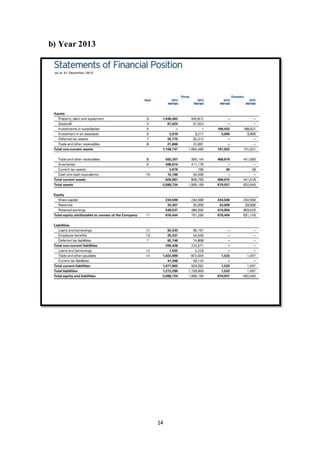

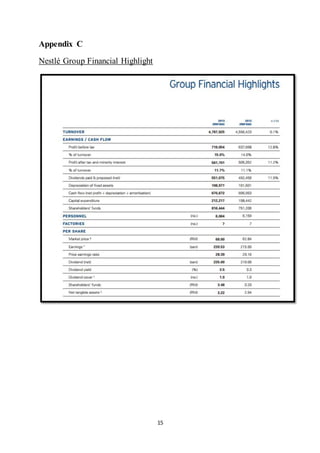

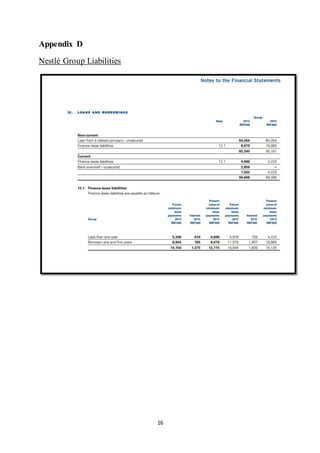

This document analyzes the financial ratios of Nestlé for the years 2012 and 2013 based on its annual reports. It calculates various profitability, stability, and valuation ratios to assess Nestlé's performance and investment worthiness. The analysis shows that while Nestlé remained profitable, its ratios declined slightly over this period. Specifically, its return on equity fell from 72% to 71.7% and its price-to-earnings ratio was high at 29.05x. Based on this, the document concludes that Nestlé's shares are not a good investment for conservative investors due to the high P/E ratio.