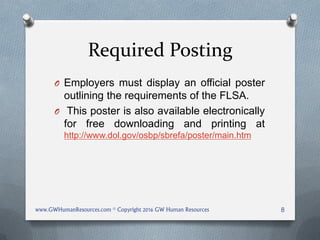

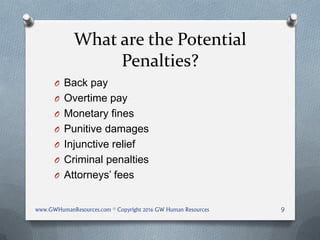

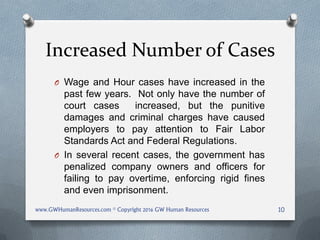

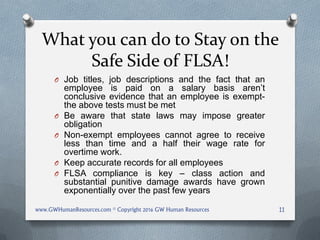

The Fair Labor Standards Act (FLSA) applies to employers with two or more employees, annual sales of $500,000 or more, or who engage in interstate commerce, which broadly includes most workplaces. The FLSA mandates minimum wage, overtime pay at 1.5 times the regular rate for hours worked over 40 in a week, and restrictions on employing minors. Employers must keep accurate records, display an official FLSA poster, and be aware of potential penalties for non-compliance.