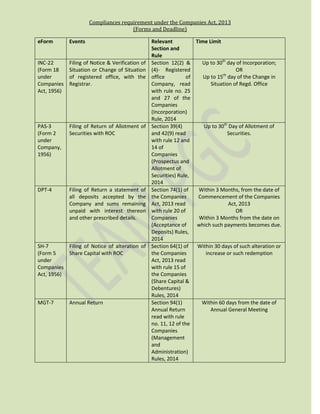

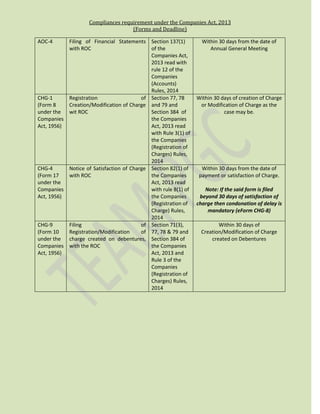

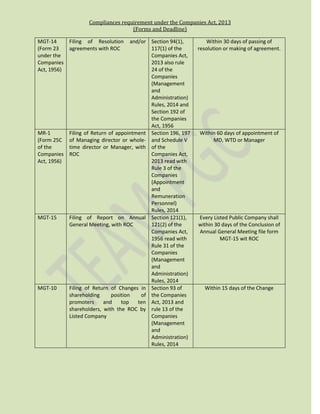

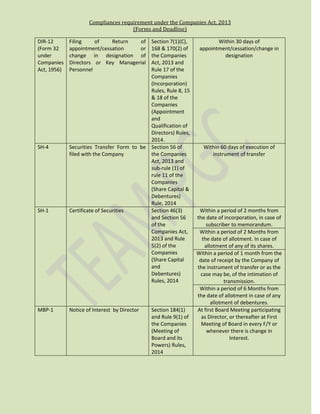

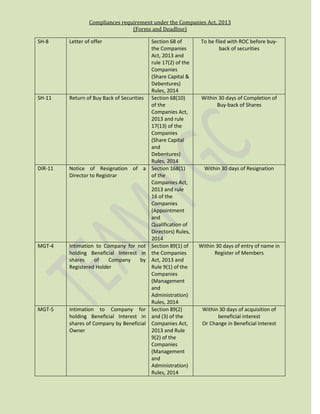

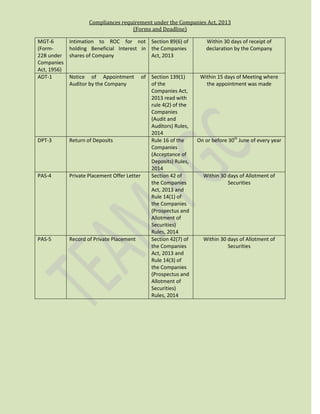

This document outlines various compliance requirements and deadlines for filing forms under the Companies Act, 2013. It lists 23 different forms that must be filed for events like changes to a company's registered office, allotment of securities, annual returns, financial statements, appointment of directors, and more. The deadlines for filing these forms range from 15 days to 60 days after the relevant event occurs. Failure to meet these deadlines to file the required forms can result in penalties for the company.