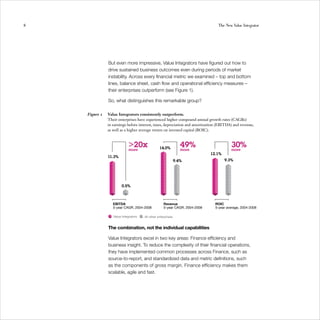

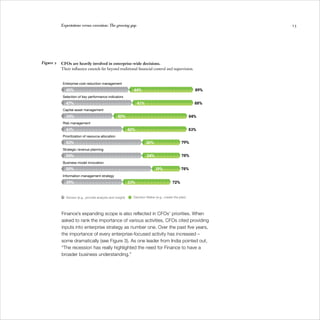

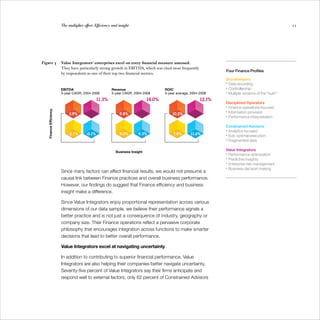

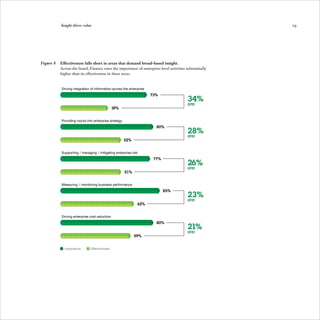

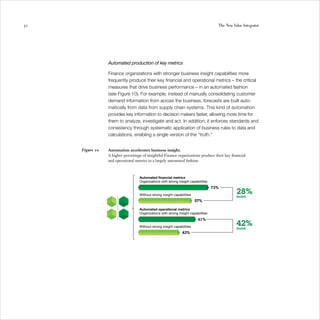

The study highlights the evolving role of Chief Financial Officers (CFOs) as they transition from traditional financial controllers to value integrators within their organizations, leveraging efficiency and insightful analytics to drive enterprise success. Despite rising expectations for strategic involvement, many finance organizations still struggle with execution, particularly in areas like risk management and information integration. Value integrators emerge as a distinct group, outperforming their peers in multiple financial metrics by effectively combining process efficiency with business insights.