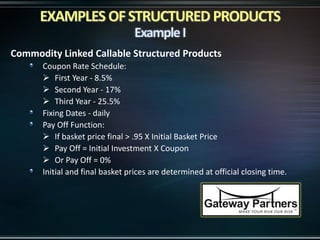

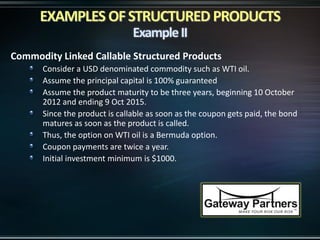

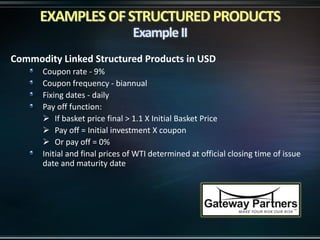

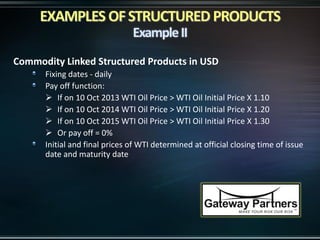

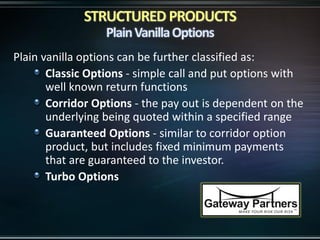

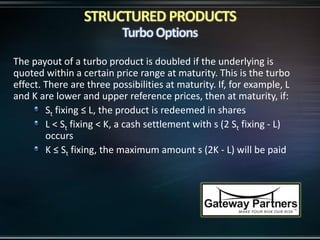

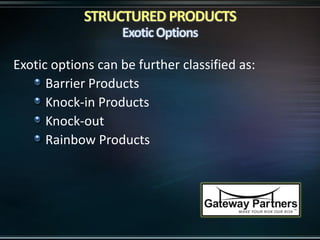

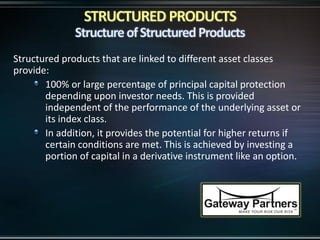

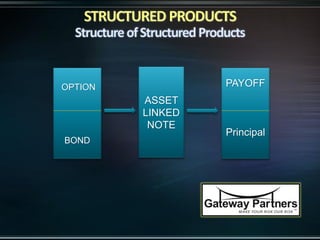

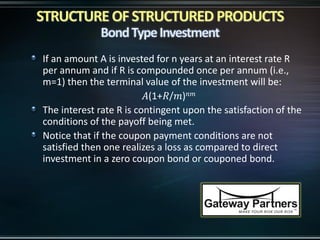

The document outlines the role of financial engineering in creating structured products, which are investment securities tailored to meet specific investor goals such as capital protection and enhanced yields. It describes the components of structured products, including a fixed income security and an options component, and various classifications based on risk and underlying assets. Additionally, it explains the mechanics of return and maturity, alongside examples of commodity-linked structured products with specific coupon structures and pay-off conditions.

![Participation rate is not set prior to expiry of issuance period. It

depends upon the issuing costs of the product and the value of

embedded option.

With participation rate PR, issue price of the product IP, service

costs SC, present value of the bond PB, and price of the option

component OP, participation rate is calculated as follows:

PR = [(IP – SC- PB)/ OP] X 100

Participation rate is also called Gearing.](https://image.slidesharecdn.com/financialengineeringstructuredproducts-151105191903-lva1-app6892/85/Financial-Engineering-Structured-Products-22-320.jpg)

![PR = [(IP – SC- PB)/ OP] X 100

One can see that the level of interest rate, volatility of the

asset, price of underlying asset, and type of option all affect

the participation rate.](https://image.slidesharecdn.com/financialengineeringstructuredproducts-151105191903-lva1-app6892/85/Financial-Engineering-Structured-Products-23-320.jpg)