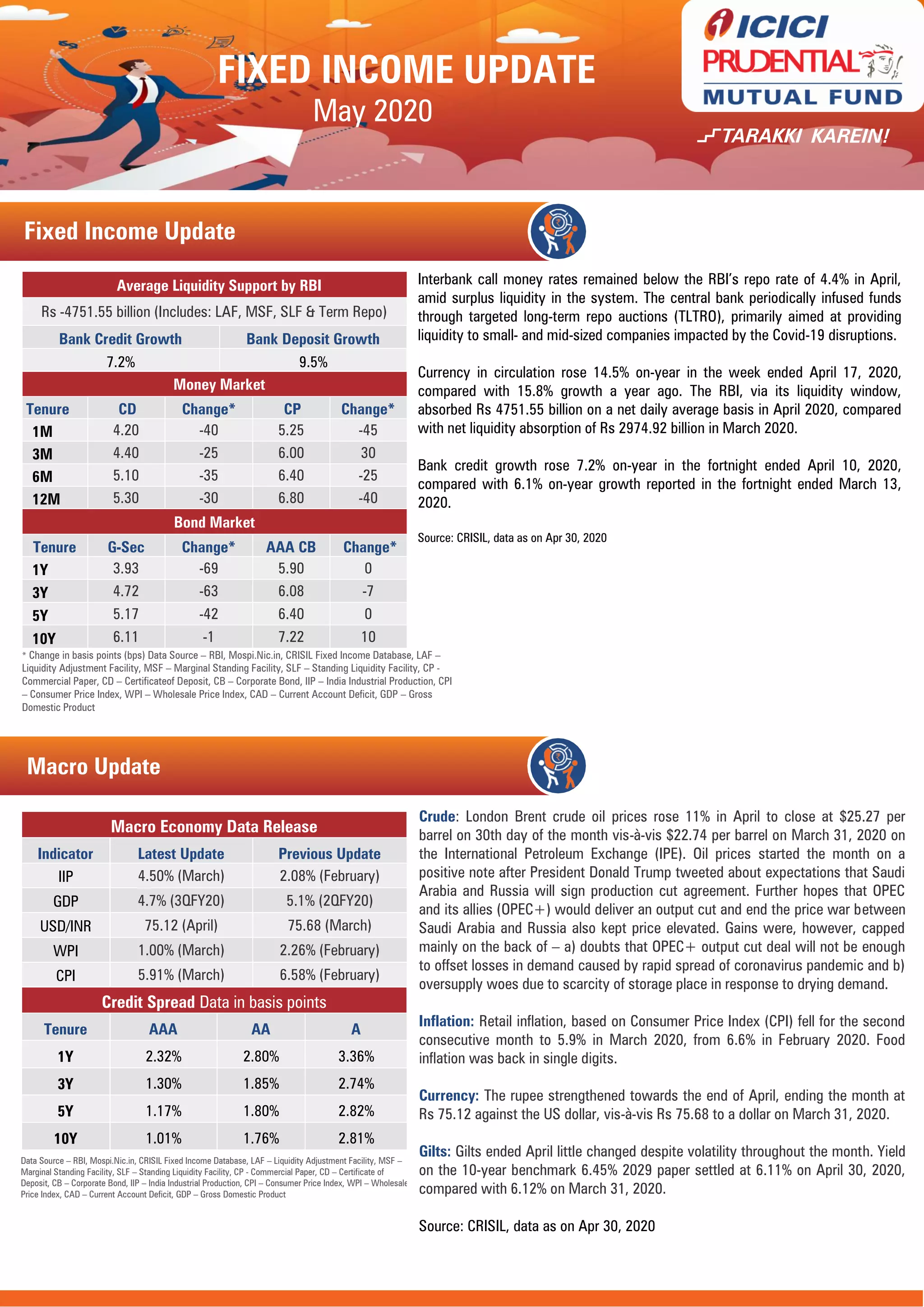

In May 2020, interbank call money rates remained below the RBI's repo rate due to excess liquidity influenced by TLTROs aimed at supporting companies affected by COVID-19, as bank credit growth rose to 7.2% year-on-year. The RBI absorbed significant liquidity through various facilities while retail inflation declined to 5.9%. Looking ahead, a combination of fiscal and monetary policies is expected to mitigate economic shocks and support bond markets.