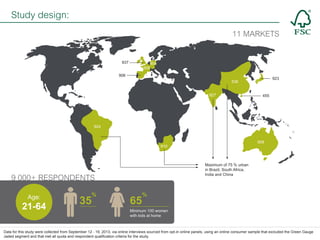

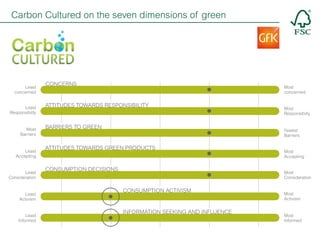

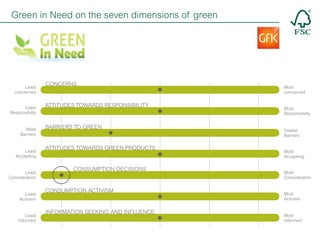

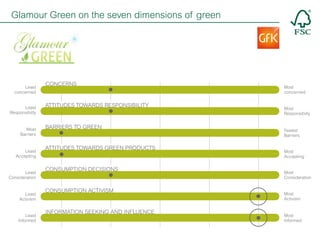

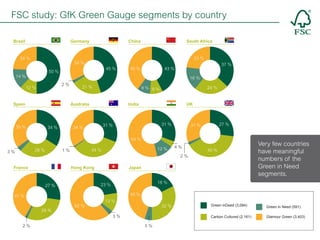

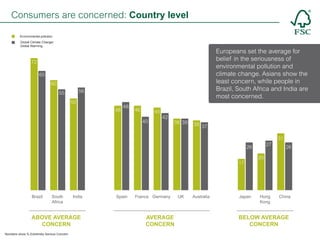

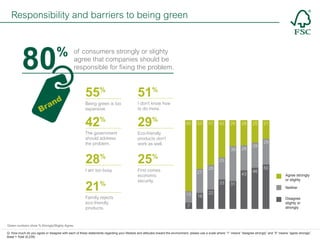

The FSC commissioned research to understand global mainstream consumers and their green habits, values, purchasing habits, and barriers to green behavior. The research used GfK's Green Gauge segmentation to classify over 9,000 respondents from 11 markets into 5 green segments based on their attitudes and behaviors. The research found that most consumers are concerned about environmental issues like pollution and climate change. At a global level, over 80% see these issues as serious problems. However, consumers' green actions vary, with behaviors like conserving energy and recycling being more common than activism. Most consumers believe their purchases can make an environmental difference and many intend to increase sustainable spending. However, barriers like cost prevent greener actions for some. Consumers hold