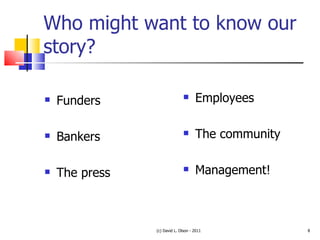

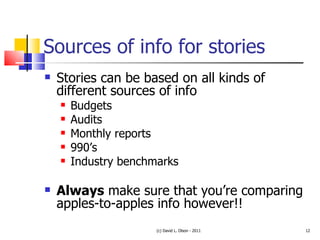

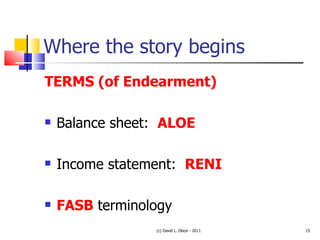

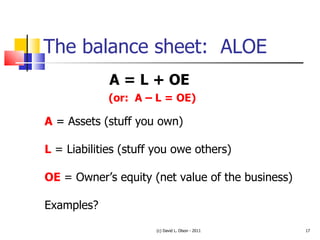

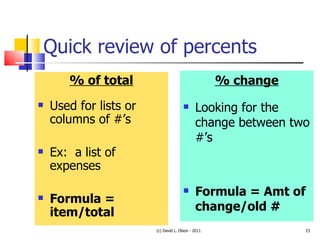

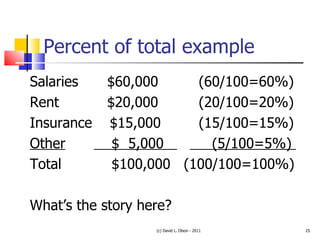

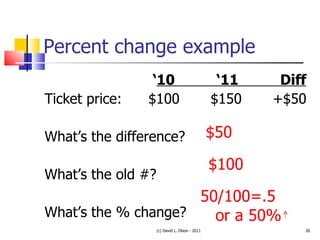

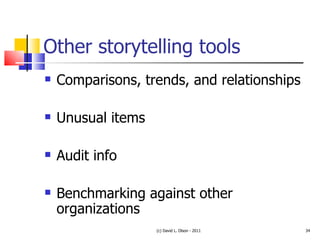

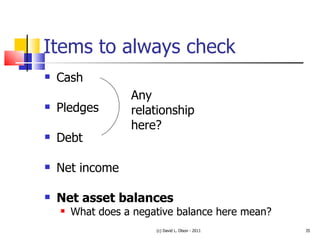

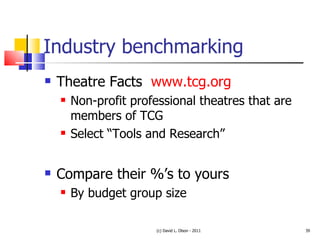

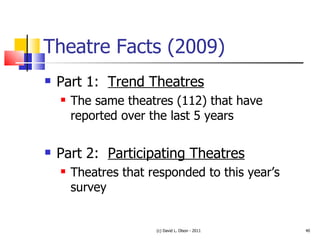

The document summarizes a presentation about using financial data to tell stories about nonprofit organizations. It discusses key financial statements like the balance sheet and income statement and tools for analysis such as percentages, ratios, comparisons, trends, and benchmarks. The goal is to interpret numbers in a way that answers questions from funders and other stakeholders about an organization's financial health and viability.

![Contact me E-mail: [email_address] Twitter: ArtsMgmtGuy LinkedIn: Dave Olson (UNCSA) Cell: 612-799-1490 (c) David L. Olson - 2011](https://image.slidesharecdn.com/financialstorytelling-110721062119-phpapp01/85/Financial-storytelling-44-320.jpg)