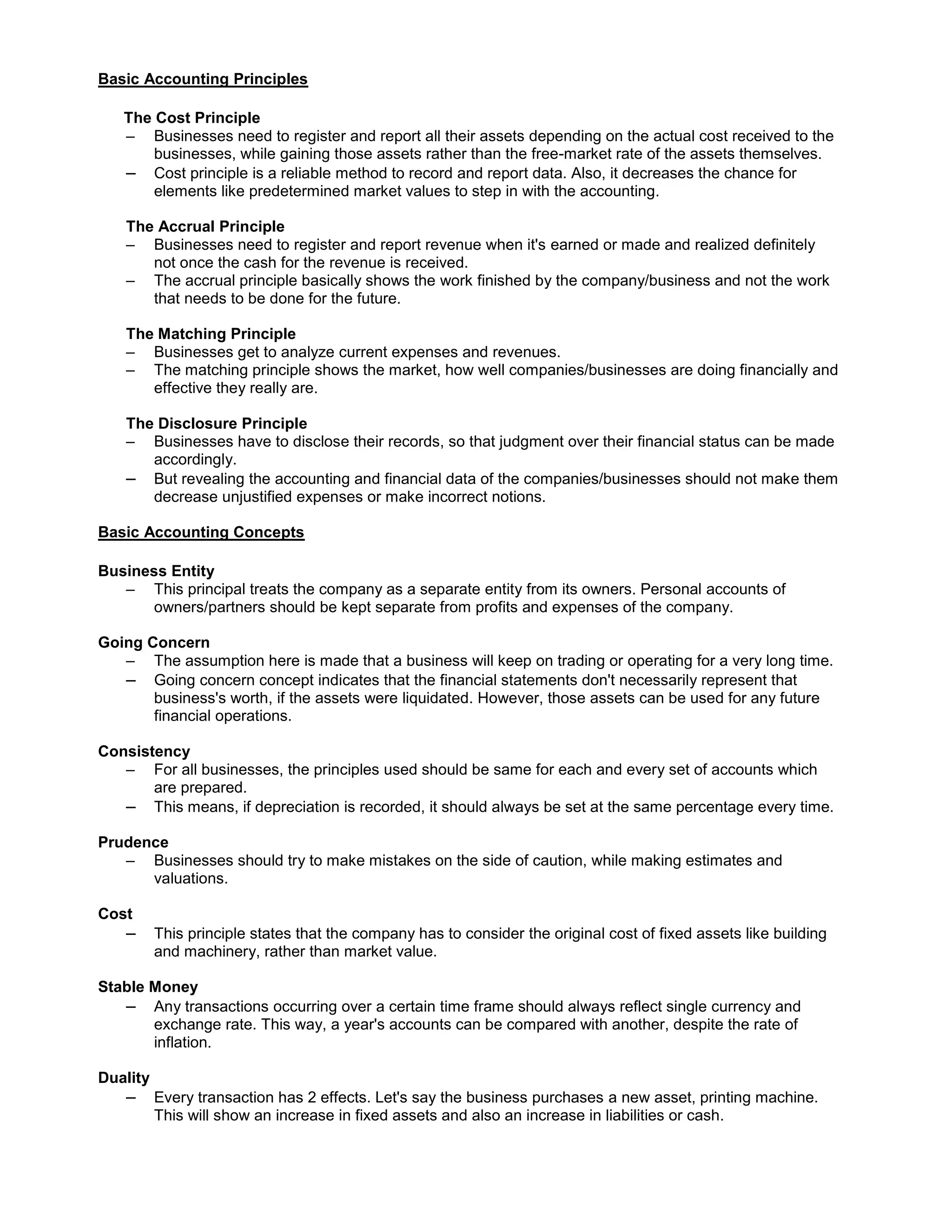

The document outlines several basic accounting principles:

1) The cost principle states that assets should be recorded at their actual cost rather than market value, reducing subjectivity.

2) The accrual principle means revenue is recorded when earned, not when cash is received, showing work done rather than future work.

3) The matching principle matches current expenses with revenues to analyze financial performance and effectiveness.

4) Businesses must disclose records so their financial status can be judged appropriately, though revealing data should not cause unjustified expenses or misconceptions.