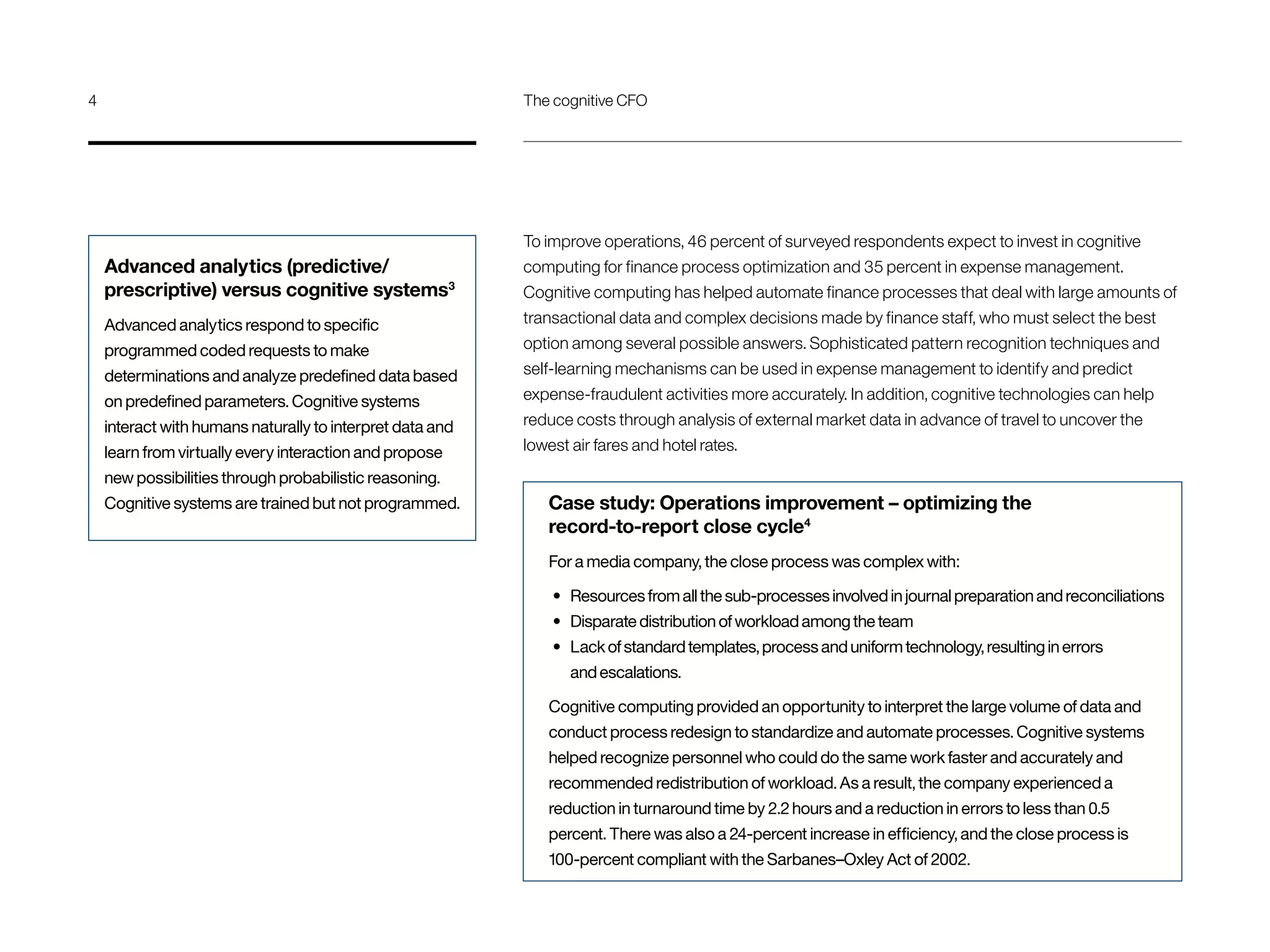

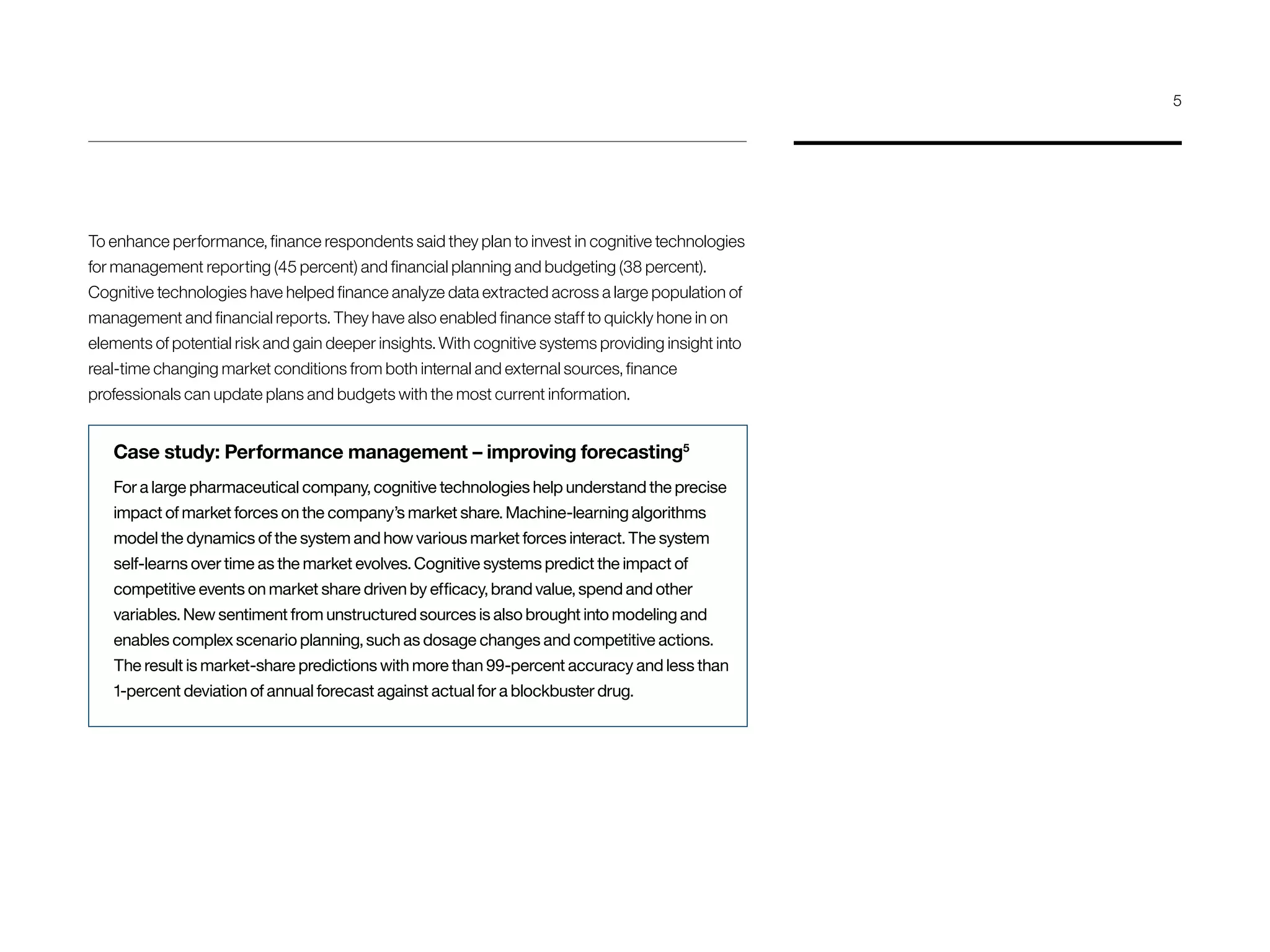

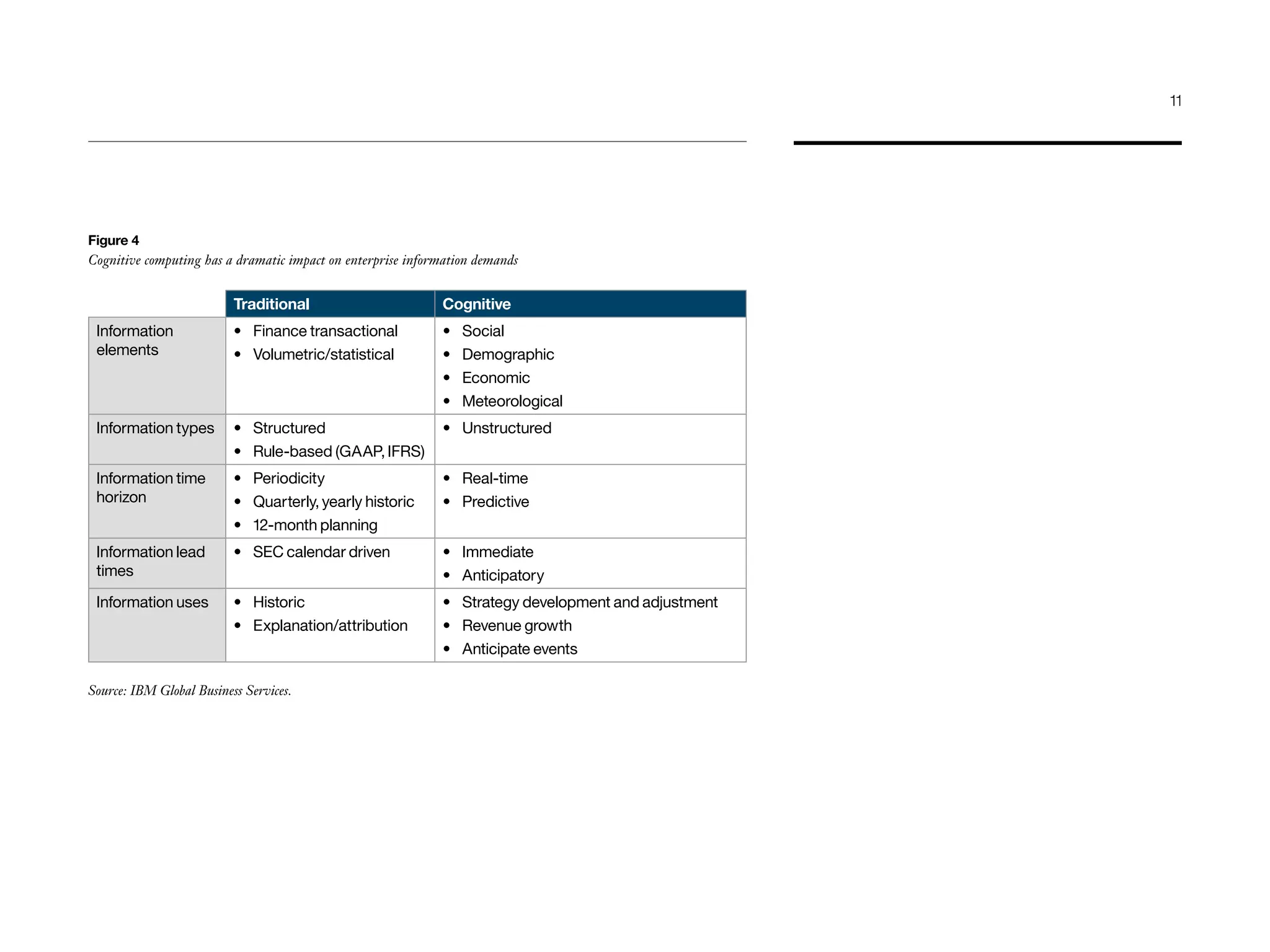

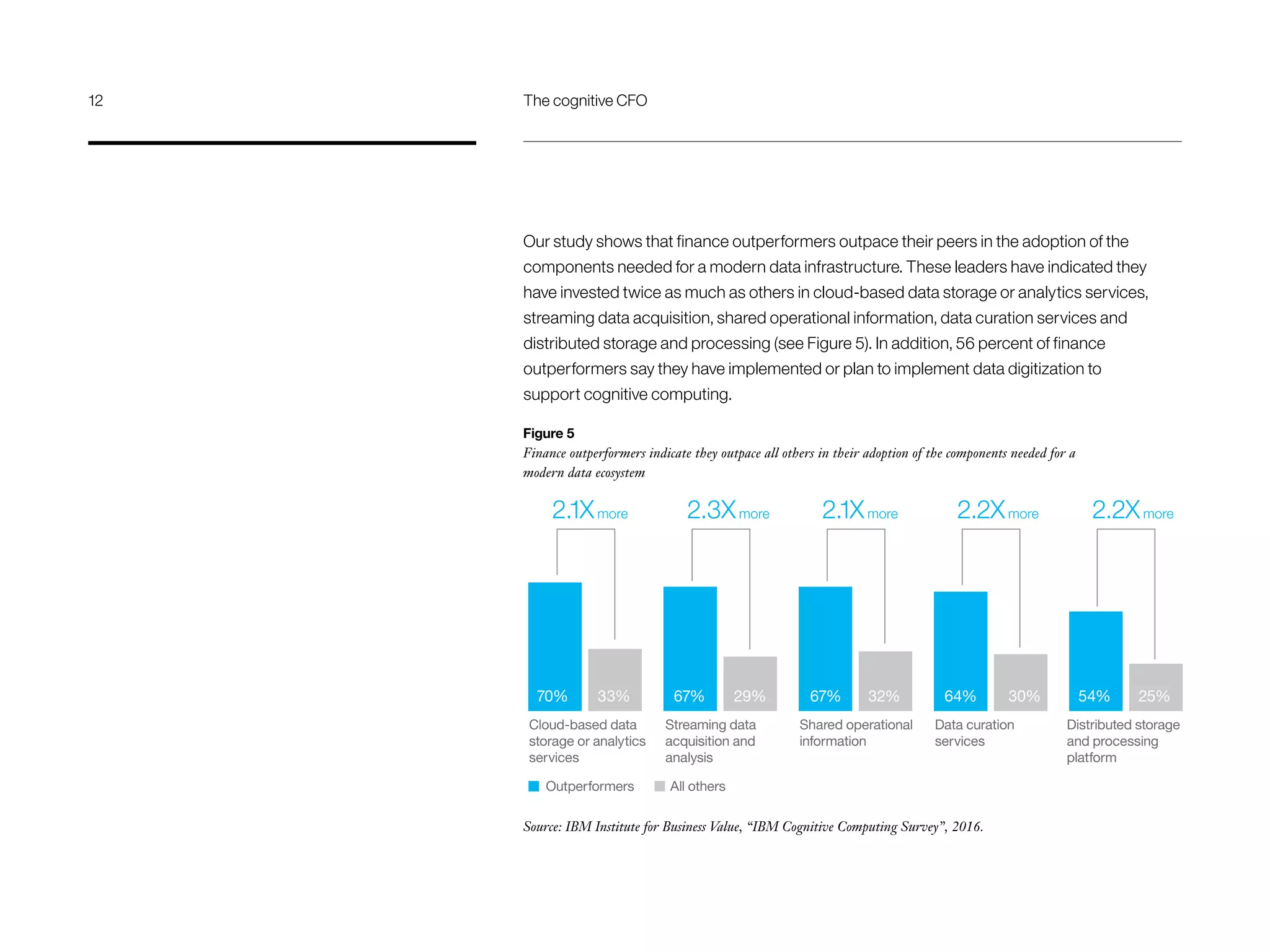

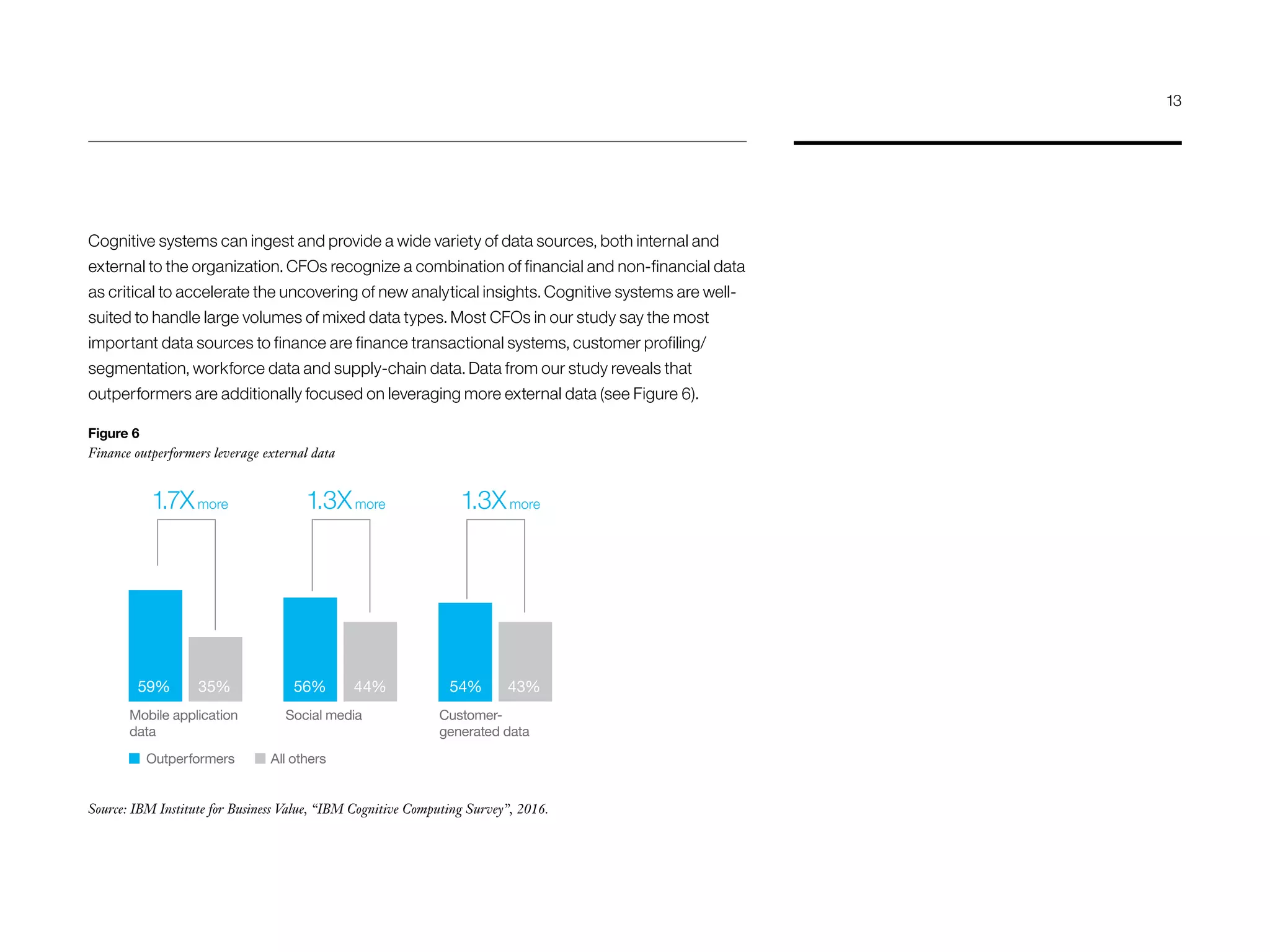

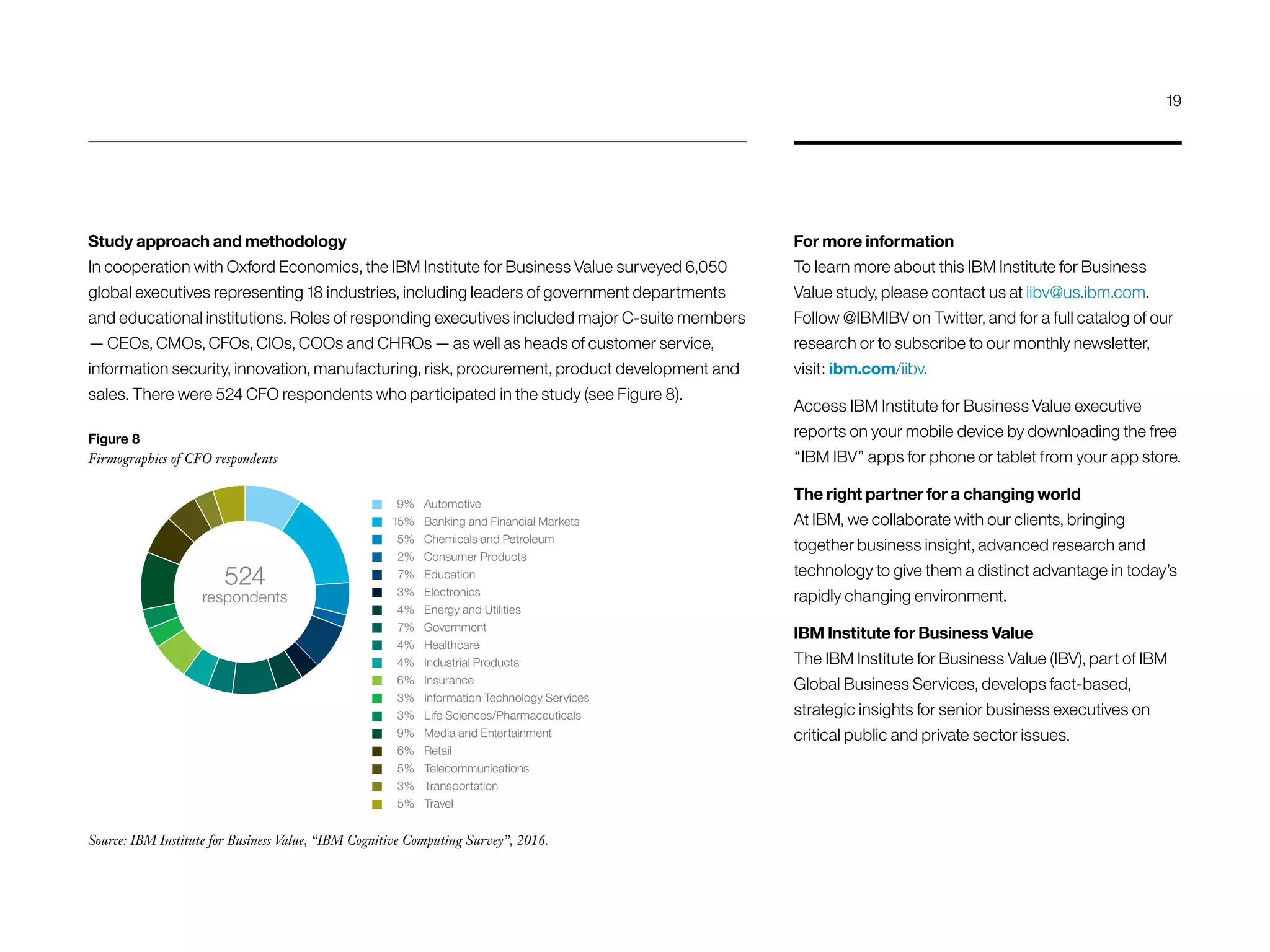

The document discusses how cognitive computing is transforming financial management, highlighting its role in enhancing decision-making, improving operational efficiency, and addressing challenges faced by CFOs in uncertain economic environments. With insights from a survey of over 6,000 executives, it emphasizes the importance of adopting cognitive technologies to manage the increasing complexity of data and improve performance outcomes. The report also identifies best practices from finance outperformers who have successfully integrated cognitive computing into their operations to drive growth and innovation.