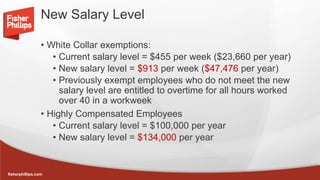

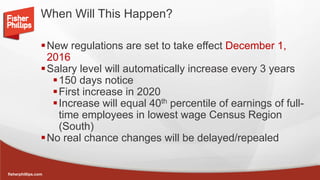

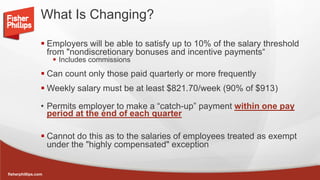

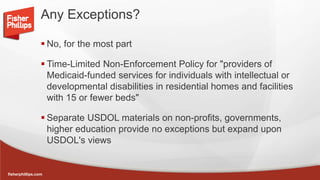

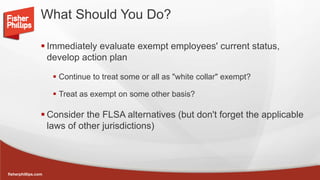

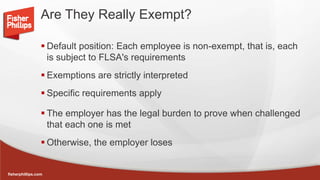

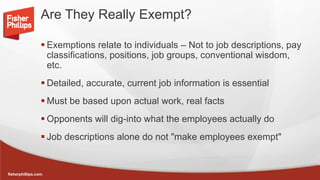

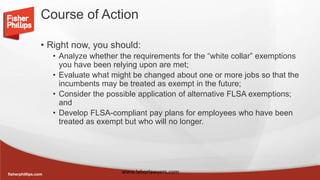

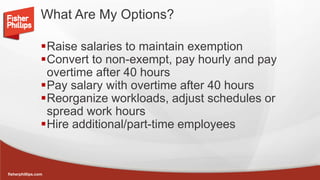

The document discusses upcoming changes to the Fair Labor Standards Act (FLSA) regarding exemptions from overtime pay for white collar workers. Beginning December 1, 2016, the salary threshold for exempt employees will increase from $455/week to $913/week. Employers will need to ensure exempt employees meet the new salary level or reclassify them as non-exempt and pay overtime. The regulations will be automatically adjusted every three years to keep pace with inflation. Employers should analyze their current classifications and compliance in light of the changes.