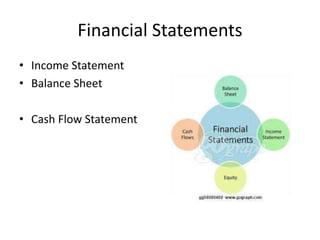

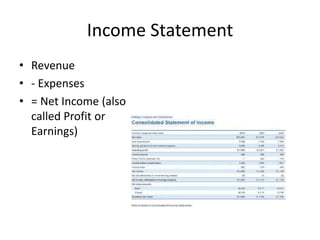

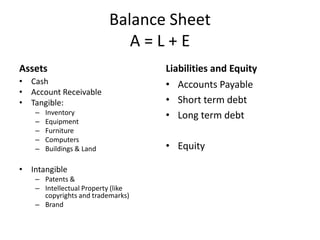

Financial statements serve as the end product of accounting, including the income statement, balance sheet, and cash flow statement, which are utilized by both internal and external stakeholders such as management, investors, and bankers. They analyze performance through metrics like profit and loss, liquidity ratios, and asset management to assess a company's financial health. Reporting entails preparing these statements in compliance with auditing standards and regulations, often accessible through public company websites and the SEC.