London is a strong hub for the growing FinTech sector for several reasons:

1) It has a large, talented workforce in the financial and technology sectors and is thought to have more FinTech workers than New York.

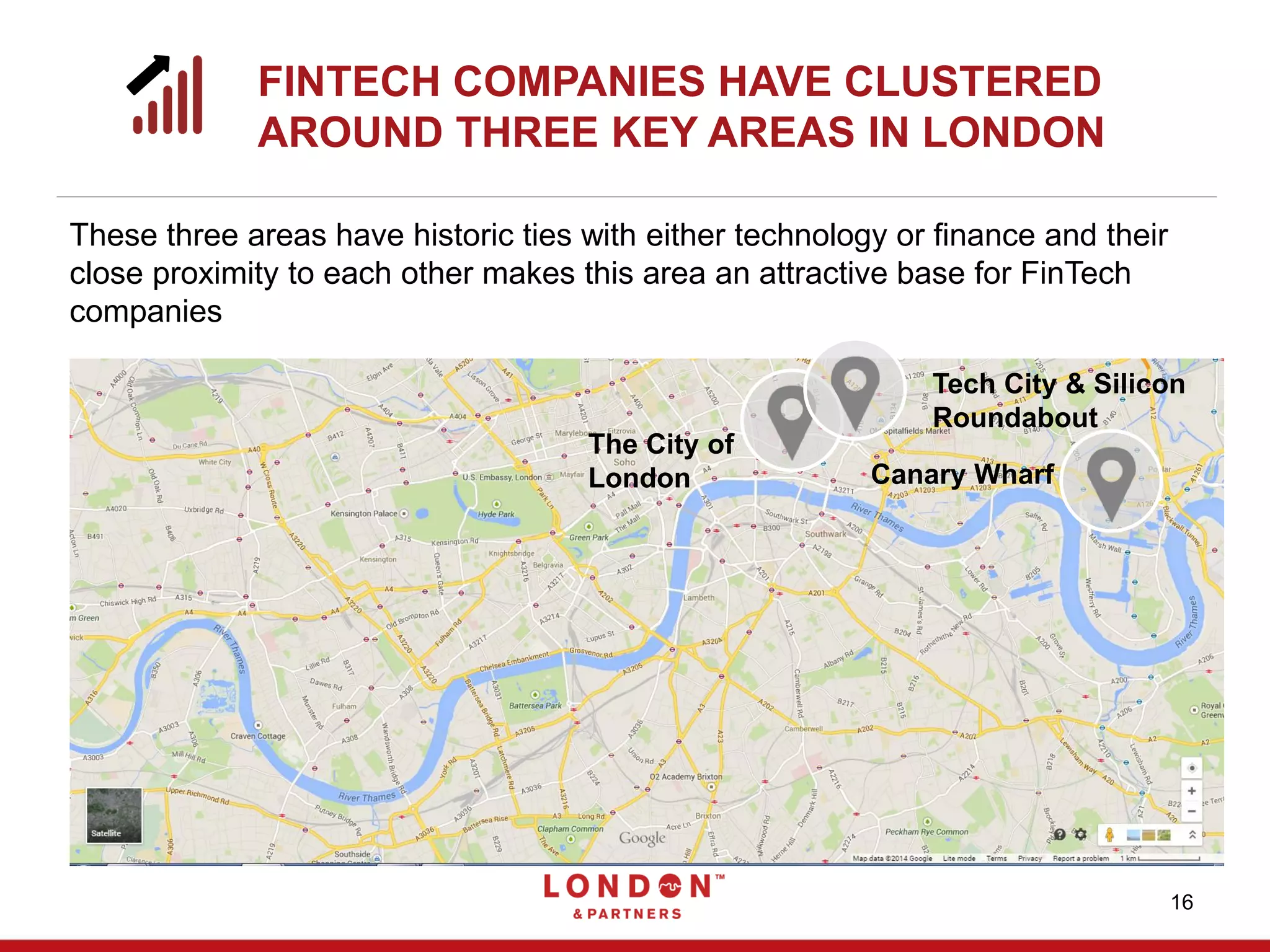

2) It is home to many major banks, financial institutions, and technology companies, as well as numerous FinTech startups that have been able to grow into global brands.

3) FinTech investment is strong in London, which receives over half of European FinTech deals and financing, and there are several accelerators that support FinTech startups.