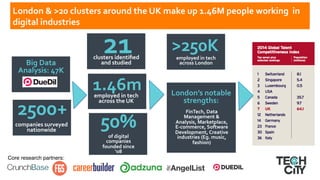

Gerard Grech, CEO of Tech City UK, highlights the factors contributing to London's dominance in the tech industry, noting that 42% of European tech unicorns are based in the UK. Key growth drivers identified include smart capital, a supportive business environment, and a rich ecosystem of tech clusters and talent. With substantial investments and favorable policy conditions, London's digital economy is thriving, attracting significant venture capital and talent.