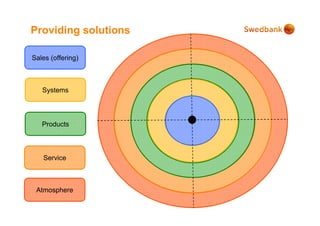

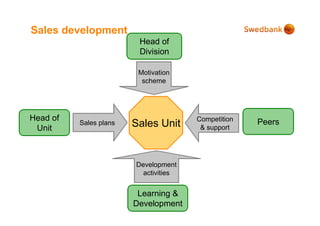

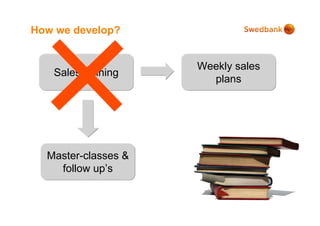

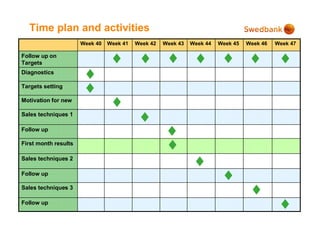

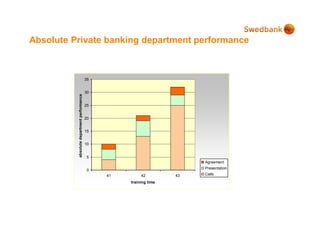

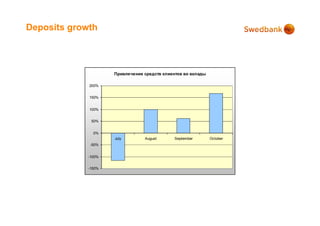

Swedbank is a leading bank in Sweden with growing profitability in the Baltic and Ukrainian markets, focusing on customer satisfaction and strong market presence. The bank aims to improve the quality of life for its clients through tailored services and efficient solutions while nurturing a positive banking culture. They prioritize employee satisfaction and training to enhance their sales capabilities and customer service.