Financial Accounting.pdf

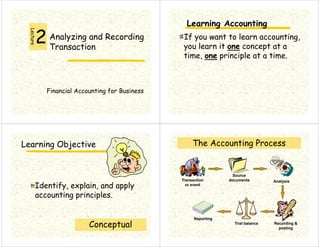

- 1. Analyzing and Recording Transaction Lecture Financial Accounting for Business Learning Accounting If you want to learn accounting, you learn it one concept at a time, one principle at a time. Learning Objective Identify, explain, and apply accounting principles. Conceptual Source documents Recording & posting Trial balance Reporting Transaction or event Analysis The Accounting Process Exh. 2.2

- 2. External Transactions occur between the organization and an outside party. Internal Transactions occur within the organization. Transactions and Events Exchanges of economic consideration between two parties. Source Documents Invoices Other Check Stubs Journal Bank Statement Detailed record of increases and decreases in specific assets, liabilities, equities, revenues, or expenses. ======================= Separate accounts are maintained for each item of importance. The Account

- 3. BASIC FORM OF ACCOUNT BASIC FORM OF ACCOUNT Left or debit side Title of Account Right or credit side Debit balance Credit balance In its simplest form, an account consists of 1. the title of the account, 2. a left or debit side, and 3. a right or credit side. The alignment of these parts resembles the letter T, and therefore the account form is called a T account.

- 4. Account Title Left Side Right Side Debits and Credits The debit/credit convention or coding system is very simple. Do not make it difficult because you cannot accept its simplicity. Debits Debit comes from Latin and merely means “left,” or the “left-hand” side of an account. Abbreviated “DR.”

- 5. Account Title Left Side Debit Side We need to stop here and change our way of thinking! Credits Credit also comes from the Latin, and means “right,” or the “right- hand” side of an account. Abbreviated “CR.” Account Title Right Side Credit Side Let’s stop here and modify our thinking – at least for this class! So, how can we use this? That’s a good question!

- 6. Accounts actually provide two equalities or balances . . . Let’s . . . At the first equality Assets Liabilities Owners’ Equity The algebraic relationship in the fundamental accounting model. Account Title Debit Credit

- 7. DR CR Assets Liabilities DR CR DR CR Owners’ Equity Debits Credits The Second Equality . . . The algebraic relationship between account increases and decreases. Expenses Revenue Owners’ Equity Liabilities Assets Debit-Credit Rules . . . Debit Credit Credit Debit Credit Debit Credit Debit Debit Credit Account Inc. Dec. Debit-Credit Rules . . . Debits Credits Assets Expenses Liabilities Equity Revenue Increase Decrease Liabilities Equity Revenue Assets Expenses

- 8. TABULAR SUMMARY COMPARED TO ACCOUNT FORM TABULAR SUMMARY COMPARED TO ACCOUNT FORM Tabular Summary Cash $15,000 - 7,000 1,200 1,500 - 600 - 900 - 200 - 250 Cash Debit Credit 15,000 1,200 1,500 600 7,000 600 200 900 Balance Account Form 8,050 $8,050 600 - 1,300 250 1,300 Example: The owner makes an initial investment of $15,000 to start the business. Cash is debited and the owner’s Capital account is credited. DEBITING AN ACCOUNT DEBITING AN ACCOUNT 15,000 Cash . Example: Monthly rent of $7,000 is paid. Cash is credited and Rent Expense is debited. CREDITING AN ACCOUNT CREDITING AN ACCOUNT 7,000 Cash DEBITING AND CREDITING AN ACCOUNT DEBITING AND CREDITING AN ACCOUNT f $ , . Example: Cash is debited for $15,000 and credited for $7,000, leaving a debit balance of $8,000. 15,000 7,000 8,000 Cash

- 9. Basic Facts About Accounts For every transaction there must be at least one debit and one credit; Debits must always equal credits for each transaction, and; Debits are always entered on the left side of an account and credits on the right side.

- 10. ebits ncrease ssets xpenses iabilities evenues redits ncrease quity After Eating Dinner Let’s Read the Comics Accounts increased with a debit: Assets Expenses Dividends Accounts increased with a credit: Liabilities Revenues Capital

- 11. NORMAL BALANCES — ASSETS AND LIABILITIES NORMAL BALANCES — ASSETS AND LIABILITIES Assets Increase Decrease Debit Credit Decrease Increase Debit Credit Liabilities Normal Balance Normal Balance NORMAL BALANCES — REVENUES AND EXPENSES NORMAL BALANCES — REVENUES AND EXPENSES Increase Decrease Debit Credit Expenses Revenues Decrease Increase Debit Credit Normal Balance Normal Balance EXPANDED BASIC EQUATION AND DEBIT/CREDIT RULES AND EFFECTS EXPANDED BASIC EQUATION AND DEBIT/CREDIT RULES AND EFFECTS Liabilities Assets Owner’s Equity = + + = + - Assets Dr. Cr. + - Liabilities Dr. Cr. - + Dr. Cr. Revenues - + Dr. Cr. Expenses + - Dr. Cr. Owner’s Capital - + Learning Objective Analyze business transactions using the accounting equation. Analytical

- 12. Analyzing Transactions 1. Analyze the transaction and its source. 2. Identify the impact of the transaction on account balances. 3. Identify the financial statements that are impacted by the transaction. Learning Objective Record transactions in a journal and post entries to a ledger. Procedural Step 1: Examine source documents. Steps in Processing Transactions Equipment (3) 30,000 Liabilities Equity Assets = + Step 2: Analyze transactions. We saw these steps earlier. Now, let’s look at some additional ones. ACCOUNTNAME: ACCOUNTNo. Date Description PR Debit Credit Balance Step 4: Record the journal information in a ledger. GENERAL JOURNAL Page 123 Date Description Post. Ref. Debit Credit Step 3: Record transactions in a journal. Step 5: Prepare a trial balance. Steps in Processing Transactions Step 1: Examine source documents. Equipment (3) 30,000 Liabilities Equity Assets = + Step 2: Analyze transactions.

- 13. General Journal Page 1 Date Description PR Debit Credit Jan 6 Art Supplies 1,800 Office Supplies 800 Accounts Payable 2,600 Purchase of art and office supplies on credit Journals . . . A journal contains a chronological record of the transactions of a business. Advantages Sets forth transactions of each day. Records transactions in chronological order. Shows the analysis of each transaction in terms of debit and credit effects. Supplies an explanation of each transaction Advantages Serves as a source for future reference to accounting transactions. Removes lengthy explanations from the ledger accounts. Makes posting the ledger at convenient times possible.

- 14. Advantages Assists in keeping the ledger in balance. Aids in tracing errors. Promotes the division of labor. Accts Rec. The General Ledger General Ledger Inventory Cash Notes Pay. Mortgage Accts Pay. Revenue Expenses Retained Earnings Transaction Analysis – Example Step 1 Identify the transaction and any source documents. Step 2 Analyze the transaction using the accounting equation. Step 3 Record the transaction in journal entry form applying double-entry accounting. Step 4 Post the entry (for simplicity, we use T-accounts to represent ledger accounts). Transaction Analysis – Example On December 1, Chuck Taylor forms an athletic shoe consulting business. He sets it up as a corporation. Taylor owns and manages the business. The marketing plan for the business is to focus primarily on consulting with sports clubs, amateur athletes and others who place orders for athletic shoes with manufacturers.

- 15. Taylor personally invests $30,000 cash in the new company in exchange for common stock, and deposits the cash in a bank account opened under the name of FastForward, Inc. Transaction Analysis – Example To illustrate how revenue recognition works, let’s return to FastForward’s transactions. Transaction Analysis – Example Chuck Taylor invests $30,000 in the company in exchange for common stock. Assets = Liabilities + Equity Cash Supplies Equipment Accounts Payable Notes Payable Equity (1) 30,000 $ 30,000 $ 30,000 $ - $ - $ - $ - $ 30,000 $ 30,000 $ = 30,000 $ 1 GENERAL JOURNAL Page 1 Date Description PR Debit Credit 2011 Dec. 1 Cash 30,000 Common Stock 30,000 Issuance of stock Transaction Date Titles of Affected Accounts Dollar amount of debits and credits Transaction explanation Chuck Taylor invests $30,000 in the company in exchange for common stock. 1

- 16. GENERAL JOURNAL Page 1 Date Description PR Debit Credit 2011 Dec. 1 Cash 30,000 Common Stock 30,000 Issuance of stock CASH ACCOUNT No. 101 Date Description PR Debit Credit Balance 2011 1 Identify the account. Posting Journal Entries - Example GENERAL JOURNAL Page 1 Date Description PR Debit Credit 2011 Dec. 1 Cash 30,000 Common Stock 30,000 Issuance of stock CASH ACCOUNT No. 101 Date Description PR Debit Credit Balance 2011 Dec. 1 2 Enter the date. Posting Journal Entries - Example GENERAL JOURNAL Page 1 Date Description PR Debit Credit 2011 Dec. 1 Cash 30,000 Common Stock 30,000 Issuance of stock CASH ACCOUNT No. 101 Date Description PR Debit Credit Balance 2011 Dec. 1 Issuance of stock 30,000 3 Enter the amount. Posting Journal Entries - Example GENERAL JOURNAL Page 1 Date Description PR Debit Credit 2011 Dec. 1 Cash 30,000 Common Stock 30,000 Issuance of stock CASH ACCOUNT No. 101 Date Description PR Debit Credit Balance 2011 Dec. 1 Issuance of stock G1 30,000 4 Enter the journal reference. Posting Journal Entries - Example

- 17. CASH ACCOUNT No. 101 Date Description PR Debit Credit Balance 2011 Dec. 1 Issuance of stock G1 30,000 30,000 5 Compute the balance. GENERAL JOURNAL Page 1 Date Description PR Debit Credit 2011 Dec. 1 Cash 30,000 Common Stock 30,000 Issuance of stock Posting Journal Entries - Example GENERAL JOURNAL Page 1 Date Description PR Debit Credit 2011 Dec. 1 Cash 101 30,000 Common Stock 301 30,000 Issuance of stock CASH ACCOUNT No. 101 Date Description PR Debit Credit Balance 2011 Dec. 1 Issuance of stock G1 30,000 30,000 Enter the ledger reference. 6 Posting Journal Entries - Example FastForward purchases $2,500 of supplies for cash. Assets = Liabilities + Equity Cash Supplies Equipment Accounts Payable Notes Payable Equity (1) 30,000 $ 30,000 $ (2) (2,500) 2,500 27,500 $ 2,500 $ - $ - $ - $ 30,000 $ 30,000 $ = 30,000 $ 2 FastForward spends $26,000 to acquire equipment for testing athletic shoes. Assets = Liabilities + Equity Cash Supplies Equipment Accounts Payable Notes Payable Equity (1) 30,000 $ 30,000 $ (2) (2,500) 2,500 (3) (26,000) 26,000 1,500 $ 2,500 $ 26,000 $ - $ - $ 30,000 $ 30,000 $ = 30,000 $ 3

- 18. FastForward purchased $7,100 of supplies on credit. Assets = Liabilities + Equity Cash Supplies Equipment Accounts Payable Notes Payable Equity (1) 30,000 $ 30,000 $ (2) (2,500) 2,500 (3) (26,000) 26,000 (4) 7,100 7,100 1,500 $ 9,600 $ 26,000 $ 7,100 $ - $ 30,000 $ 37,100 $ = 37,100 $ 4 FastForward provides consulting services to an athletic club and collects $4,200 in cash. Assets = Liabilities + Equity Cash Supplies Equipment Accounts Payable Notes Payable Equity (1) 30,000 $ 30,000 $ (2) (2,500) 2,500 (3) (26,000) 26,000 (4) 7,100 7,100 (5) 4,200 4,200 5,700 $ 9,600 $ 26,000 $ 7,100 $ - $ 34,200 $ 41,300 $ = 41,300 $ 5 FastForward pays $1,000 rent to the landlord of the building where its store is located. Assets = Liabilities + Equity Cash Supplies Equipment Accounts Payable Notes Payable Equity (1) 30,000 $ 30,000 $ (2) (2,500) 2,500 (3) (26,000) 26,000 (4) 7,100 7,100 (5) 4,200 4,200 (6) (1,000) (1,000) 4,700 $ 9,600 $ 26,000 $ 7,100 $ - $ 33,200 $ 40,300 $ = 40,300 $ 6 FastForward pays the biweekly $700 salary of the company’s only employee. Assets = Liabilities + Equity Cash Supplies Equipment Accounts Payable Notes Payable Equity (1) 30,000 $ 30,000 $ (2) (2,500) 2,500 (3) (26,000) 26,000 (4) 7,100 7,100 (5) 4,200 4,200 (6) (1,000) (1,000) (7) (700) (700) 4,000 $ 9,600 $ 26,000 $ 7,100 $ - $ 32,500 $ 39,600 $ = 39,600 $ 7

- 19. Revenue Recognition Principle 1. Revenue is recognized when earned. 2. Assets received from selling products and services need not be in cash. 3. Revenue recognized is measured by the cash received plus the cash equivalent (market) value of any other assets received. FastForward provides consulting services of $1,600 and rents its test facilities for $300. Assets = Liabilities + Equity Cash Accounts Rec Supplies Equipment Accounts Payable Notes Payable Equity (1) 30,000 $ 30,000 $ (2) (2,500) 2,500 (3) (26,000) 26,000 (4) 7,100 7,100 (5) 4,200 4,200 (6) (1,000) (1,000) (7) (700) (700) (8) 1,900 1,600 300 4,000 $ 1,900 $ 9,600 $ 26,000 $ 7,100 $ - $ 34,400 $ $ $ 8 The client in transaction 8 pays $1,900 to FastForward 10 days after it is billed for consulting services. Assets = Liabilities + Equity Cash Accounts Rec Supplies Equipment Accounts Payable Notes Payable Equity (1) 30,000 $ 30,000 $ (2) (2,500) 2,500 (3) (26,000) 26,000 (4) 7,100 7,100 (5) 4,200 4,200 (6) (1,000) (1,000) (7) (700) (700) (8) 1,900 1,900 (9) 1,900 (1,900) 5,900 $ $0 9,600 $ 26,000 $ 7,100 $ - $ 34,400 $ 41,500 $ = 41,500 $ 9 FastForward pays $900 to CalTech Supply as partial payment for its earlier $7,100 purchase of supplies. Assets = Liabilities + Equity Cash Accounts Rec Supplies Equipment Accounts Payable Notes Payable Equity (1) 30,000 $ 30,000 $ (2) (2,500) 2,500 (3) (26,000) 26,000 (4) 7,100 7,100 (5) 4,200 4,200 (6) (1,000) (1,000) (7) (700) (700) (8) 1,900 1,900 (9) 1,900 (1,900) (10) (900) (900) 5,000 $ $0 9,600 $ 26,000 $ 6,200 $ - $ 34,400 $ 40,600 $ = 40,600 $ 10

- 20. FastForward declares and pays a $200 cash dividend to its owner. Assets = Liabilities + Equity Cash Accounts Rec Supplies Equipment Accounts Payable Notes Payable Equity (1) 30,000 $ 30,000 $ (2) (2,500) 2,500 (3) (26,000) 26,000 (4) 7,100 7,100 (5) 4,200 4,200 (6) (1,000) (1,000) (7) (700) (700) (8) 1,900 1,900 (9) 1,900 (1,900) (10) (900) (900) (11) (200) (200) 4,800 $ $0 9,600 $ 26,000 $ 6,200 $ - $ 34,200 $ 40,400 $ = 40,400 $ 11 Cash (1) 30,000 (5) 4,200 (9) 1,900 36,100 -31,300 4,800 (2) 2,500 (3) 26,000 (6) 1,000 (7) 700 (10) 900 (11) 200 31,300 Increases Decreases Balance Decreases Cash Account No. 101 Date Item PR Debit Credit Balance Debit Credit (1) 30,000 30,000 (2) 2,500 27,500 (3) 26,000 1,500 (5) 4,200 5,700 (6) 1,000 4,700 (7) 700 4,000 (9) 1,900 5,900 (10) 900 5,000 (11) 200 4,800 CASH ACCOUNT No. 101 Date Description PR Debit Credit Balance 2011 Dec. 1 Issuance of stock G1 30,000 30,000 Dec. 2 Purchased supplies G1 2,500 27,500 Dec. 3 Purchased equipment G1 26,000 1,500 Dec. 10 Collection from customer G1 1,900 3,400 T-accounts are useful illustrations, but balance column ledger accounts are used in practice. Balance Column Ledger

- 21. CASH ACCOUNT No. 101 Date Description PR Debit Credit Balance 2011 Dec. 1 Issuance of stock G1 30,000 30,000 Dec. 2 Purchased supplies G1 2,500 27,500 Dec. 3 Purchased equipment G1 26,000 1,500 Dec. 10 Collection from customer G1 1,900 3,400 Balance Column Ledger Note the the t-account tool is derived from the debit and credit columns of the ledger. The last line in the balance column shows the current balance in the account. Exh. 2.16 CASH ACCOUNT No. 101 Date Description PR Debit Credit Balance 2011 Dec. 1 Issuance of stock G1 30,000 30,000 Dec. 2 Purchased supplies G1 2,500 27,500 Dec. 3 Purchased equipment G1 26,000 1,500 Dec. 10 Collection from customer G1 1,900 3,400 Balance Column Ledger FastForward transactions 12.FastForward receives $3,000 cash in advance of providing consulting services to a customer. 13.FastForward pays $2,400 cash (insurance premium) for a 24-month insurance policy. Coverage begins on December 1. 14.FastForward pays $120 cash for supplies. 15.FastForward pays $230 cash for December utilities expense. 16.FastForward pays $700 cash in employee salary for work performed in the latter part of December. 83 THE TRIAL BALANCE THE TRIAL BALANCE A trial balance is a list of accounts and their balances at a given time. The primary purpose of a trial balance is to prove the mathematical equality of debits and credits after posting. A trial balance also uncovers errors in journalizing and posting. The procedures for preparing a trial balance consist of 1. listing the account titles and their balances, 2. totaling the debit and credit columns, and 3. proving the equality of the two columns. 84

- 22. 85 FastForward trial balance 86 LIMITATIONS OF A TRIAL BALANCE LIMITATIONS OF A TRIAL BALANCE A trial balance does not prove that all transactions have been recorded or that the ledger is correct. Numerous errors may exist even though the trial balance columns agree. The trial balance may balance even when 1. a transaction is not journalized, 2. a correct journal entry is not posted, 3. a journal entry is posted twice, 4. incorrect accounts are used in journalizing or posting, 5. offsetting errors are made in recording the amount of the transaction. 87 DETECTING ERRORS THROUGH A TRIAL BALANCE DETECTING ERRORS THROUGH A TRIAL BALANCE A trial balance will not balance if double-entry accounting has not been completed properly. The trial balance may not balance when 1. debit or credit omitted, 2. duplication of debit or credit, 3. transposing errors 88

- 23. Six Steps for Searching for and Correcting Errors If the trial balance does not balance, the error(s) must be found and corrected. Verify that the trial balance columns are correctly added. Verify that account balances are correctly entered from the ledger. See whether a debit (or credit) balance is mistakenly listed as a credit (or debit). Recompute each account balance in the ledger. Verify that each journal entry is properly posted. Verify that each original journal entry has equal debits and credits. 2-89 89 o Describes the relationship between the amounts of the company’s liabilities and assets. o Helps to assess the risk that a company will fail to pay its debts. Debt Ratio = Total Liabilities Total Assets Debt Ratio = Total Liabilities Total Assets Debt Ratio A2 2-90 We Have Learned . . . The first five steps in the accounting cycle. Examine Source Documents Analyze Transactions Record Transactions Post Transactions Prepare Trial Balance 91 Analyze Transactions Preparing Financial Statements Examine Source Documents Record Transactions Post Transactions Financial Statements Prepare Trial Balance 92

- 24. Tutorial 2.1 a. On August 1, Worthy invested $3,000 cash and $15,000 of equipment in Expressions. b. On August 2, Expressions paid $600 cash for furniture for the shop. c. On August 3, Expressions paid $500 cash to rent space in a strip mall for August. d. On August 4, it purchased $1,200 of equipment on credit for the shop (using a long-term note payable). e. On August 5, Expressions opened for business. Cash received from haircutting services in the first week and a half of business (ended August 15) was $825. Tutorial 2.1 f. On August 15, it provided $100 of haircutting services on account. g. On August 17, it received a $100 check for services previously rendered on account. h. On August 17, it paid $125 to an assistant for hours worked during the grand opening. i. Cash received from services provided during the second half of August was $930. j. On August 31, it paid a $400 installment toward principal on the note payable entered into on August 4. k. On August 31, Worthy withdrew $900 cash for personal use. Tutorial 2.1 1. Open the following ledger accounts in balance column format: Cash; Accounts Receivable; Furniture; Store Equipment; Note Payable; J. Worthy, Capital ; J. Worthy, Withdrawals; Haircutting Services Revenue; Wages Expense; and Rent Expense. Prepare general journal entries for the transactions. 2. Post the journal entries from (1) to the ledger accounts.