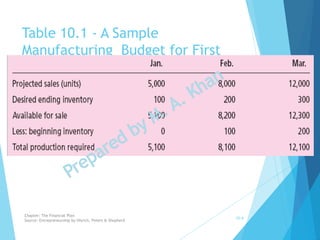

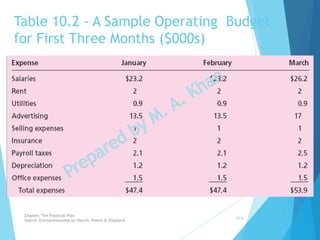

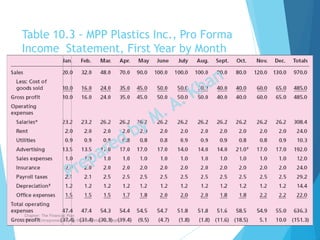

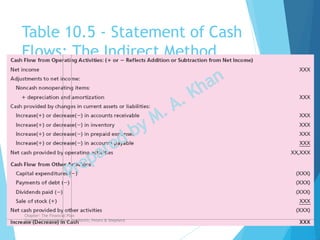

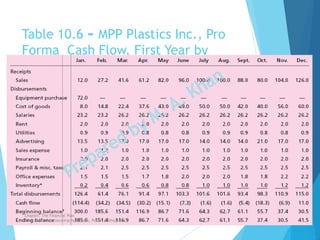

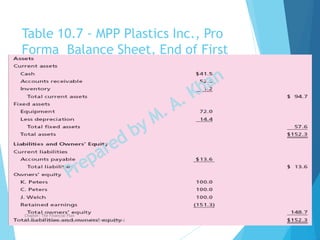

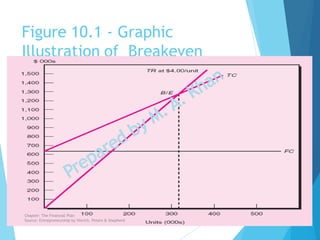

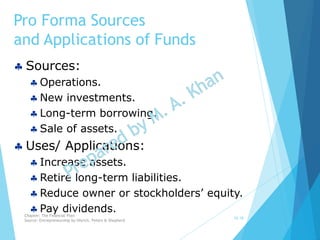

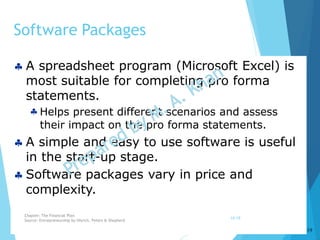

The financial plan provides a complete picture of the projected financial position of a new venture, including cash inflows and outflows. It consists of operating and capital budgets, pro forma income statements, cash flow statements, balance sheets, and break-even analysis. The financial plan explains how the entrepreneur intends to financially manage the venture and meet obligations.