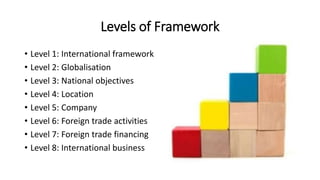

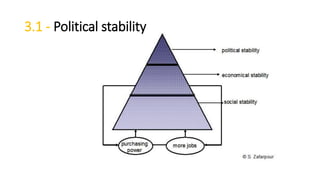

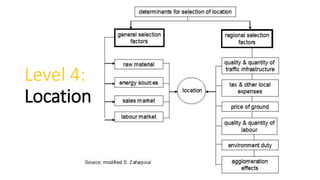

The document presents a framework for analyzing the international business environment, highlighting the complexity and interdependency of eight key levels including international framework, globalization, national objectives, and foreign trade activities. It outlines the roles of various organizations, impacts of globalization, and necessary considerations for companies of differing sizes and strategies. The conclusion emphasizes the framework's utility in understanding international trade's effects on national economies, including job creation and increased purchasing power.