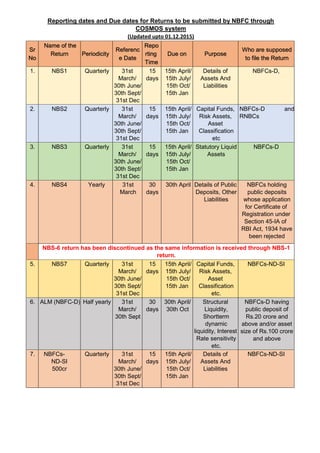

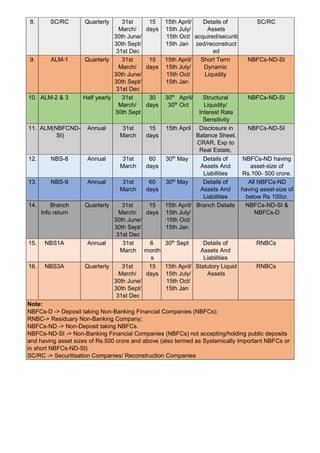

1. The document outlines 16 different types of returns that must be submitted by various categories of Non-Banking Financial Companies (NBFCs) to the Central Repository of Information on Large Credits (COSMOS) system on a quarterly, half-yearly, or annual basis.

2. It provides details such as the name and purpose of each return, the reference date for reporting, the reporting deadline, and the types of NBFCs that must file each return.

3. The returns require NBFCs to report information like their assets and liabilities, capital funds, risk assets, asset classification, statutory liquid assets, public deposits, securitized assets, and structural liquidity.