This document discusses various mechanisms for financing dental care, including:

- Private fee-for-service payments, where patients pay dentists directly.

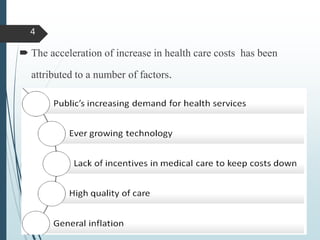

- Third-party payment plans like insurance, which emerged to help cover rising healthcare costs. These include commercial insurance, nonprofit plans like Delta Dental, and public programs.

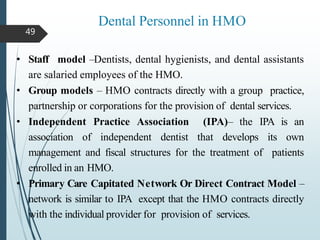

- Prepaid plans like HMOs, where dentists are salaried or contracted and patients pay fixed monthly fees for comprehensive care.

The history and types of third-party dental plans are described in detail. India primarily uses out-of-pocket fee-for-service payments due to low public spending on healthcare. Some early dental insurance plans in India are also mentioned.