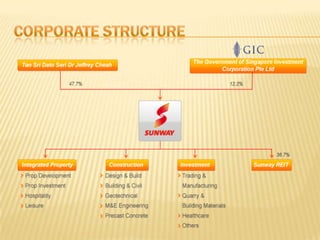

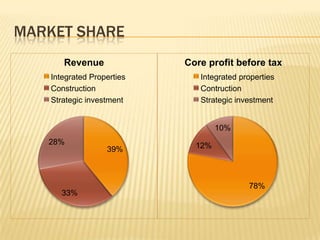

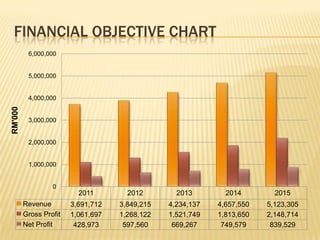

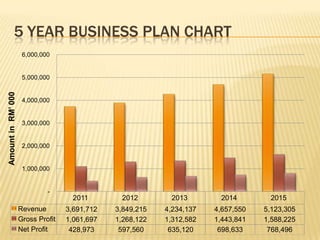

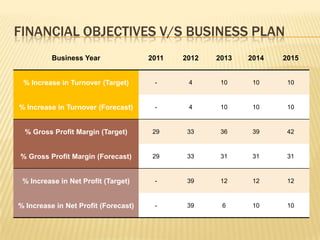

This document summarizes a presentation on Sunway Berhad, a Malaysian conglomerate founded in 1978. It provides an introduction to the company and its divisions, as well as milestones, objectives, market share details, and 5-year financial highlights and business plan. The company aims to increase annual revenue by 10% and net profit by 12% through expanding its property development, construction, and other business segments. While targets for revenue growth can be met, efforts are needed to lower costs and improve gross profit margins to fully achieve financial objectives.