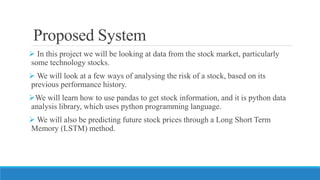

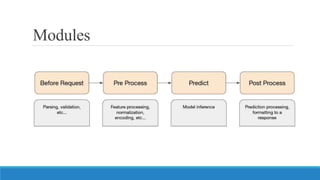

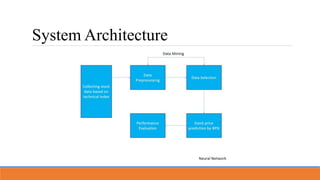

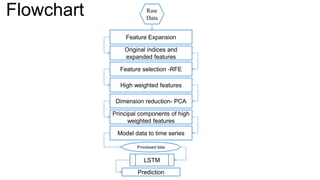

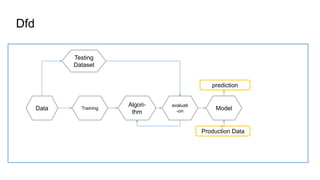

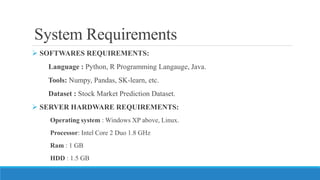

This document provides an introductory seminar on using deep learning and LSTM methods for stock price prediction. It discusses using machine learning to analyze stock market data and predict future prices. The objectives are to accurately predict stock prices and provide a mobile app interface for visualization. Literature on existing prediction systems is reviewed and a proposed system is described using tools like Pandas, NumPy, and Scikit-learn. The system architecture involves data processing, dimension reduction, model training with LSTM, and price prediction. Potential advantages include automation and continuous improvement, while disadvantages include time/resources and error-prone models.

![References

C. METZ, "NYTimes," 22 Oct 2017. [Online]. Available:

https://www.nytimes.com/2017/10/22/technology/artificialintelligence-experts-salaries.html. [Accessed 4 Nov 2017].

I. Wladawsky-Berger, "The Wall Street Journal," 15 Sep 2017.[Online]. Available:

httpsblogsx,wsjcom/cio/2017/09/15/artificialintelligence-is-ready-for-business-are-businesses-ready-for- ai/.[Accessed

4 Nov 2017].

A.Semeney, Jan 2017. [Online]. Available: https//www.devteamspace/blog/artificial-intelligence-in-

stocktrading-future-trends/. [Accessed 1 Nov 2017]

"Machine Learning For Stock Trading Strategies," 14 Apr 2016.[Online]. Available:

https://www.nanalyze.com/2016/04/machinelearning-for-stock-trading-strategies/. [Accessed 7 Nov 2017].

S. Greg Walters, 22 Mar 2017. [Online]. Available:

https://www.livescience.com/58364-ai-investors-rack-up-massivereturns-in-stock-market-study.html. [Accessed 12

Oct 2017].](https://image.slidesharecdn.com/flowchart-221227192622-d4ced34c/85/flowchart-ON-DEEP-LEARNING-SPP-18-320.jpg)