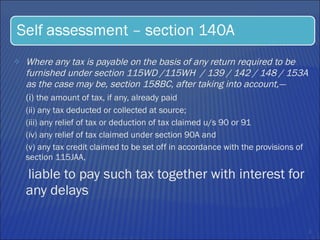

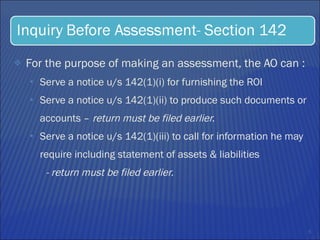

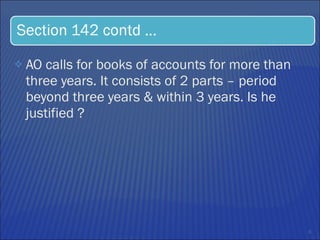

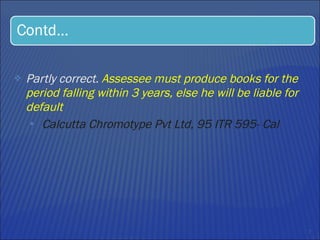

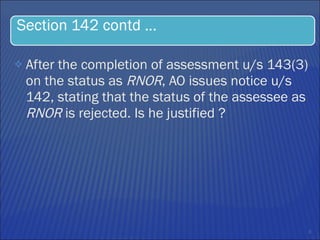

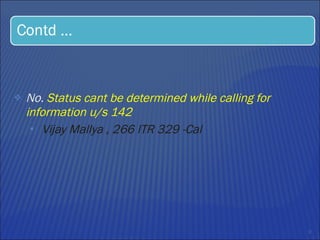

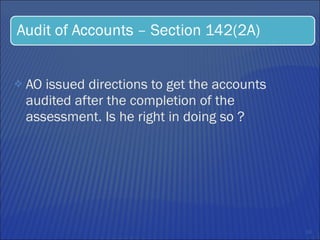

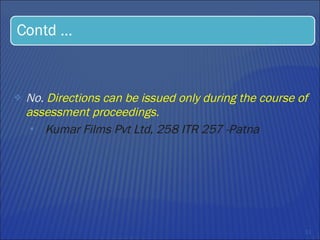

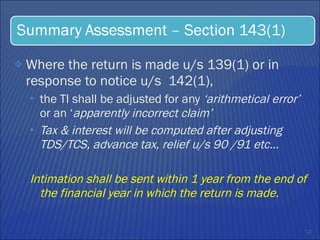

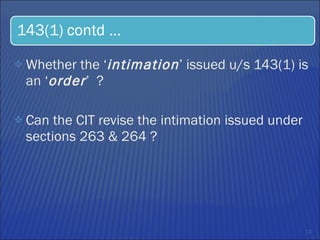

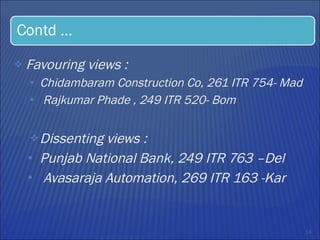

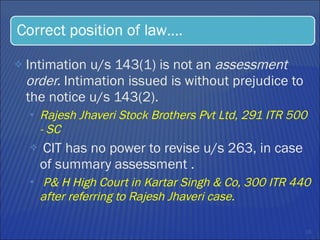

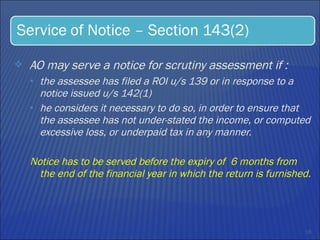

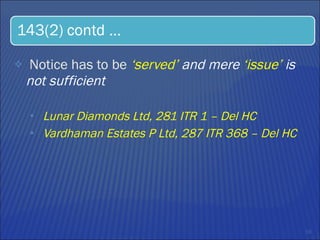

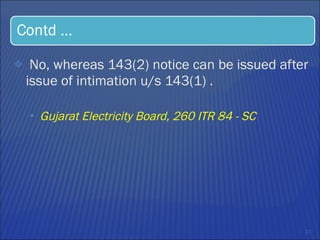

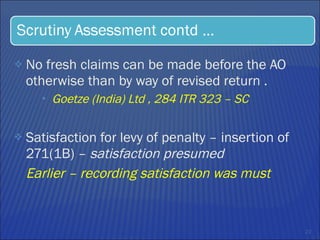

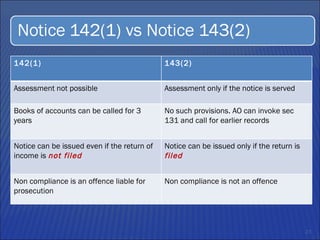

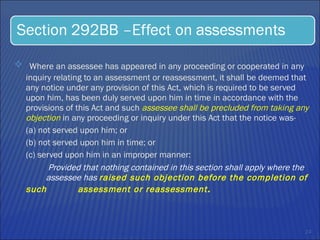

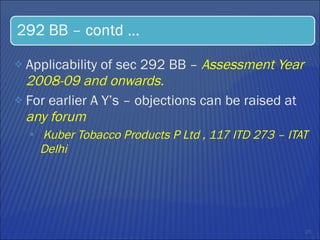

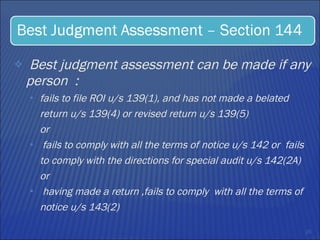

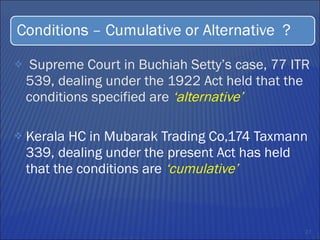

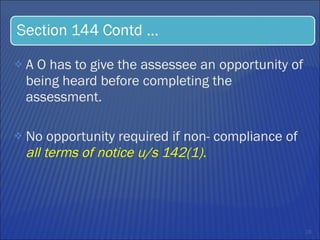

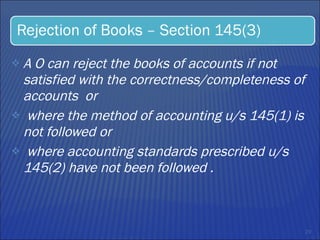

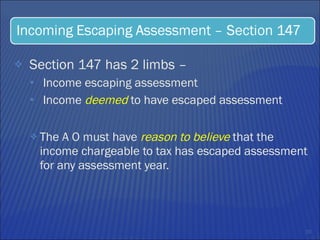

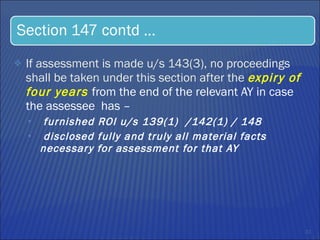

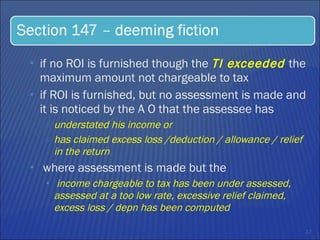

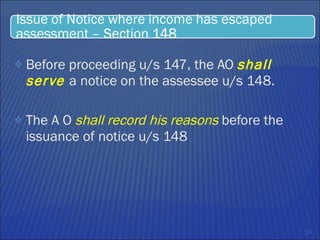

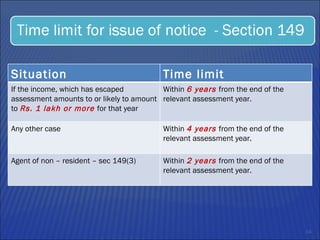

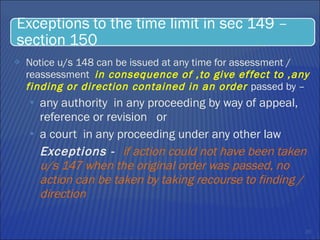

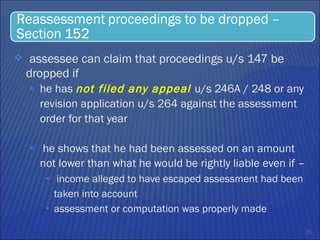

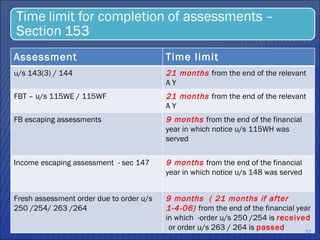

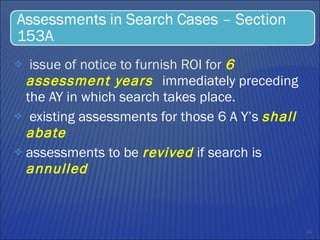

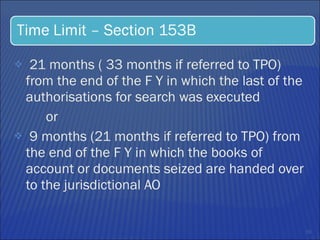

The document discusses various types of tax assessments under the Income Tax Act, including self-assessment, summary assessment, and best judgment assessment. It discusses the procedures for issuing notices under sections 142, 143, 147, and 148 and the time limits for completing assessments. Key points include that intimations under section 143(1) are not considered orders, notices under section 148 must be served before making assessments under section 147, and the conditions for best judgment assessments are considered alternative rather than cumulative by the Supreme Court.

![Thank you [email_address]](https://image.slidesharecdn.com/assessmentprocedures-100220095045-phpapp01/85/Assessment-Procedures-44-320.jpg)