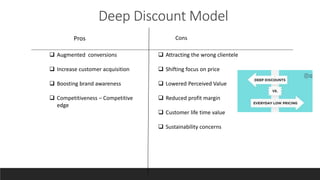

Flipkart transitioned from an online book seller in 2007 to India's largest e-commerce platform by 2015. It shifted from a deep discount model to a marketplace model, growing its seller base from 30,000 to 100,000 sellers. While the deep discount model boosted sales and growth, it reduced margins and profitability. E-commerce in India faces challenges of heavy losses due to high costs and intense competition. Traditional retail still dominates India, but e-commerce is growing rapidly, led by platforms like Flipkart and Amazon and targeting smaller cities and towns. Kirana stores remain important for last-mile delivery and local customer relationships in India's retail landscape.