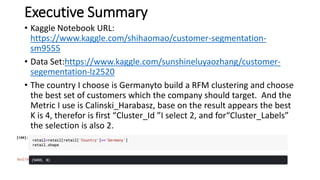

The document is a draft presentation by Jackson Mao on statistical measurements, analysis, and research. It includes sections on self-introduction, education background, and three parts of the presentation: summary, market research report, and appendix. The summary discusses what was learned in class about statistical analysis used in marketing. The market research report outlines sessions on finding a new dataset and reproducing capstone project milestones related to research design, hypothesis testing, regression, and clustering. The appendix includes revised versions of previous submissions.