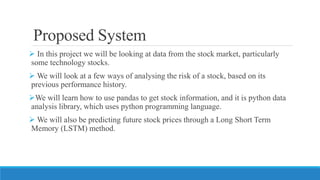

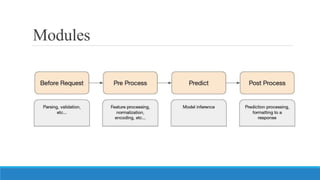

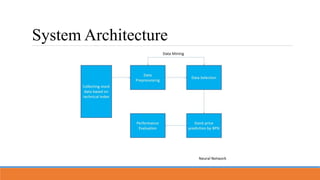

This document provides an introduction to a seminar on using deep learning and LSTM methods for stock price prediction. It discusses using machine learning algorithms to analyze stock market data and predict future prices. The proposed system would use tools like Pandas, NumPy, and Scikit-learn to get stock data and predict prices using an LSTM model. It presents the modules, architecture, advantages, and requirements of the system. The conclusion states that both machine learning techniques showed improved prediction accuracy compared to traditional methods, with LSTM proving more efficient.

![References

C. METZ, "NYTimes," 22 Oct 2017. [Online]. Available:

https://www.nytimes.com/2017/10/22/technology/artificialintelligence-experts-salaries.html. [Accessed 4 Nov 2017].

I. Wladawsky-Berger, "The Wall Street Journal," 15 Sep 2017.[Online]. Available:

httpsblogsx,wsjcom/cio/2017/09/15/artificialintelligence-is-ready-for-business-are-businesses-ready-for- ai/.[Accessed

4 Nov 2017].

A.Semeney, Jan 2017. [Online]. Available: https//www.devteamspace/blog/artificial-intelligence-in-

stocktrading-future-trends/. [Accessed 1 Nov 2017]

"Machine Learning For Stock Trading Strategies," 14 Apr 2016.[Online]. Available:

https://www.nanalyze.com/2016/04/machinelearning-for-stock-trading-strategies/. [Accessed 7 Nov 2017].

S. Greg Walters, 22 Mar 2017. [Online]. Available:

https://www.livescience.com/58364-ai-investors-rack-up-massivereturns-in-stock-market-study.html. [Accessed 12

Oct 2017].](https://image.slidesharecdn.com/finelpptproject1-221227193017-0c670516/85/LSTM-based-method-oh-ML-pptx-13-320.jpg)