Embed presentation

Download to read offline

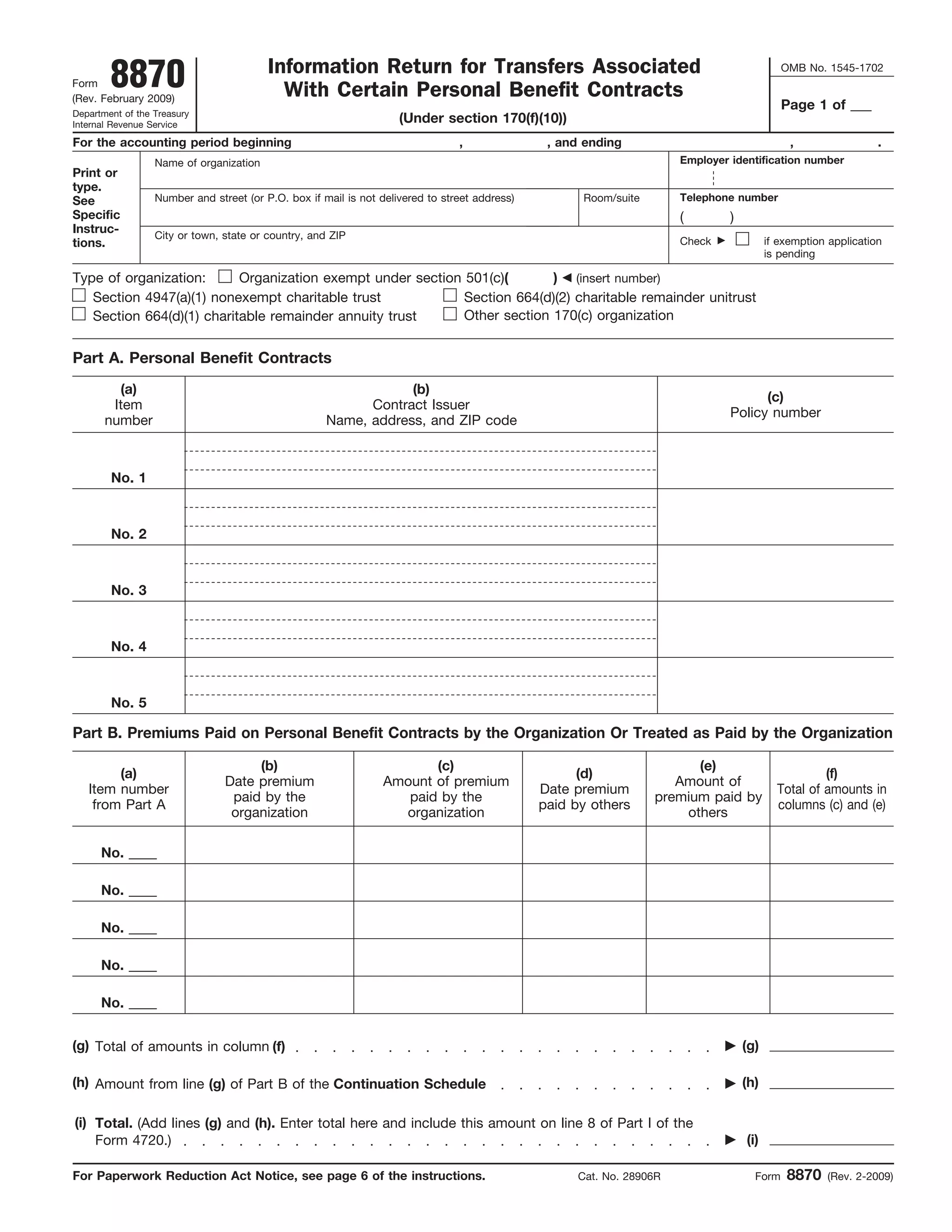

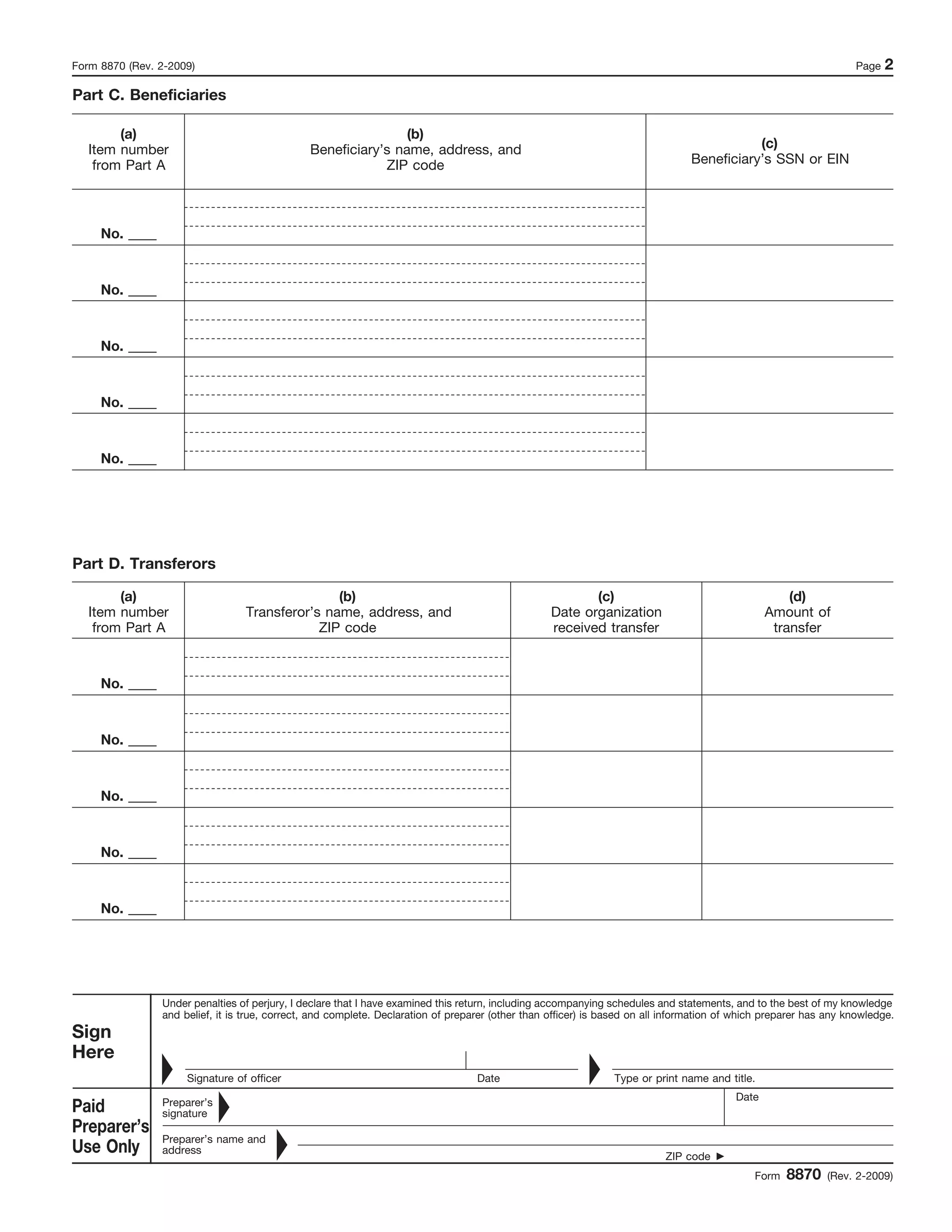

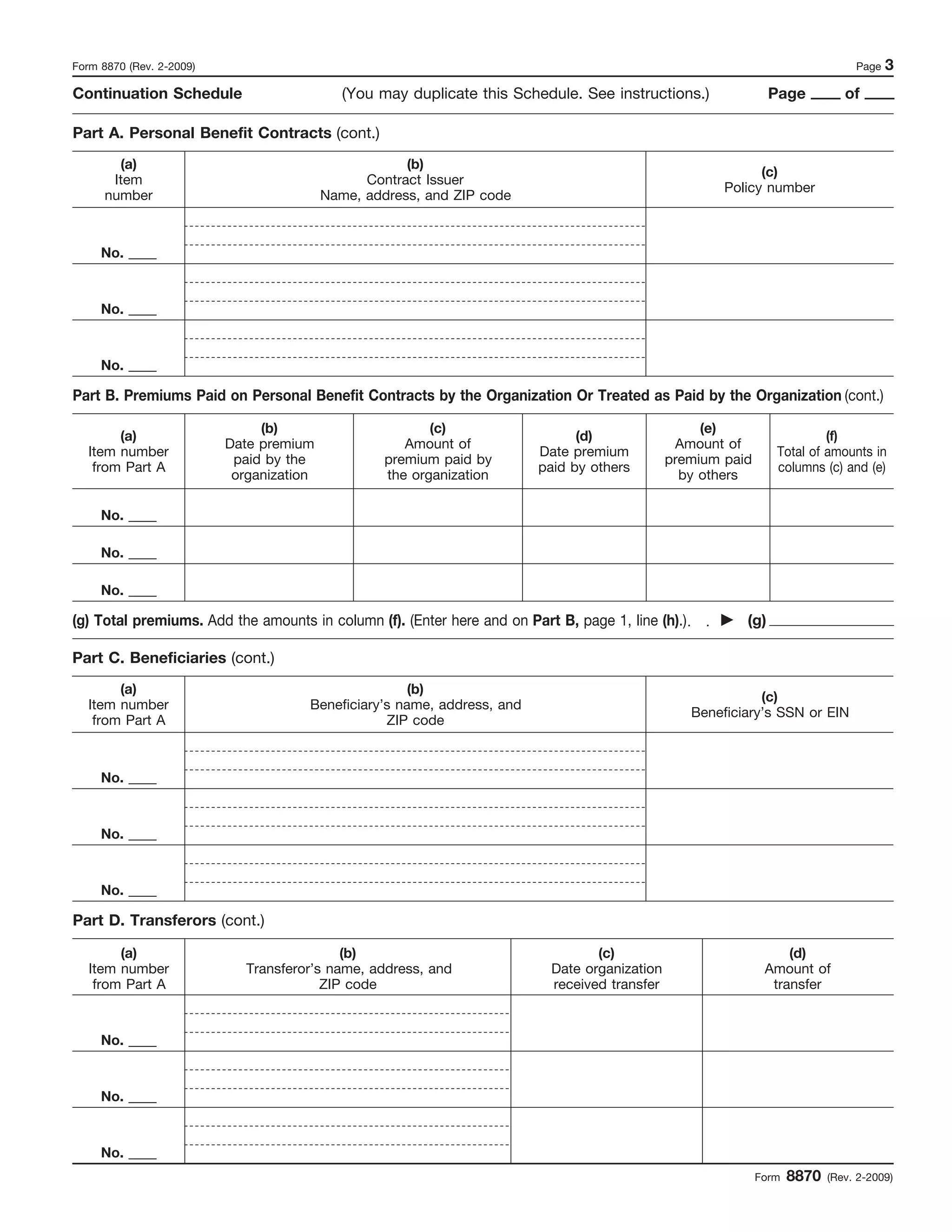

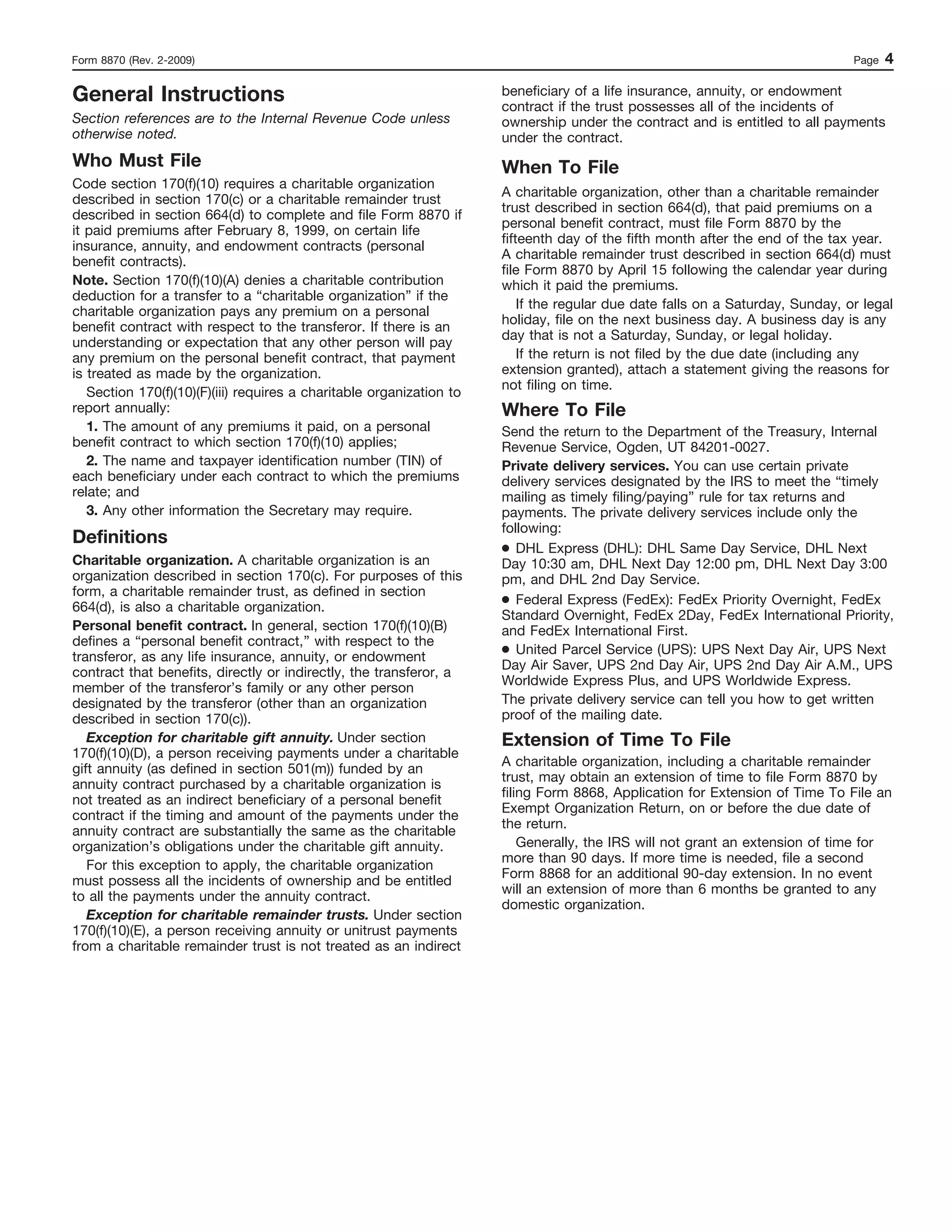

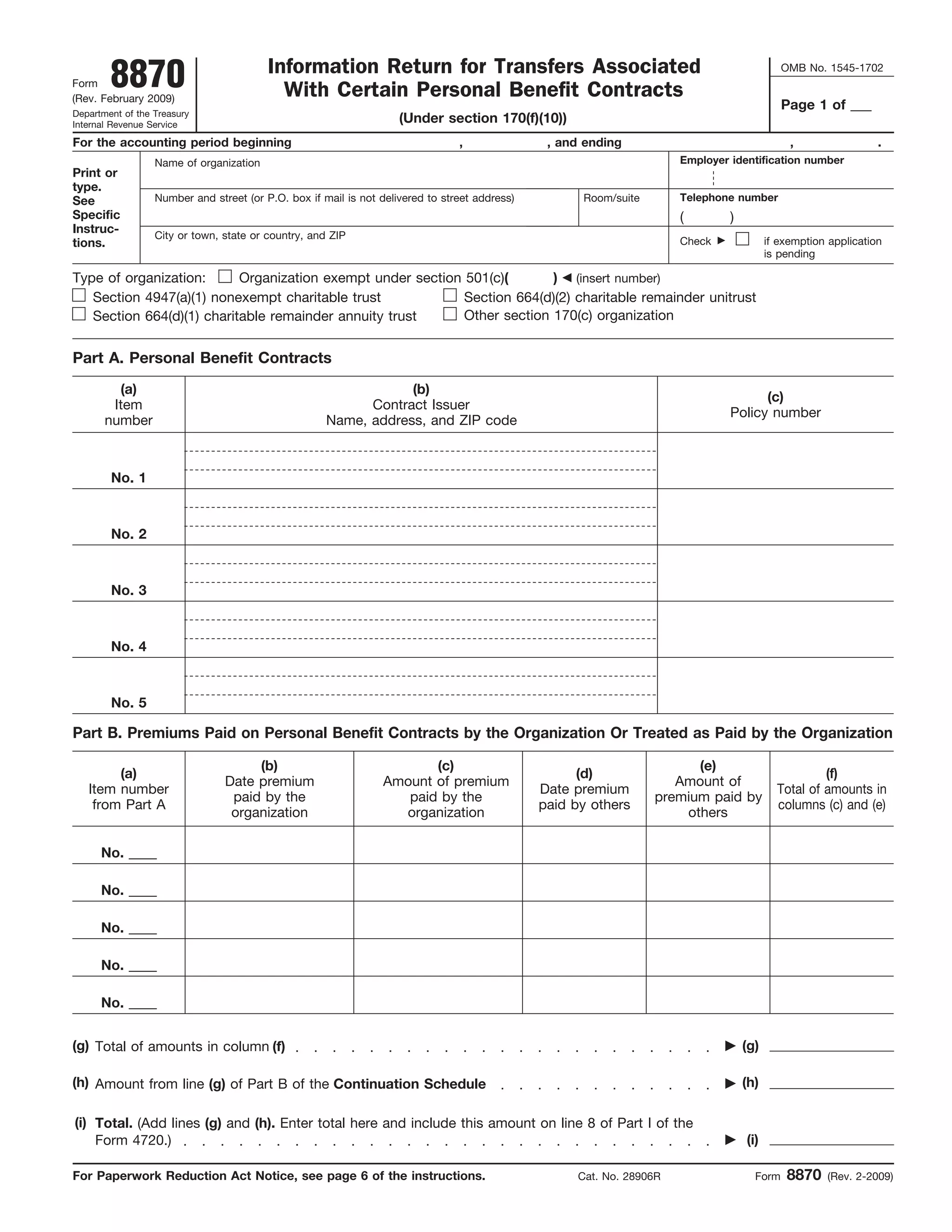

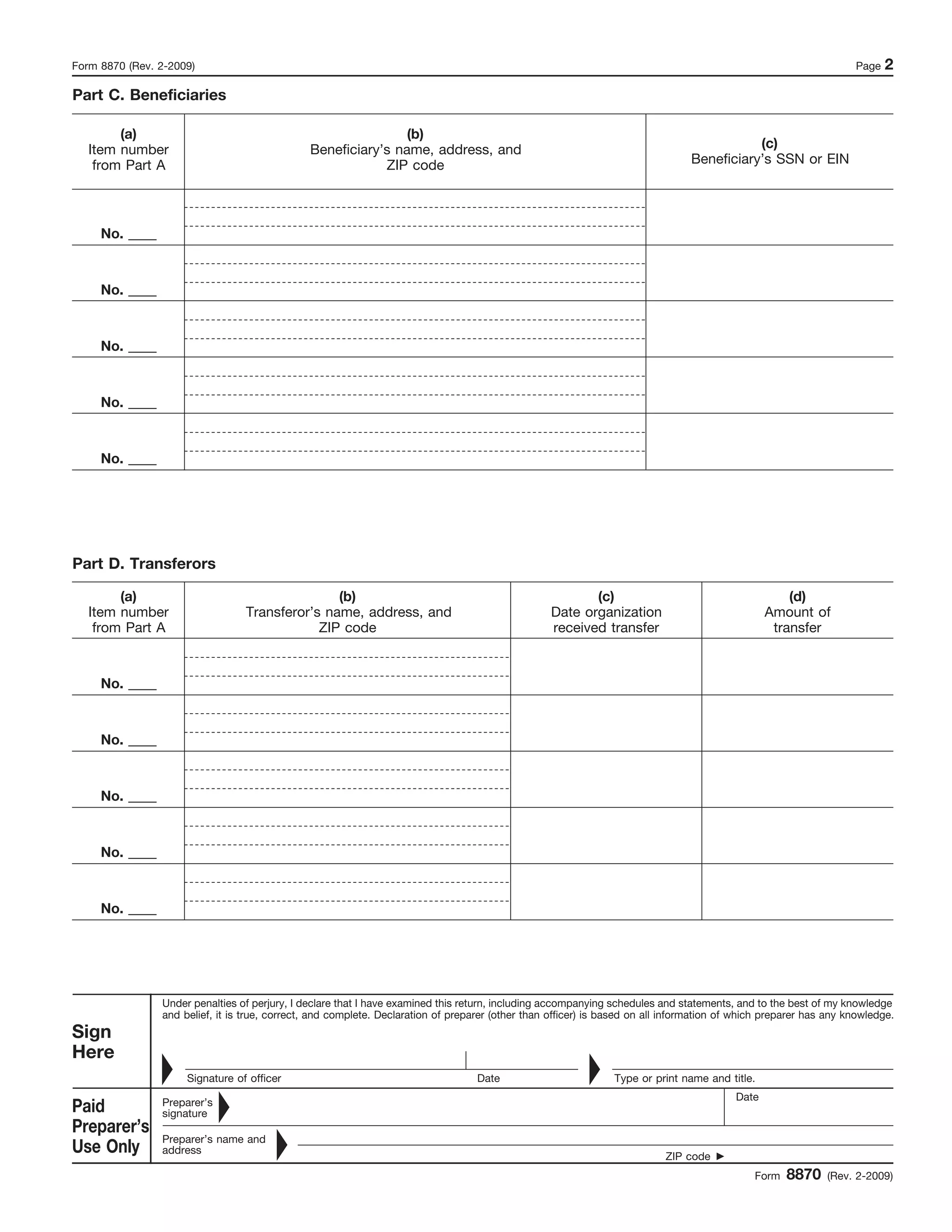

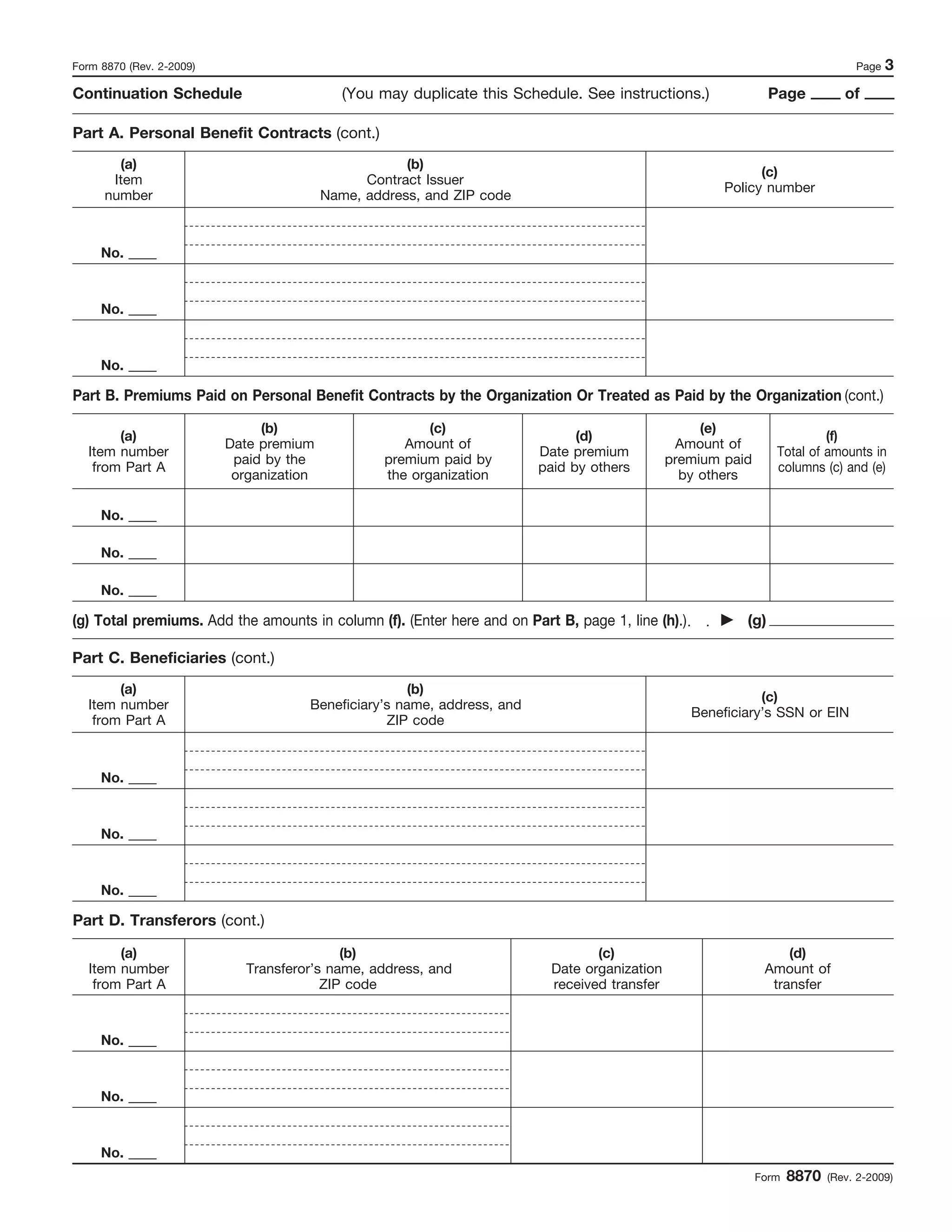

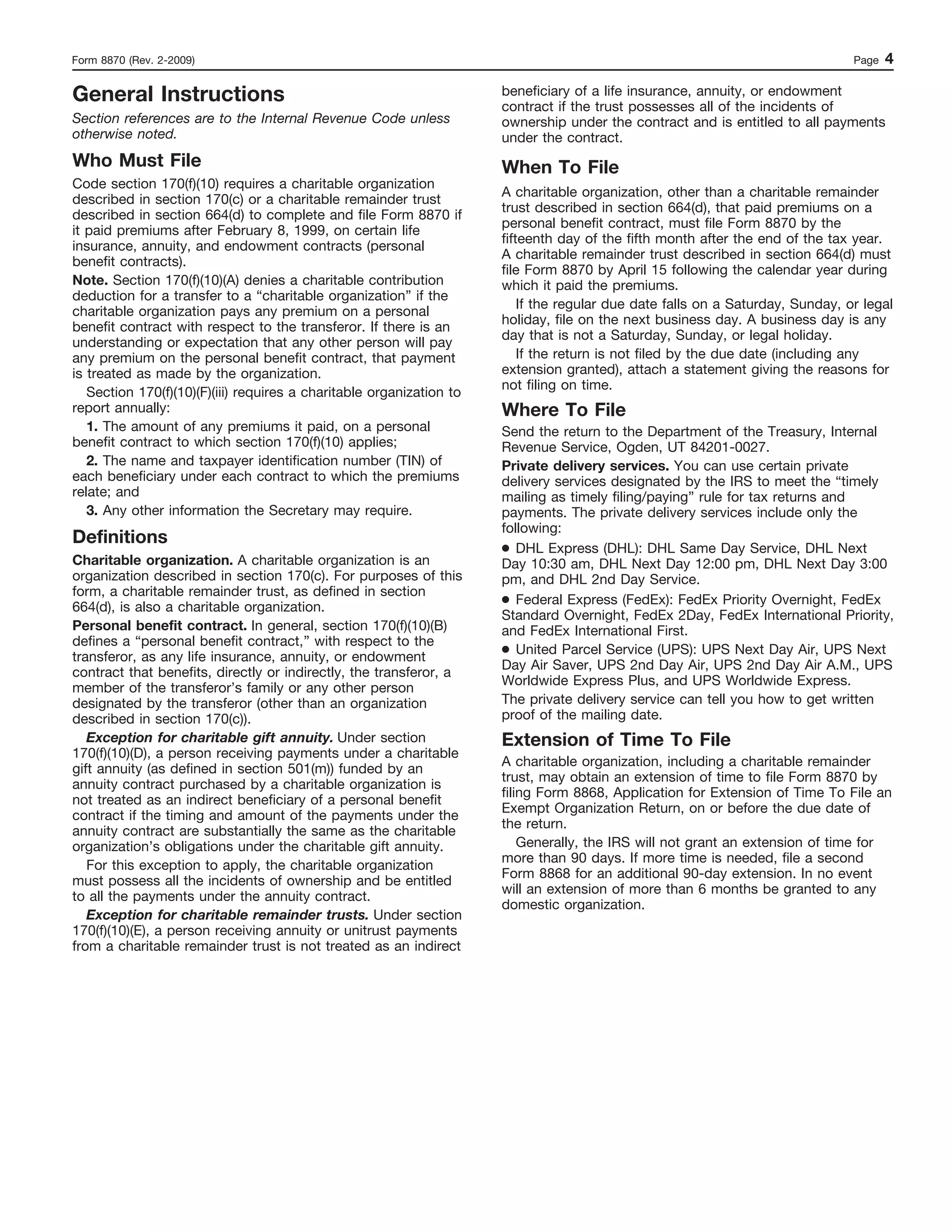

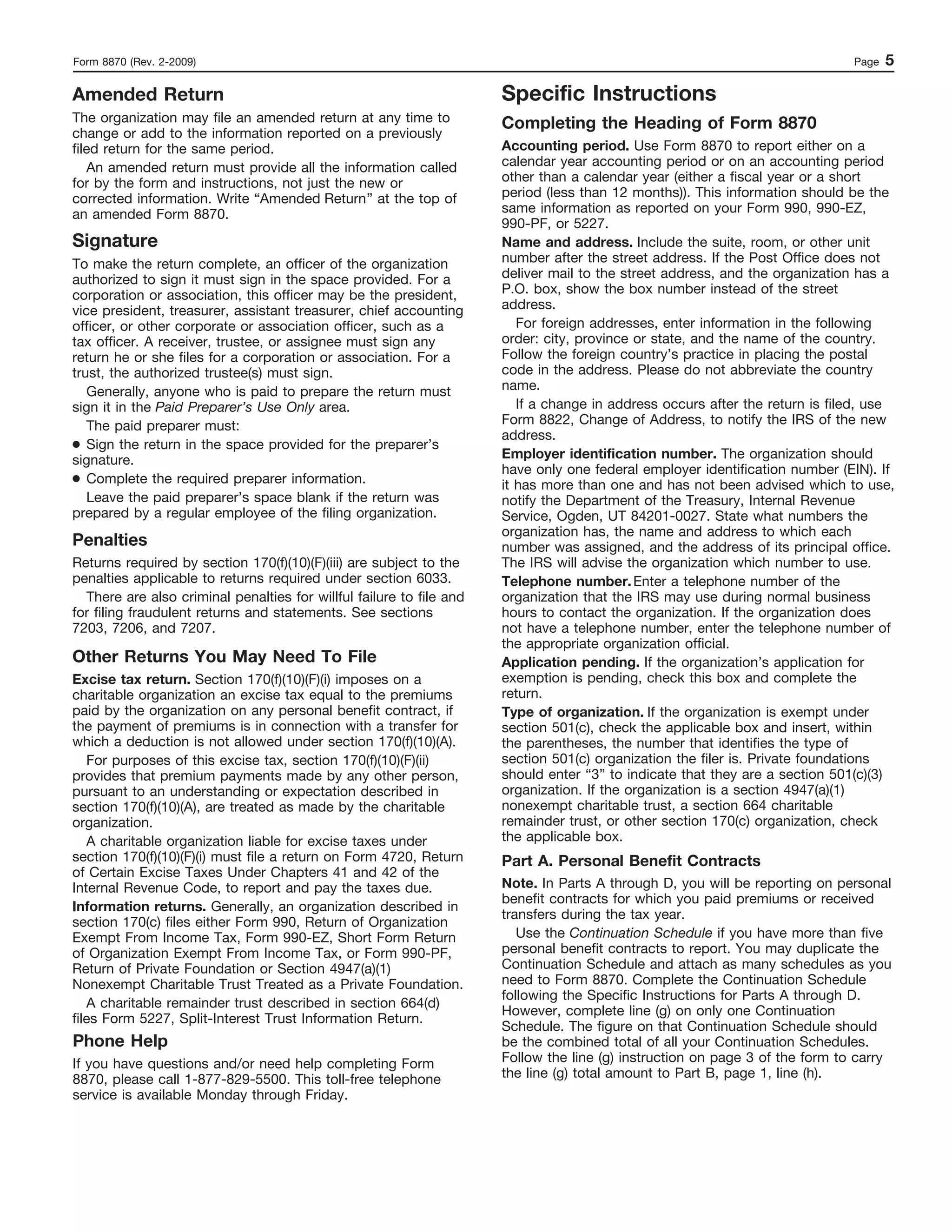

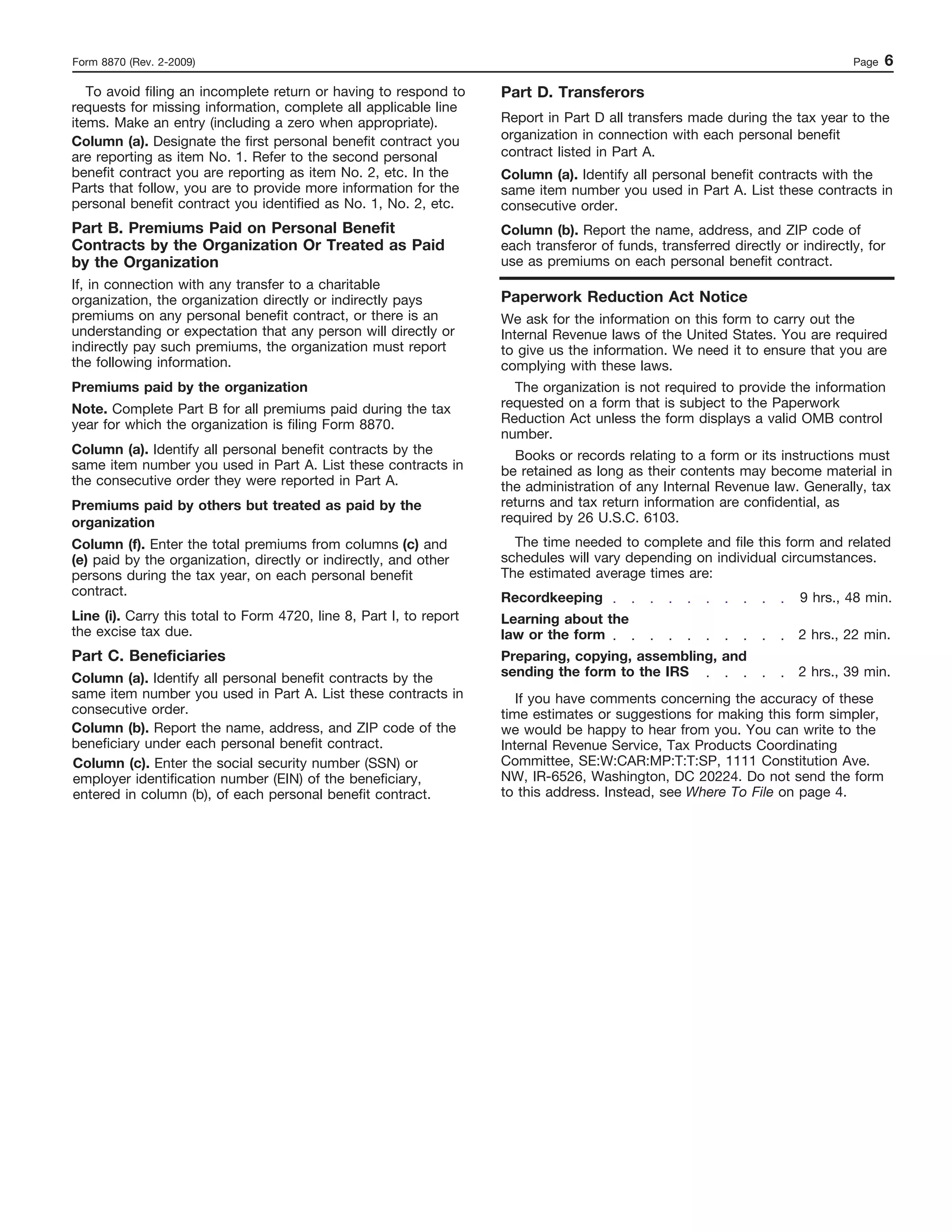

This document is an IRS Form 8870 that is required to be filed by certain charitable organizations. It provides information about personal benefit contracts for which the organization paid premiums or received transfers during the tax year. The form requires the organization to provide details in Parts A through D, including the contract issuer and policy number (Part A), premiums paid (Part B), beneficiaries (Part C), and transferors (Part D). Additional continuation schedules can be attached if more than five contracts need to be reported.