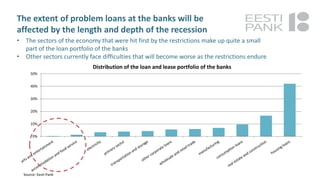

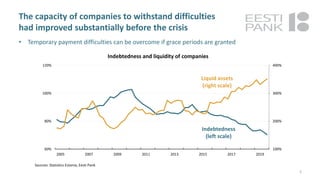

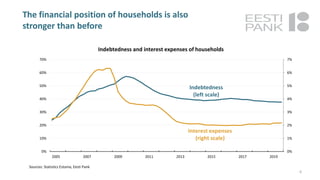

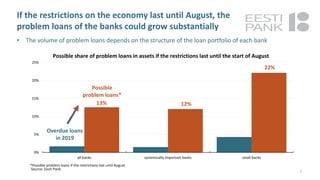

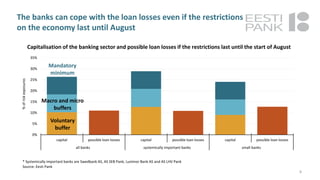

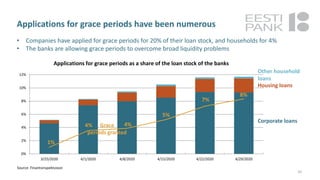

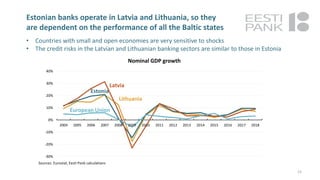

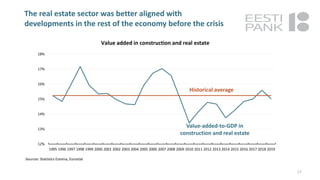

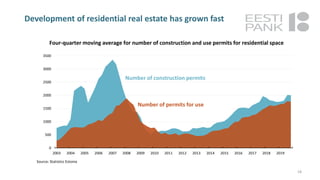

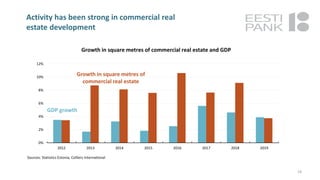

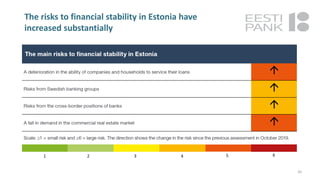

The ability of companies and households to repay loans is deteriorating due to the economic impact of the coronavirus restrictions. If restrictions last until August, problem loans could increase substantially. Neighboring countries' economic performance and financial sector issues could also affect Estonia. Demand may fall sharply in the real estate market, although the sector entered the crisis in better shape than previously. Central banks are taking extraordinary measures to ease financial conditions and support the economy. Overall, Estonia's financial sector is relatively well positioned to cope with the crisis.